Question: Problem 11.06 (Solution Video) Your answer is incorrect. Try again Sheridan Potions, Inc., a pharmaceutical company, bought a machine at a cost of $2 million

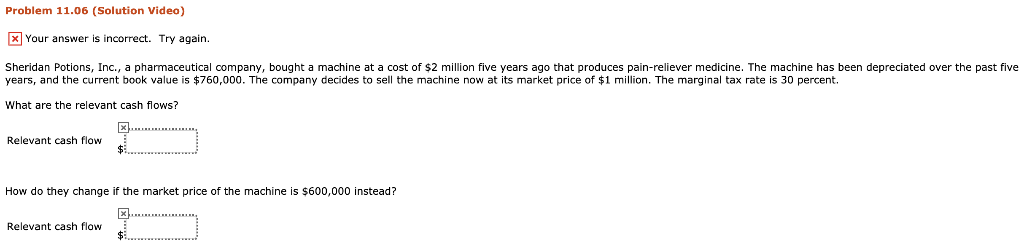

Problem 11.06 (Solution Video) Your answer is incorrect. Try again Sheridan Potions, Inc., a pharmaceutical company, bought a machine at a cost of $2 million five years ago that produces pain-reliever medicine. The machine has been depreciated over the past five years, and the current book value i $760,000. The company decides to sell the machine now at its market price of $1 million. The marginal tax rate is 30 percent. What are the relevant cash flows? Relevant cash flow How do they change if the market price of the machine is s600.000 instead? Relevant cash flow

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts