Question: Problem 1-1 True or False Write True if the statement is correct or False if the statement is incorrect. Eminent domain and police power can

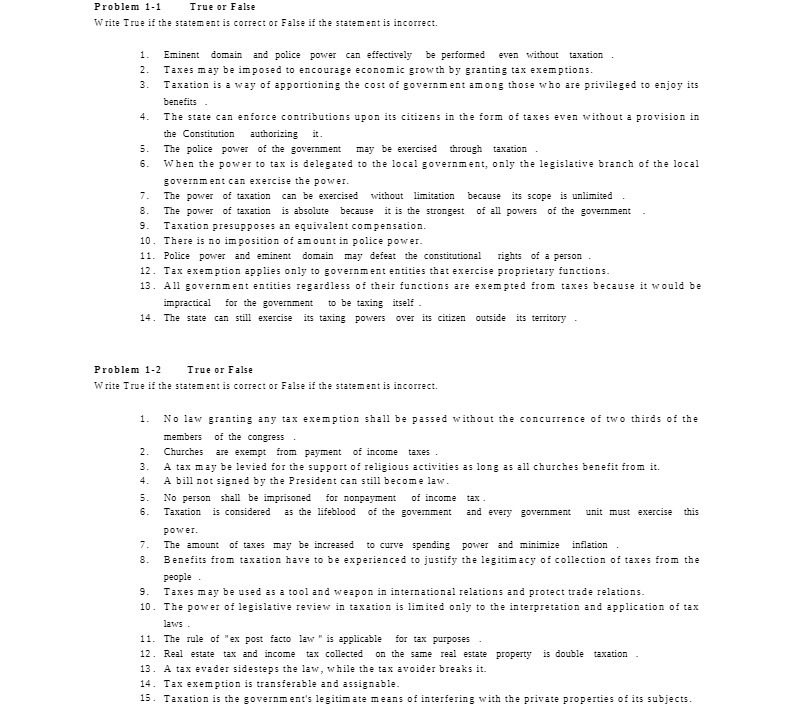

Problem 1-1 True or False Write True if the statement is correct or False if the statement is incorrect. Eminent domain and police power can effectively be performed even without taxation Taxes may be imposed to encourage economic growth by granting tax exemptions. Taxation is a way of apportioning the cost of government among those who are privileged to enjoy its benefits 4. The state can enforce contributions upon its citizens in the form of taxes even without a provision in the Constitution authorizing it. The police power of the government may be exercised through taxation When the power to tax is delegated to the local government, only the legislative branch of the local government can exercise the power. 7. The power of taxation can be exercised without limitation because its scope is unlimited The power of taxation is absolute because it is the strongest of all powers of the government Taxation presupposes an equivalent compensation. 10. There is no imposition of amount in police power. 11. Police power and eminent domain may defeat the constitutional rights of a person . 12. Tax exemption applies only to government entities that exercise proprietary functions. 13. All government entities regardless of their functions are exempted from taxes because it would be impractical for the government to be taxing itself . 14. The state can still exercise its taxing powers over its citizen outside its territory Problem 1-2 True or False Write True if the statement is correct or False if the statement is incorrect. 1. No law granting any tax exemption shall be passed without the concurrence of two thirds of the members of the congress 2. Churches are exempt from payment of income taxes . A tax may be levied for the support of religious activities as long as all churches benefit from it. 4 . A bill not signed by the President can still become law. 5. No person shall be imprisoned for nonpayment of income tax . 6. Taxation is considered as the lifeblood of the government and every government unit must exercise this power. 7. The amount of taxes may be increased to curve spending power and minimize inflation 3. Benefits from taxation have to be experienced to justify the legitimacy of collection of taxes from the people 9. Taxes may be used as a tool and weapon in international relations and protect trade relations. 10. The power of legislative review in taxation is limited only to the interpretation and application of tax laws 11. The rule of "ex post facto law " is applicable for tax purposes 12. Real estate tax and income tax collected on the same real estate property is double taxation 13. A tax evader sidesteps the law, while the tax avoider breaks it. 14. Tax exemption is transferable and assignable. 15. Taxation is the government's legitimate means of interfering with the private properties of its subjects

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts