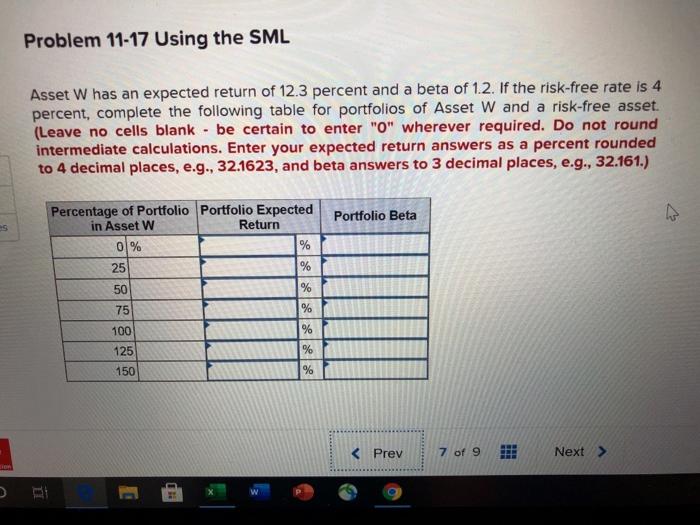

Question: Problem 11-17 Using the SML Asset W has an expected return of 12.3 percent and a beta of 1.2. If the risk-free rate is 4

Problem 11-17 Using the SML Asset W has an expected return of 12.3 percent and a beta of 1.2. If the risk-free rate is 4 percent, complete the following table for portfolios of Asset W and a risk-free asset. (Leave no cells blank - be certain to enter "0" wherever required. Do not round intermediate calculations. Enter your expected return answers as a percent rounded to 4 decimal places, e.g., 32.1623, and beta answers to 3 decimal places, e.g., 32.161.) Portfolio Beta Percentage of Portfolio Portfolio Expected in Asset W Return 0 % % % 25 50 % 75 % 100 % 125 % 150 % BE

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts