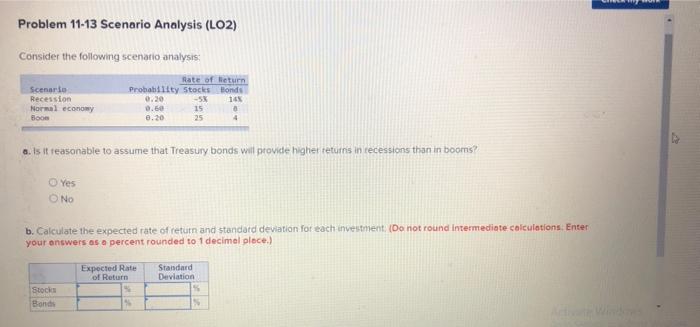

Question: Problem 11-13 Scenario Analysis (LO2) Consider the following scenario analysis: Scenario Recession Normal economy Boom Rate of Return Probability Stocks Honde 0.20 -5X 165 0.60

Problem 11-13 Scenario Analysis (LO2) Consider the following scenario analysis: Scenario Recession Normal economy Boom Rate of Return Probability Stocks Honde 0.20 -5X 165 0.60 15 8.20 4 a. Is it reasonable to assume that Treasury bonds will provide highet returns in recessions than in booms Yes No b. Calculate the expected rate of return and standard deviation for each investment (Do not round Intermediate calculations Enter your answers as a percent rounded to 1 decimal place.) Expected Rate of Return Standard Deviation Stocic Bond

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts