Question: Problem 11.16 Perpetual Ltd. has issued bonds that never require the principal amount to be repaid to investors. Correspondingly, Perpetual must make interest payments into

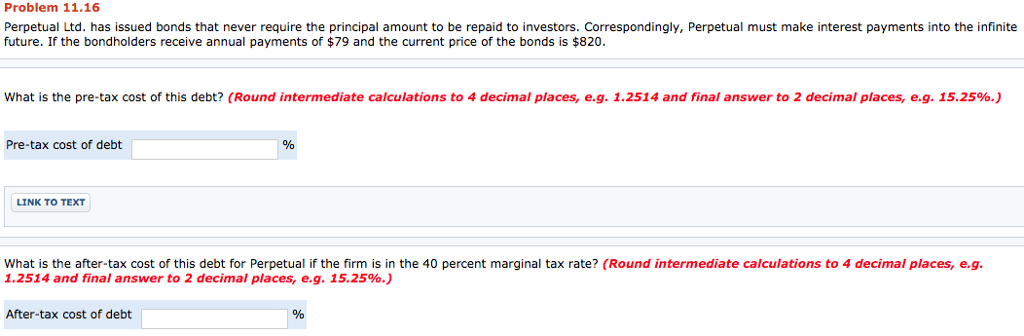

Problem 11.16 Perpetual Ltd. has issued bonds that never require the principal amount to be repaid to investors. Correspondingly, Perpetual must make interest payments into the infinite future. If the bondholders receive annual payments of $79 and the current price of the bonds is $820. What is the pre-tax cost of this debt? (Round intermediate calculations to 4 decimal places, e.g. 1.2514 and final answer to 2 decimal places, e.g. 15.25%.) Pre-tax cost of debt LINK TO TEXT What is the after-tax cost of this debt for Perpetual if the firm is in the 40 percent marginal tax rate? (Round intermediate calculations to 4 decimal places, e.g. 1.2514 and final answer to 2 decimal places, e.g. 15.25%.) After-tax cost of debt

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts