Question: Problem 11.21 Your answer is partially correct. Try again. Archer Daniels Midland Company is considering buying a new farm that it plans to operate for

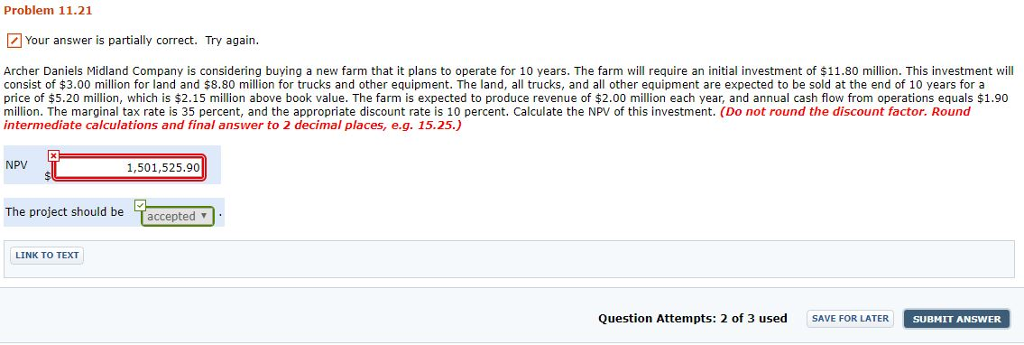

Problem 11.21 Your answer is partially correct. Try again. Archer Daniels Midland Company is considering buying a new farm that it plans to operate for 10 years. The farm will require an initial investment of $11.80 million. This investment will consist of $3.00 million for land and $8.80 million for trucks and other equipment. The land, all trucks, and all other equipment are expected to be sold at the end of 10 years for a price of $5.20 million, which is $2.15 million above book value. The farm is expected to produce revenue of $2.00 million each year, and annual cash flow from operations equals $1.90 million. The marginal tax rate is 35 percent, and the appropriate discount rate is 10 percent. Calculate the NPV of this investment. (Do not round the discount factor. Round intermediate calculations and final answer to 2 decimal places, e.g. 15.25.) NPV 1,501,525.90 The project should be T-accepted LINK TO TEXT Question Attempts: 2 of 3 used SAVE FOR LATER SUBHIT

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts