Question: Problem 11: Problem 11 Intro Blunt Aesthetics is a U.S. fashion retailer which imports products from Europe. The company will need 100,000 euros () in

Problem 11:

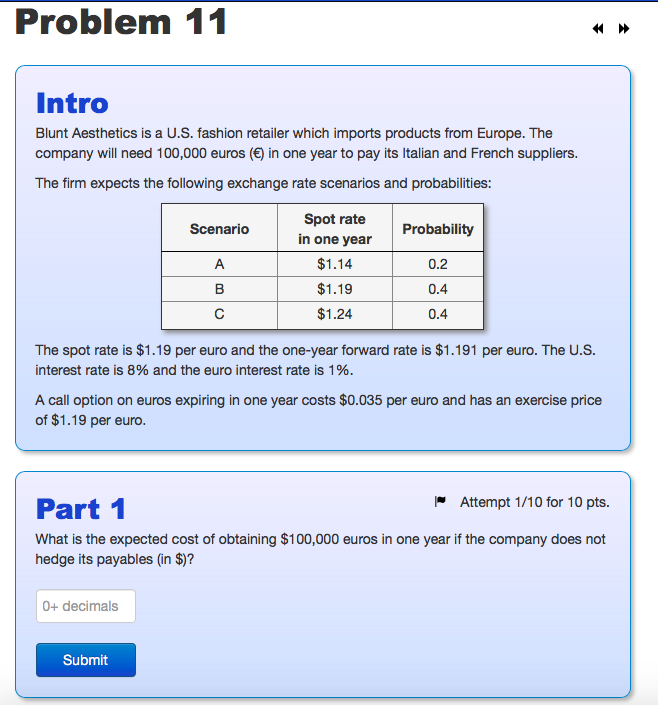

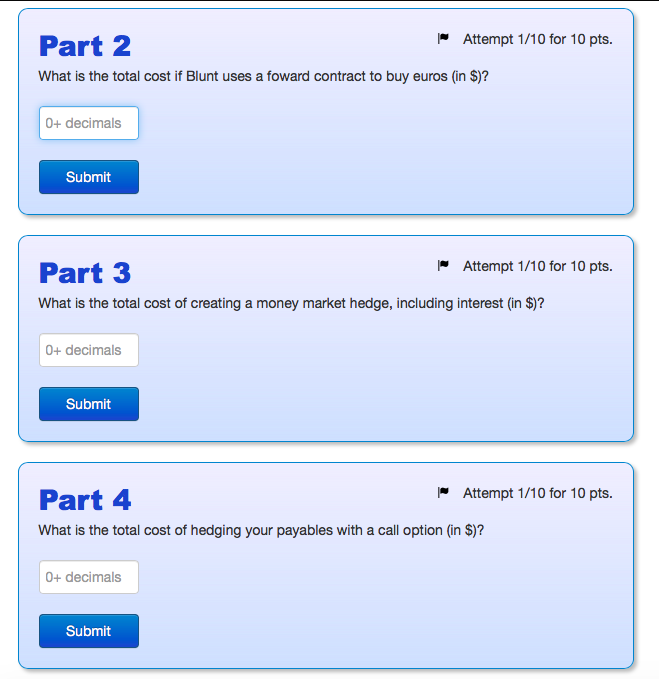

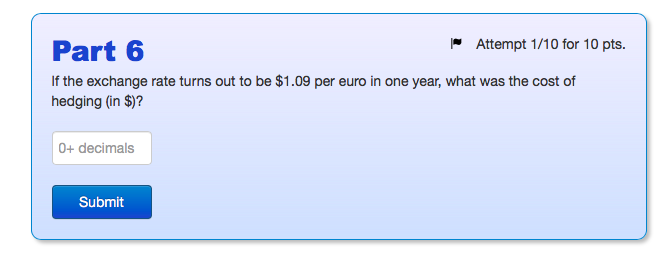

Problem 11 Intro Blunt Aesthetics is a U.S. fashion retailer which imports products from Europe. The company will need 100,000 euros () in one year to pay its Italian and French suppliers. The firm expects the following exchange rate scenarios and probabilities: Scenario Probability A B Spot rate in one year $1.14 $1.19 $1.24 0.2 0.4 0.4 The spot rate is $1.19 per euro and the one-year forward rate is $1.191 per euro. The U.S. interest rate is 8% and the euro interest rate is 1%. A call option on euros expiring in one year costs $0.035 per euro and has an exercise price of $1.19 per euro. Part 1 Attempt 1/10 for 10 pts. What is the expected cost of obtaining $100,000 euros in one year if the company does not hedge its payables (in $)? 0+ decimals Submit | Attempt 1/10 for 10 pts. Part 2 What is the total cost if Blunt uses a foward contract to buy euros (in $)? 0+ decimals Submit Part 3 | Attempt 1/10 for 10 pts. What is the total cost of creating a money market hedge, including interest (in $)? 0+ decimals Submit Part 4 Attempt 1/10 for 10 pts. What is the total cost of hedging your payables with a call option (in $)? 0+ decimals Submit Part 6 Attempt 1/10 for 10 pts. If the exchange rate turns out to be $1.09 per euro in one year, what was the cost of hedging (in $)? 0+ decimals Submit

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts