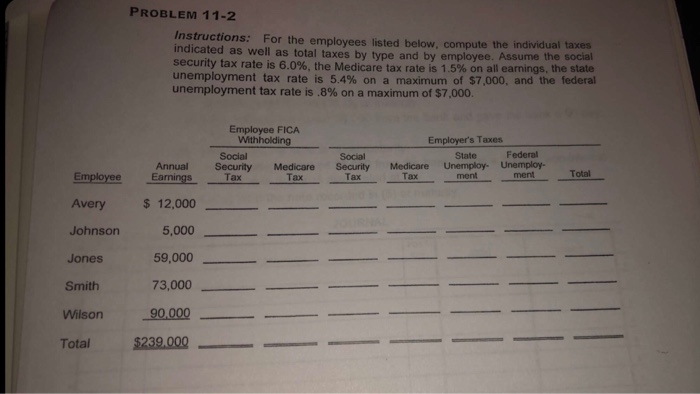

Question: PROBLEM 11-2 Instructions: For the employees listed below, indicated as well as total taxes by type and by employee. security tax rate is 6.0%, the

PROBLEM 11-2 Instructions: For the employees listed below, indicated as well as total taxes by type and by employee. security tax rate is 6.0%, the Medicare tax rate is 1.5% on all earnings, the state unemployment tax rate is 5.4% on a maximum of $7,000, and the federal unemployment tax rate is .8% on a maximum of $7,000. compute the individual taxes Assume the social Employee FICA Withholding Employer's Taxes State Social Federal AnnualSecurity Medicare Security Medicare Unemploy- Unemploy- EmployeeEarnings TaxTaxTaxTaxment ment Avery Johnson Jones Smith Wilson 90,000_ menTotal $ 12,000 5,000 9,000 73,000 Total $239.000

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts