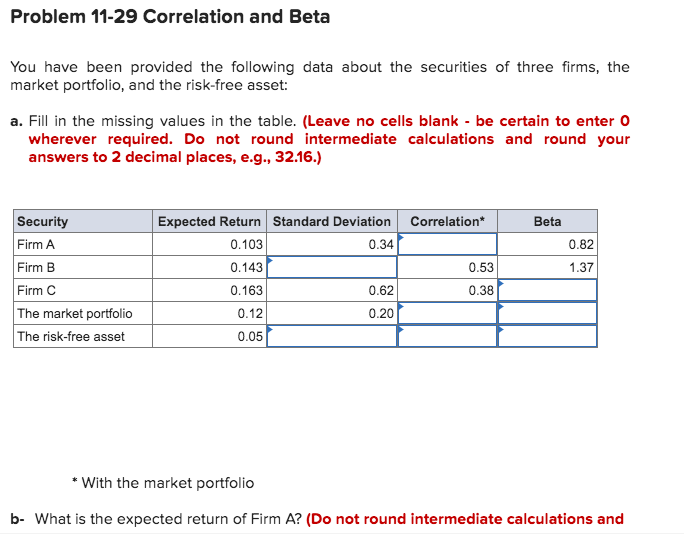

Question: Problem 11-29 Correlation and Beta You have been provided the following data about the securities of three firms, the market portfolio, and the risk-free asset:

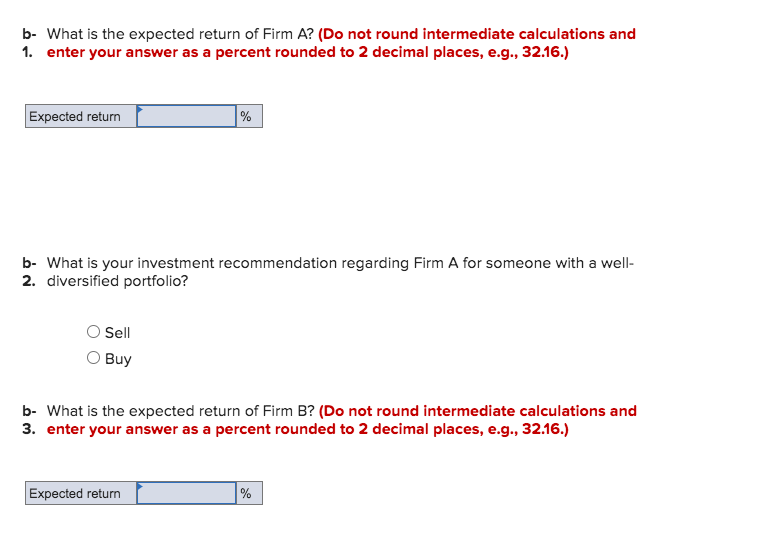

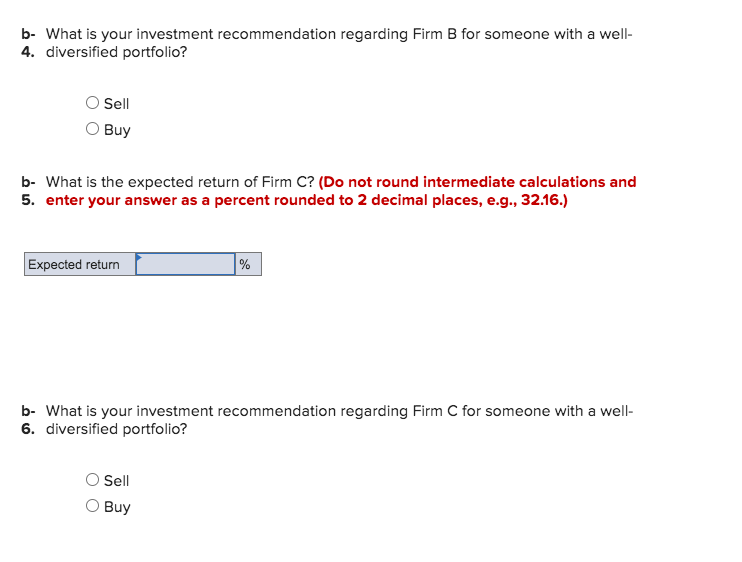

Problem 11-29 Correlation and Beta You have been provided the following data about the securities of three firms, the market portfolio, and the risk-free asset: a. Fill in the missing values in the table. (Leave no cells blank - be certain to enter 0 wherever required. Do not round intermediate calculations and round your answers to 2 decimal places, e.g., 32.16.) Security Firm A Firm B Firm C The market portfolio The risk-free asset Expected Return Standard Deviation Correlation* 0.103 0.34 0.143 0.53 0.163 0.62 0.38 0.12 0.20 Beta 0.82 1.37 0.05 * With the market portfolio b- What is the expected return of Firm A? (Do not round intermediate calculations and b- What is the expected return of Firm A? (Do not round intermediate calculations and 1. enter your answer as a percent rounded to 2 decimal places, e.g., 32.16.) Expected return % b- What is your investment recommendation regarding Firm A for someone with a well- 2. diversified portfolio? O Sell O Buy b- What is the expected return of Firm B? (Do not round intermediate calculations and 3. enter your answer as a percent rounded to 2 decimal places, e.g., 32.16.) Expected return % b- What is your investment recommendation regarding Firm B for someone with a well- 4. diversified portfolio? Sell Buy b- What is the expected return of Firm C? (Do not round intermediate calculations and 5. enter your answer as a percent rounded to 2 decimal places, e.g., 32.16.) Expected return % b- What is your investment recommendation regarding Firm C for someone with a well- 6. diversified portfolio? Sell O Buy

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts