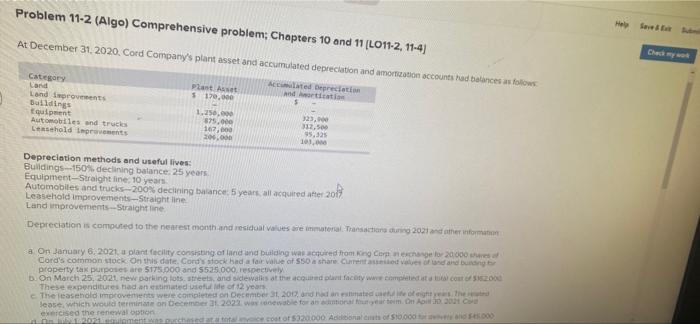

Question: Problem 11-2 (Algo) Comprehensive problem: Chapters 10 and 11 [L011-2, 11-4 fe Chasing At December 31, 2020. Cord Company's plant asset and accumulated depreciation and

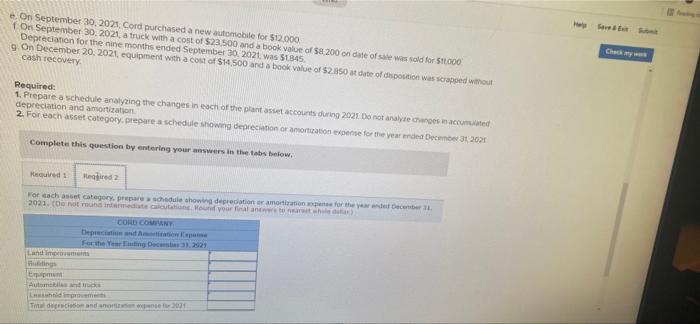

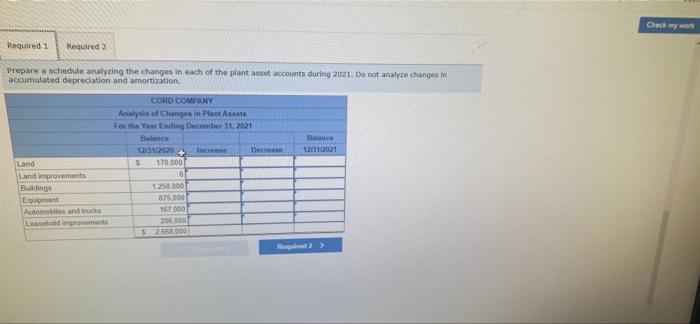

Problem 11-2 (Algo) Comprehensive problem: Chapters 10 and 11 [L011-2, 11-4 fe Chasing At December 31, 2020. Cord Company's plant asset and accumulated depreciation and moon accountstad balances as follows depreciatim Category plants Land $ 170.00 $ Land for Buildings 1.250.000 23. Equipment 375.000 312.500 Automobiles and truces 102, 95.325 Leasehold improvements 200.000 10. Depreciation methods and useful lives: Buildings--150% declining balance 25 years Equipment-line 10 years Leasehold improvements-Straight line Land improvements - Straight line Depreciation is computed to the nearest month and residual values are interal Transactions during 2021 and other information Automobiles and arche-2009decening bwance, 5 years, all acquired after 2017 a On January 6, 2021 a plant facility consisting of land and building was acquired from Connector 20.000 Cord's common stock On this date. Cord's stock had a fair value of $50 share. Crevet and but property tax purposes are $175.000 and 5525.000, respectively On March 25, 2021 new parking lots, streets and sidewalks at the courant facity we completed to co These expenditures had an estimated some of 12 years The leasehold improvements were completed on December 31, 2017 and animated content Jease. which would term on December , 2023 wwe foran item. On 0.001 exercised the renewal option Romance cost of 5320000 Adeboral 10.000 On September 30, 2021. Cord purchased a new automobile for $22.000 On September 30, 2021, a truck with a cost of $23.500 and a book value of 58 200 on date of sale was sold for 511000 Depreciation for the nine months ended September 30, 2021 was $1845 G.On December 20, 2021, equipment with a cost of $14.500 and a book value of $2.50 date of dispution was scrapped without cash recovery Required: 1. Prepare a schedule analyzing the changes in each of the plants et accounts during 2021. Do not analyse changes in acciated depreciation and amortization 2. For each assetCategory, prepare a schedule showing depreciation or amortization expense for the year med December 31 2021 Complete this question by entering your answers in the tabs below Hered 1 Pred2 For each as category, prepare schedule showing depreciation or amortization for the detect 2021. not run intermediate und Vorlato CORD COUNY Depende For the Yewing Dec 31.2923 Landows : Autom Ltd Tection and no 2001 Check my werk Required 1 Required Prepare a schedule analyzing the changes in each of the plant asset accounts during 2021. Do not analyse changes in accumulated depreciation and amortization new 12010021 Land and improvements Buildings Equiment Automobiles and trucks Lasehold provements CORD COMPANY Analysis of Changes in Plant AS For the Year Ending December 31, 2021 Balance 1200120204 Increase Dec 5 170 000 0 1.200.000 75 000 167.000 206 300 3 20000 gad > >

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts