Question: Problem 11-3 Portfolio Expected Return (LO 1] You own a portfolio that is 20 percent invested in Stock X, 35 percent in Stock Y, and

![Problem 11-3 Portfolio Expected Return (LO 1] You own a portfolio](https://dsd5zvtm8ll6.cloudfront.net/si.experts.images/questions/2024/09/66f92ac9d330a_44966f92ac979c94.jpg)

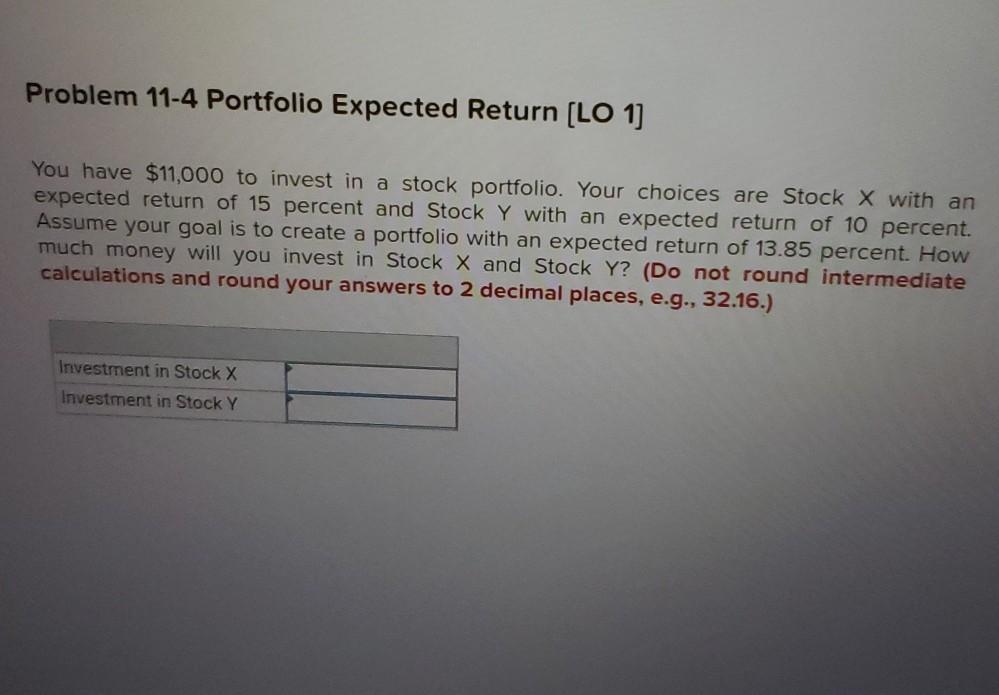

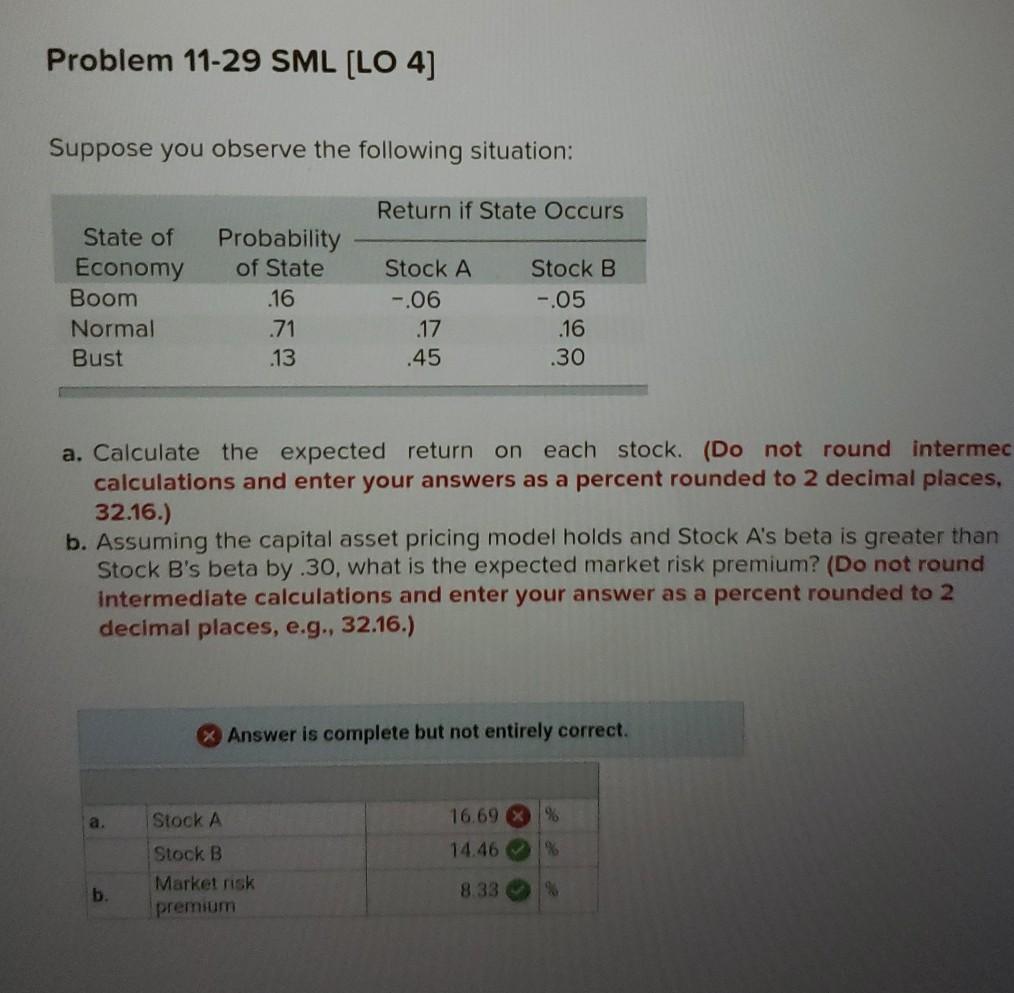

Problem 11-3 Portfolio Expected Return (LO 1] You own a portfolio that is 20 percent invested in Stock X, 35 percent in Stock Y, and 45 percent in Stock Z. The expected returns on these three stocks are 8 percent, 11 percent, and 13 percent, respectively. What is the expected return on the portfolio? (Do not round intermediate calculations and enter your answer as a percent rounded to 2 decimal places, e.g., 32.16.) Expected return % Problem 11-4 Portfolio Expected Return [LO 1] You have $11,000 to invest in a stock portfolio. Your choices are Stock X with an expected return of 15 percent and Stock Y with an expected return of 10 percent. Assume your goal is to create a portfolio with an expected return of 13.85 percent. How much money will you invest in Stock X and Stock Y? (Do not round intermediate calculations and round your answers to 2 decimal places, e.g., 32.16.) Investment in Stock X Investment in Stock Y Problem 11-29 SML (LO 4] Suppose you observe the following situation: Return if State Occurs State of Economy Boom Normal Bust Probability of State .16 .71 .13 Stock A -.06 17 .45 Stock B -.05 .16 .30 a. Calculate the expected return on each stock. (Do not round intermec calculations and enter your answers as a percent rounded to 2 decimal places, 32.16.) b. Assuming the capital asset pricing model holds and Stock A's beta is greater than Stock B's beta by.30, what is the expected market risk premium? (Do not round intermediate calculations and enter your answer as a percent rounded to 2 decimal places, e.g., 32.16.) Answer is complete but not entirely correct. a 16.69 % % 14.46 % Stock A Stock B Market risk premium b b 8.33

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts