Question: Problem 11-1 A project that is expected to last six years will generate incremental profit and cash flow before taxes and depreciation of $23,000 per

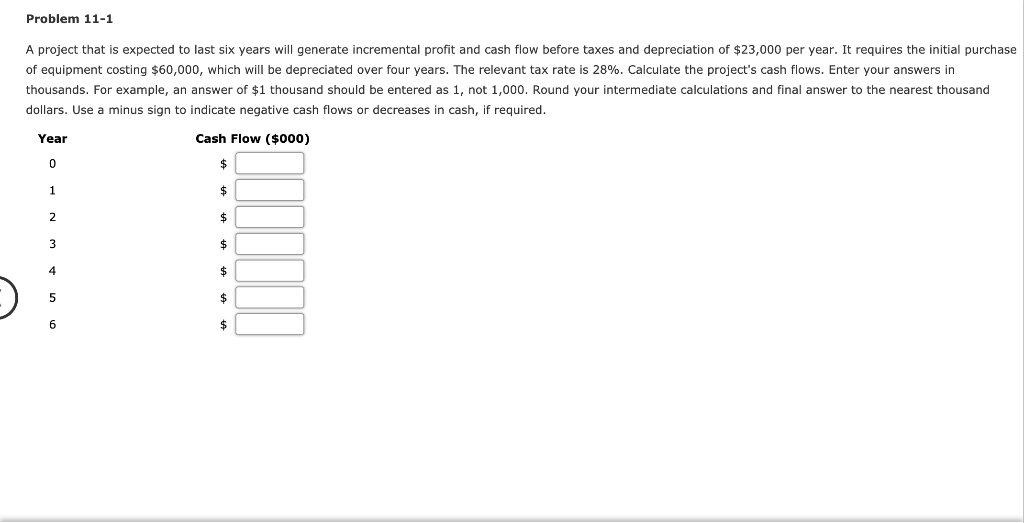

Problem 11-1 A project that is expected to last six years will generate incremental profit and cash flow before taxes and depreciation of $23,000 per year. It requires the initial purchase of equipment costing $60,000, which will be depreciated over four years. The relevant tax rate is 28%. Calculate the project's cash flows. Enter your answers in thousands. For example, an answer of $1 thousand should be entered as 1, not 1,000. Round your intermediate calculations and final answer to the nearest thousand dollars. Use a minus sign to indicate negative cash flows or decreases in cash, if required. Year Cash Flow ($000) 0 $ 1 $ 2 $ 3 $ 4 $ 5 $ 6 $

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts