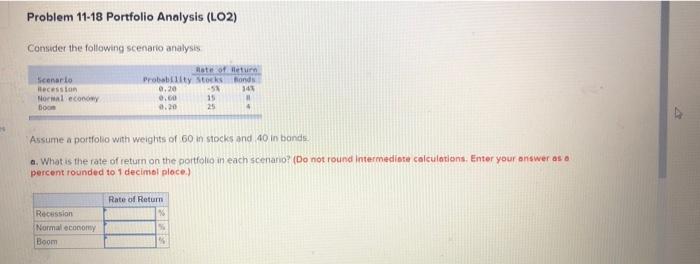

Question: Problem 11-18 Portfolio Analysis (LO2) Comider the following scenario analyses te of Return Probability Stork Bonds 0.20 -58 0.60 0.20 25 Scenario Recession Normal economy

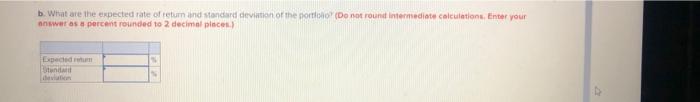

Problem 11-18 Portfolio Analysis (LO2) Comider the following scenario analyses te of Return Probability Stork Bonds 0.20 -58 0.60 0.20 25 Scenario Recession Normal economy boce 14 4 Assume a portfolio with weights of 60 in stocks and 40 in bonds a. What is the rate of return on the portfolio m each scenario? (Do not round Intermediate calculations. Enter your answer as a percent rounded to 1 decimal place.) Rate of Return Recession Normal economy Boom b. What are the expected rate of return and standard deviation of the north (Do not round intermediate calculations Enter your answer as a percent rounded 102 decimal places) Depeche Stone

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts