Question: Problem 11-25 (Algo) Basic Transfer Pricing [LO11-3] Alpha and Beta are divisions within the same company. The managers of both divisions are evaluated based on

![Problem 11-25 (Algo) Basic Transfer Pricing [LO11-3] Alpha and Beta are](https://dsd5zvtm8ll6.cloudfront.net/si.experts.images/questions/2024/10/66fc12b3bae4e_89166fc12b353cfd.jpg)

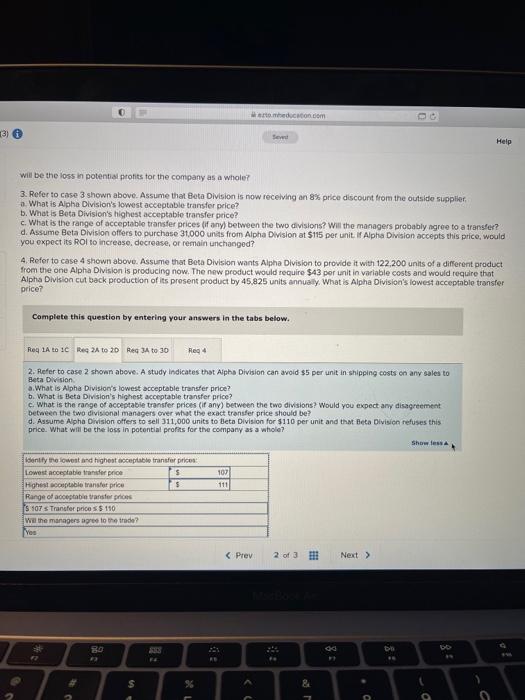

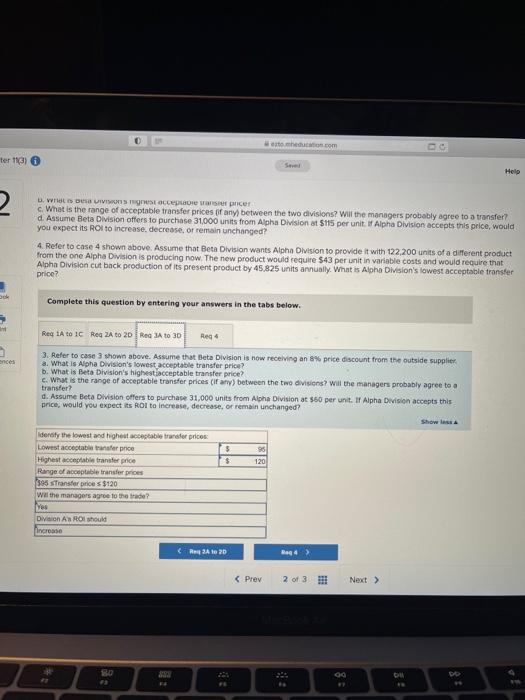

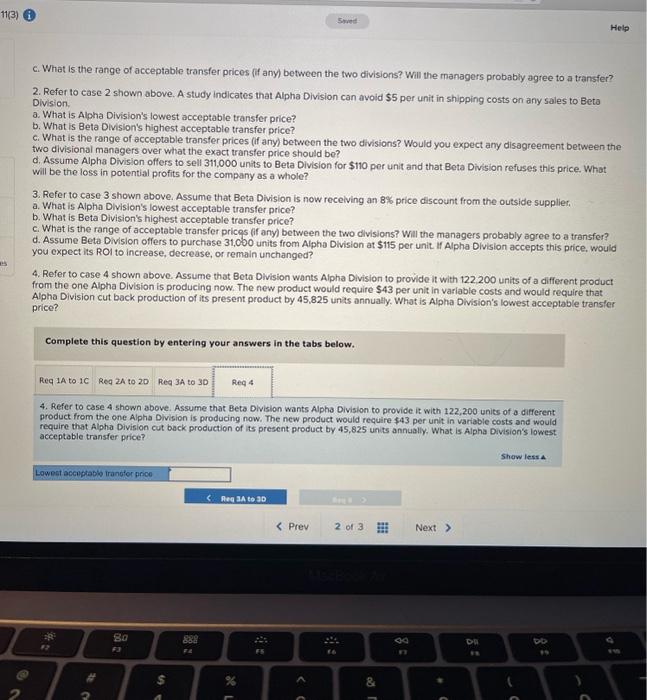

Problem 11-25 (Algo) Basic Transfer Pricing [LO11-3] Alpha and Beta are divisions within the same company. The managers of both divisions are evaluated based on their own division's return on investment (ROI). Assume the following information relative to the two divisions: erore any purchase discount. Required: 1. Refer to case 1 shown above. Alpha. Division can avold $2 per unit in commissions on any sales to Beta Division. a. What is Alpho Division's lowest acceptable transfer price? b. What is Beta Division's highest acceptable transfer price? c. What is the range of acceptable transfer prices (if any) between the two divisions? Wil the managers probably agree to a transfer? 2. Refer to case 2 shown above. A study indicates that Alpho Division can avoid $5 per unit in shipping costs on any sates to Beta Division. a. What is Alpha Division's lowest acceptable transfer price? b. What is Beta Division's highest acceptable transfer price? c. What is the range of acceptable transfer prices (if any) between the two divisions? Would you expect any disagreement between the two divisional managers over what the exact tansfer price should be? d. Assume Alpha Division offers to sell 31.000 units to Beta Division for $110 per unit and that Beta Division refuses this price. What will be the loss in potential profits for the company as a whole? 3. Refer to case 3 shown above. Assume that Beta Division is now receivina an will be the loss in potential profits tor the company as a whole? 3. Refer to case 3 shown above. Assume that 8eta Division is now recelving an 8% price discount from the outside supplier. a. What is Apha Division's lowest acceptable-transfer price? b. What is Bota Division's highest acceptabie transfer price? c. What is the range of acceptablo transfer prices (if any) between the two divisions? Will the managers probably agree to a transfer? d. Assume Beta Division offers to purchase 31,000 unats from Alpha Division at 5115 per unit if Alpha Division accepts this price, would you expect its ROI to increase, decrease, of remain unchanged? 4. Refer to case 4 shown above. Assume that Beea Division wants Alpha Division to prowide it with 122,200 units of a different product from the one Alpha Dlvision is producing now. The new product would require $43 per anit in variable costs and would require that Alphs Division cut back production of its prosent product by 45.825 units annualy. What is Alpha Division's lowest acceptable transfer price? Camplete this question by entering your answers in the tabs below. 2. Refer to case 2 shown above. A study indicates thst Aphs. Division can avoid 35 per unit in-shipping costs on any sales to Beta Divisian a. What is Alpha Division's lowest acceptable transfer price? b. What is Beta Division's highest acceptable transfer price? c. What is the range of acceptabie transfer prices (if any) between the twe divisions? Would you expect any disagreement between the two divisional managers over what the exact transfer price should be? d. Assume Apha Division offers to sell 311,000 units to Eleta Division for $110 per unit and that Beca Division refuses this price. What witi be the loss in potential profits for the company as a whole? 4. wriat is oesa Uivisoras ingnest accepcabie transier pricer c. What is the range of acceptable transfer prices (if any between the two divisions? Will the managers probably agree to a transfer? d. Assume Beta Division offers to purchase 31,000 units from Alpha Division ot $115 per unit if Alpha Division accepts this price, would you expect its RO: to increase, decrease, of remain unchanged? 4. Reler to case 4 shewn above. Assume that Beta. Division wants Alpha Division to provide it with 122,200 units of a different product Trom the one Alpha Dwision is producing now. The new product would require $43 per unit in variable costs and would reculre that Alpha Division cut back production of its present product by 45.825 units annually. What is Alpha Division's lowest acceptable transfer price? Complete this question by entering your answers in the tabs below. 3. Refer to case 3 shown above. Assume that Beta Division is now receiving an sis price discount from the outside supplicz a. What is Aloha Division's lowest acceptable tranafer pelce? 3. What is Alpha Division's lowest acceptable transfer price? b. What is Beta Division's highestiacceptable transfer price? c. Why is the range of acceptable transfer prices (If afy) between the two diviens? Will the managers probably agree to a transfer? d. Assume Beta Division effers to purchabe 31,000 units from Alpha Division at 560 per unit. If Alpha Division accepts this price, would you expect iss Roil to increase, decrease, or remain unchanged? c. What is the range of acceptable transfer prices (if any) between the two divisions? Will the managers probably agree to a transfer? 2. Refer to case 2 shown above. A study indicates that Alpha Division can avoid $5 per unit in shipping costs on any sales to Beta Division. a. What is Alpha Division's lowest acceptable transfer price? b. What is Beta Division's highest acceptable transfer price? c. What is the range of acceptable transfer prices (ff any) between the two divisions? Would you expect any disagreement between the two divisional managers over what the exact transfer price should be? d. Assume Alpha Division offers to sell 311,000 units to Beta Division for $110 per unit and that Beta Division refuses this price. What will be the loss in potential profits for the company as a whole? 3. Refer to case 3 shown above. Assume that Beta Division is now receiving an 8% price discount from the outside supplier. a. What is Alpha Division's lowest acceptable transfer price? b. What is Beta Division's highest acceptable transfer price? c. What is the range of acceptable transfer prices (if any) between the two divisions? Will the managers probably agree to a transfer? d. Assume Beta Division offers to purchase 31,000 units from Alpho Division at $115 per unit. If Alpha Division accepts this price. would you expect its ROI to increase, decrease, or remain unchanged? 4. Refer to case 4 shown above. Assume that Beta Division wants Alpha Division to provide it with 122,200 units of a different product from the one Alpha Division is producing now. The new product would require $43 per unit in variable costs and would require that Alpha Division cut back production of its present product by 45,825 units annually. What is Alpha Division's lowest acceptable transfer price? Complete this question by entering your answers in the tabs below. 4. Refer to case 4 shown above. Assume that Beta Division wants Alpha Division to provide it with 122,200 units of a different product from the one Alpha Division is producing now. The new product would require $43 per unit in variable costs and would require that Alpha Division cut back production of its present product by 45,825 units annually. What is Alpha Division's lowest acceptable transfer price

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts