Question: Problem 11-19 (algorithmic) Question Help A corporation is trying to decide whether to buy the patent for a product designed by another company. The decision

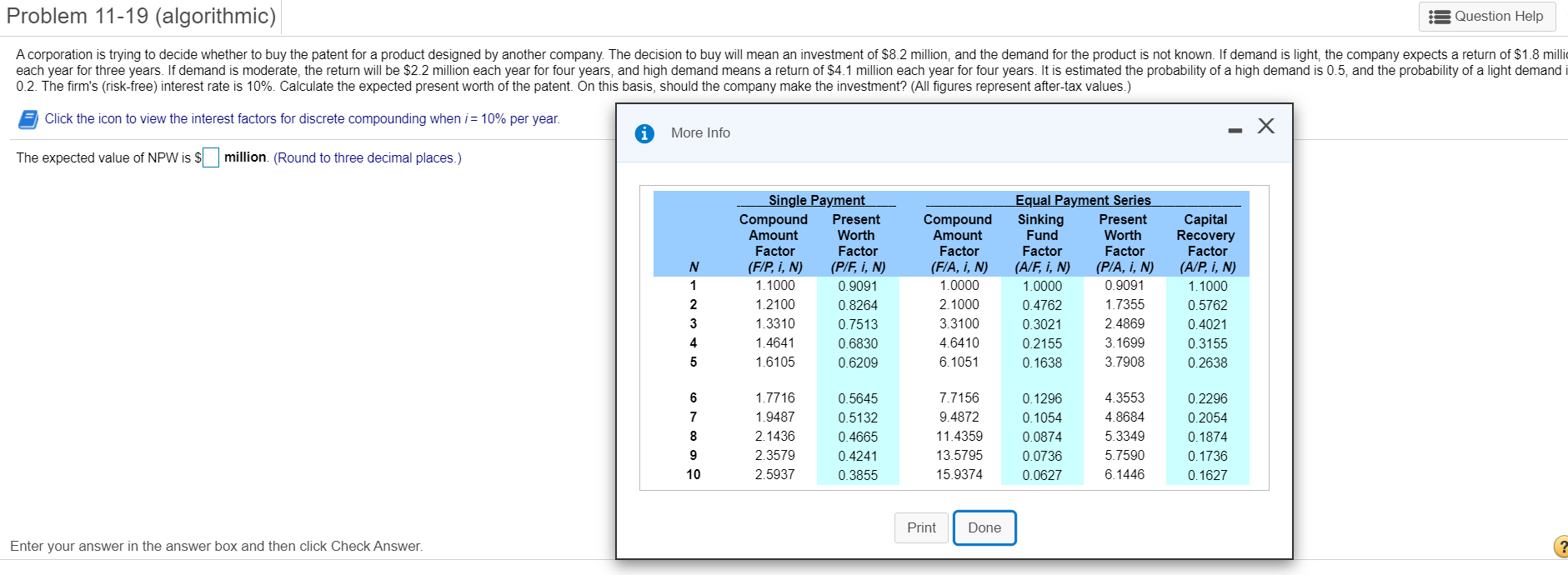

Problem 11-19 (algorithmic) Question Help A corporation is trying to decide whether to buy the patent for a product designed by another company. The decision to buy will mean an investment of $8.2 million, and the demand for the product is not known. If demand is light, the company expects a return of $1.8 milli each year for three years. If demand is moderate, the return will be $2.2 million each year for four years, and high demand means a return of $4.1 million each year for four years. It is estimated the probability of a high demand is 0.5, and the probability of a light demand 0.2. The firm's (risk-free) interest rate is 10%. Calculate the expected present worth of the patent. On this basis, should the company make the investment? (All figures represent after-tax values.) Click the icon to view the interest factors for discrete compounding when i= 10% per year. More Info The expected value of NPW is $ million. (Round to three decimal places.) N 1 Single Payment Compound Present Amount Worth Factor Factor (F/P, I, N) (P/F, I, N) 1.1000 0.9091 1.2100 0.8264 1.3310 0.7513 1.4641 0.6830 1.6105 0.6209 Compound Amount Factor (F/A, I, N) 1.0000 2.1000 3.3100 4.6410 6.1051 Equal Payment Series Sinking Present Fund Worth Factor Factor (A/F, i, N) (P/A, I, N) 1.0000 0.9091 0.4762 1.7355 0.3021 2.4869 0.2155 3.1699 0.1638 3.7908 Capital Recovery Factor (A/P, I, N) 1.1000 0.5762 0.4021 0.3155 0.2638 2 3 4 5 6 7 8 1.7716 1.9487 2.1436 2.3579 2.5937 0.5645 0.5132 0.4665 0.4241 0.3855 7.7156 9.4872 11.4359 13.5795 15.9374 0.1296 0.1054 0.0874 0.0736 0.0627 4.3553 4.8684 5.3349 5.7590 6.1446 0.2296 0.2054 0.1874 0.1736 0.1627 9 10 Print Done Enter your answer in the answer box and then click Check Answer. ? A corporation is trying to decide whether to buy the patent for a product designed by another company. The decision to buy will mean an investment of $8.2 million, and the demand for the product is not known. If demand is light, the company expects a return of $1.8 million each year for three years. If demand is moderate, the return will be $2.2 million each year for four years, and high demand means a return of $4.1 million each year for four years. It is estimated the probability of a high demand is 0.5, and the probability of a light demand is 0.2. The firm's (risk-free) interest rate is 10%. Calculate the expected present worth of the patent. On this basis, should the company make the investment? (All figures represent after-tax values.) Click the icon to view the interest factors for discrete compounding when i = 10% per year. The expected value of NPW is $million (Round to three decimal places.)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts