Question: Problem 11-11 (Part Level Submission) On January 1, 2015, a machine was purchased for $91,800. The machine has an estimated salvage value of $6,120 and

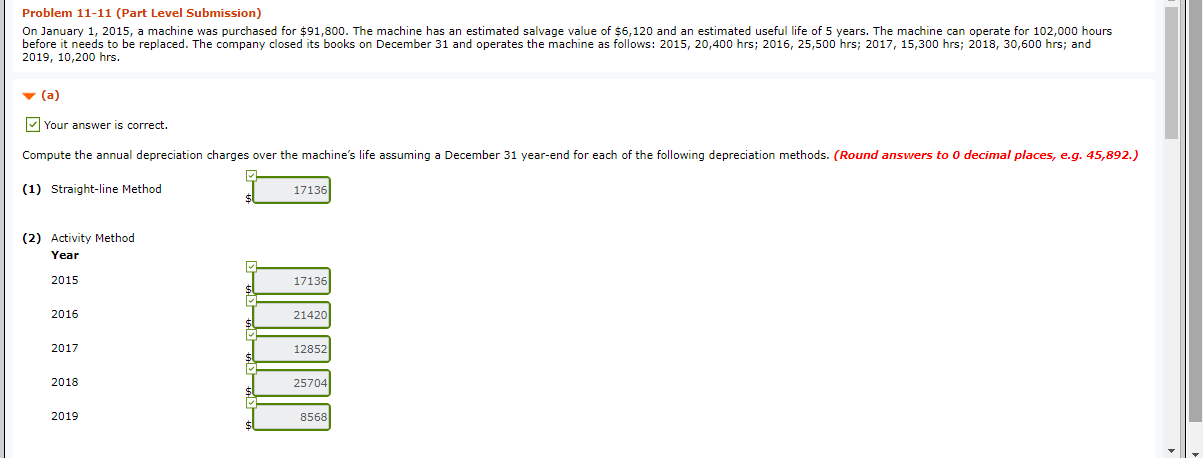

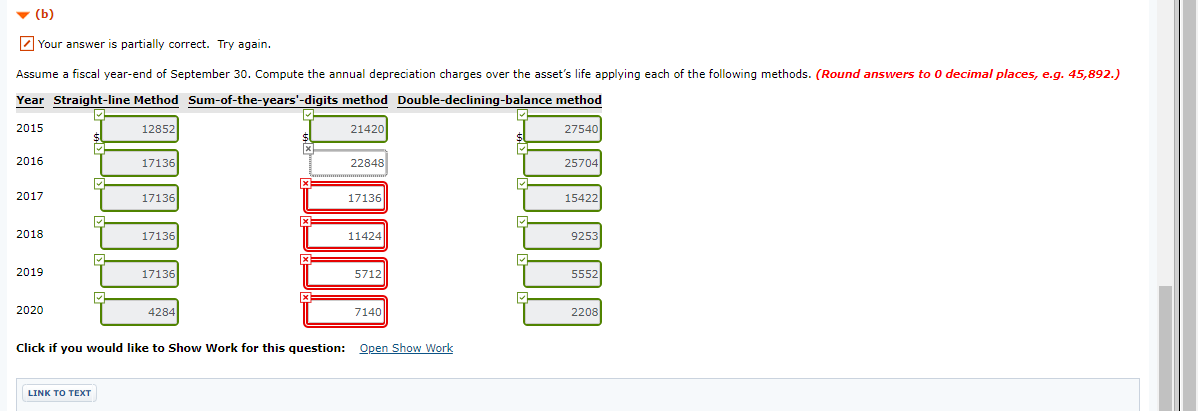

Problem 11-11 (Part Level Submission) On January 1, 2015, a machine was purchased for $91,800. The machine has an estimated salvage value of $6,120 and an estimated useful life of 5 years. The machine can operate for 102,000 hours before it needs to be replaced. The company closed its books on December 31 and operates the machine as follows: 2015, 20,400 hrs; 2016, 25,500 hrs; 2017, 15,300 hrs; 2018, 30,600 hrs; and 2019, 10,200 hrs. (a) Your answer is correct. Compute the annual depreciation charges over the machine's life assuming a December 31 year-end for each of the following depreciation methods. (Round answers to 0 decimal places, e.g. 45,892.) (1) Straight-line Method 17136 (2) Activity Method Year 2015 17136 2016 21420 2017 2018 12852 25704 8568 2019 J (6) Your answer is partially correct. Try again. Assume a fiscal year-end of September 30. Compute the annual depreciation charges over the asset's life applying each of the following methods. (Round answers to O decimal places, e.g. 45,892.) Year Straight-line Method Sum-of-the-years'-digits method Double-declining-balance method 2015 12852 21420 27540 2016 T 17136 22848 25704 15422 2017 T 17136 17136 T 2018 17136 11424 9253 2019 17136 5712 5552 2020 T 4284 7140 T 2208 Click if you would like to Show Work for this question: Open Show Work LINK TO TEXT

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts