Question: Problem 11-1 LO3, 4, 6 On December 31, Year 1, Precision Manufacturing Inc. (PMI) of Edmonton purchased 100% of the outstanding ordinary shares of Sandora

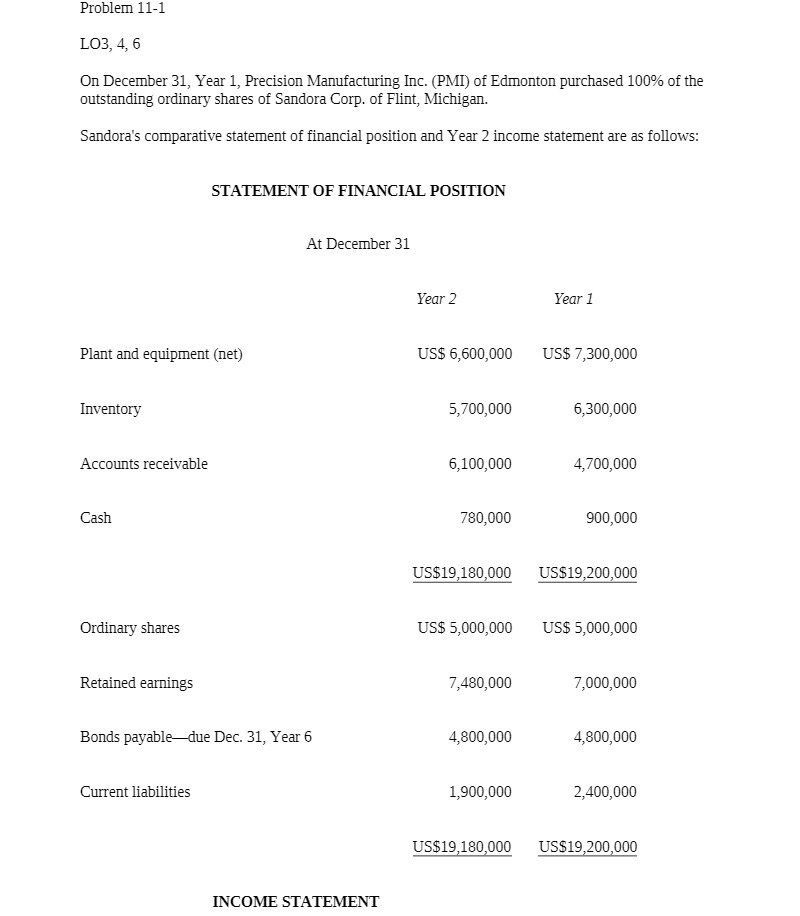

Problem 11-1 LO3, 4, 6 On December 31, Year 1, Precision Manufacturing Inc. (PMI) of Edmonton purchased 100% of the outstanding ordinary shares of Sandora Corp. of Flint, Michigan. Sandora's comparative statement of financial position and Year 2 income statement are as follows: STATEMENT OF FINANCIAL POSITION At December 31 Year 2 Year 1 Plant and equipment (net) US$ 6,600,000 US$ 7,300,000 Inventory 5,700,000 6,300,000 Accounts receivable 6,100,000 4,700,000 Cash 780,000 900,000 US$19,180,000 US$19,200,000 Ordinary shares US$ 5,000,000 US$ 5,000,000 Retained earnings 7,480,000 7,000,000 Bonds payable-due Dec. 31, Year 6 4,800,000 4,800,0 Current liabilities 1,900,000 2,400,000 US$19,180,000 US$19,200,000 INCOME STATEMENT

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts