Question: Problem 11-14 Replacement Analysis DeYoung Entertainment Enterprises is considering replacing the latex molding machine it uses to fobricate rubber chickens with a aewer, more emcient

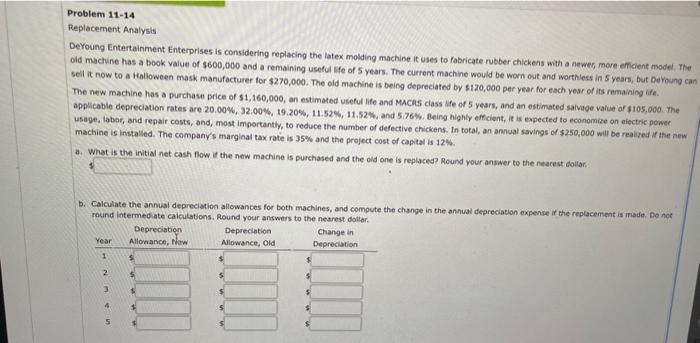

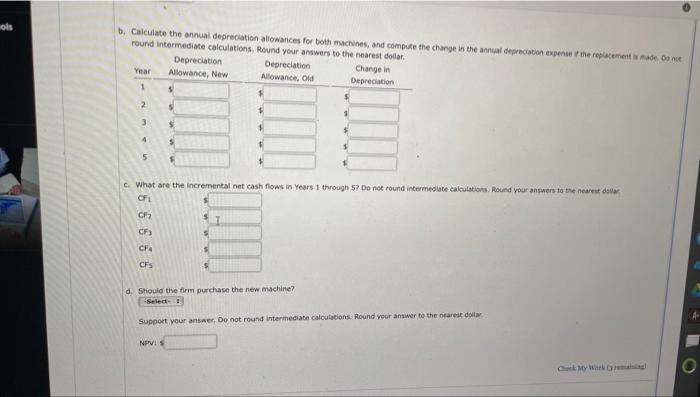

Problem 11-14 Replacement Analysis DeYoung Entertainment Enterprises is considering replacing the latex molding machine it uses to fobricate rubber chickens with a aewer, more emcient model. The oid machine has a book value of $600,000 and a remaining useful we of 5 years. The current machine would be worn out and worthless in 5 years, but Ceroung e seil it now to a italloween mask manufacturer for $270,000. The old machine is being depreciated by $120,000 per year for esch year of its remaining ife. The new machine has a purchase price of $1,160,000, an estimated vieful life and MACHS class Mfe of 5 years, and an estimated salvage value of 5105, oco. The apphicabie depreciation rates are 20.00%,32.00%,19.20%,11.52%,11.52%, and 5.76%, deing highty efficient, it is expected to economice on eiectric power usage, labor, and repair costs, and, most importantly, to reduce the number of defective chickens. In total, an annual savings of $250,000 will be realifed if the new machine is installed. The company's marginal tax rate is 35% and the project cost of capital is 12%. a. What is the initial net cash fow if the new machine is purchased and the oid one is replaced? Round your answer to the nearest dollar. b. Caiculate the annual depreciation aliowances for both mackines, and compute the change in the annual depreciation experse \& the reolacment a hade. Oe nue round intermediate calculations. Reund year ancwaen ka tha c. What are the incremental net cash foows in Years 1 through 5? Do not round intermeolate calculations. Bound you answers to the neareat dsela? d. Should the firm purchase the new machine? Sopoct your answer, Do not round intermeciate calcutabions. Round your answer to the neareas dolly: NeVis 9

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts