Question: Problem 11-28 Determining the break-even point and preparing a contribution margin income statement LO 11-5 Ritchie Manufacturing Company makes a product that it sells for

Problem 11-28 Determining the break-even point and preparing a contribution margin income statement LO 11-5

Ritchie Manufacturing Company makes a product that it sells for $140 per unit. The company incurs variable manufacturing costs of $78 per unit. Variable selling expenses are $13 per unit, annual fixed manufacturing costs are $350,000, and fixed selling and administrative costs are $149,800 per year.

Required

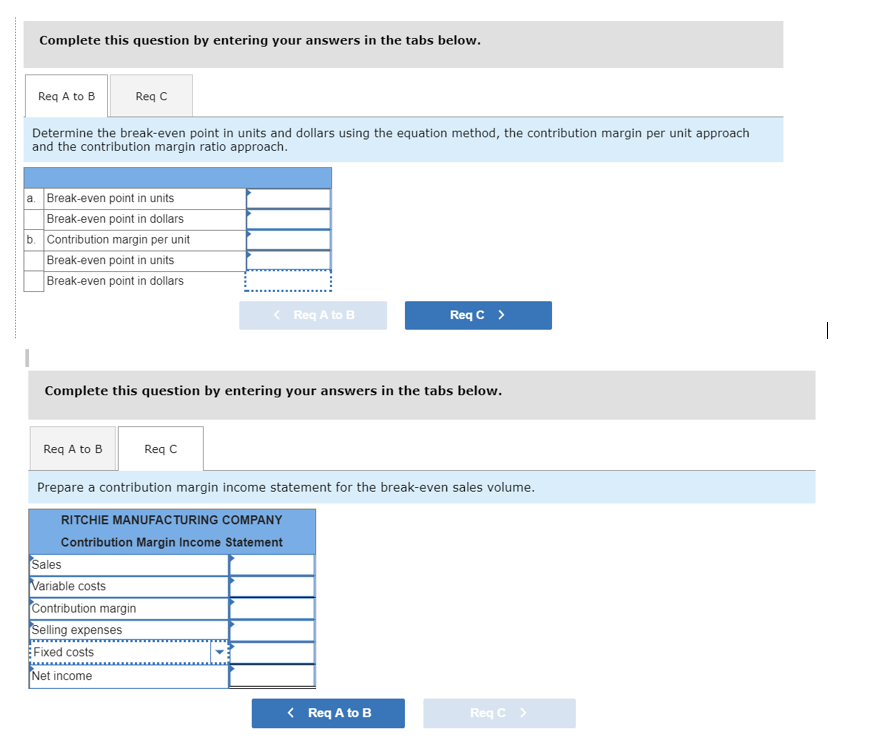

Determine the break-even point in units and dollars using each of the following approaches:

- Use the equation method.

- Use the contribution margin per unit approach.

- Prepare a contribution margin income statement for the break-even sales volume.

Complete this question by entering your answers in the tabs below. Req A to B Reqc Determine the break-even point in units and dollars using the equation method, the contribution margin per unit approach and the contribution margin ratio approach. Break-even point in units Break-even point in dollars b. Contribution margin per unit Break-even point in units Break-even point in dollars Req A to B Reqc > Complete this question by entering your answers in the tabs below. Req A to B Reqc Prepare a contribution margin income statement for the break-even sales volume. RITCHIE MANUFACTURING COMPANY Contribution Margin Income Statement Sales Variable costs Contribution margin Selling expenses Fixed costs Net income

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts