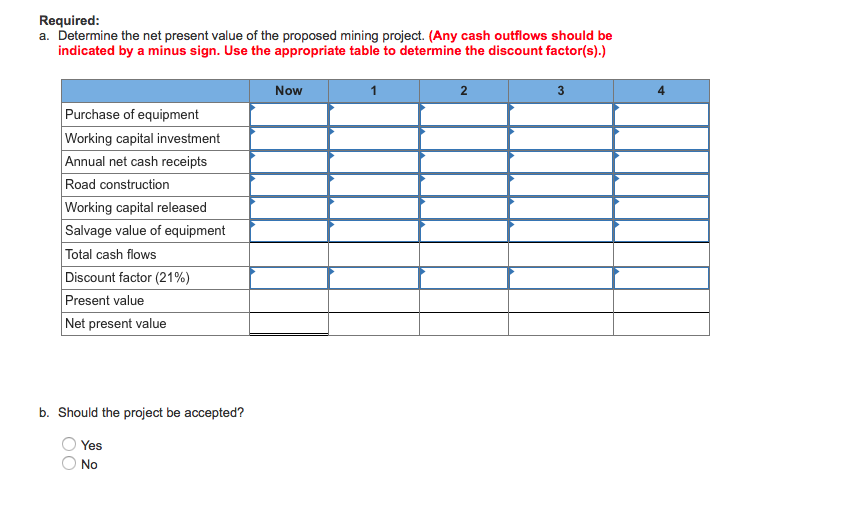

Question: Problem 11-12A Basic Net Present Value Analysis [LO11-2] Windhoek Mines, Ltd., of Namibia, is contemplating the purchase of equipment to exploit a mineral deposit on

![Problem 11-12A Basic Net Present Value Analysis [LO11-2] Windhoek Mines, Ltd.,](https://dsd5zvtm8ll6.cloudfront.net/si.experts.images/questions/2024/09/66e84a9be5a37_48366e84a9b845c2.jpg)

Problem 11-12A Basic Net Present Value Analysis [LO11-2] Windhoek Mines, Ltd., of Namibia, is contemplating the purchase of equipment to exploit a mineral deposit on land to which the company has mineral rights. An engineering and cost analysis has been made, and it is expected that the following cash flows would be associated with opening and operating a mine in the area Cos t of new equipment and timbers Working capital required Annual net cash receipts Cost to construct new roads in three years Salvage value of equipment in four years 390,000 125,000 $ 140,000* S 45,000 $ 70,000 Receipts from sales of ore, less out-of-pocket costs for salaries, utilities, insurance, and so forth. The mineral deposit would be exhausted after four years of mining. At that point, the working capital would be released for reinvestment elsewhere. The company's required rate of return is 21% Click here to view Exhibit 11B-1 and Exhibit 11B-2, to determine the appropriate discount factor(s) using tables

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts