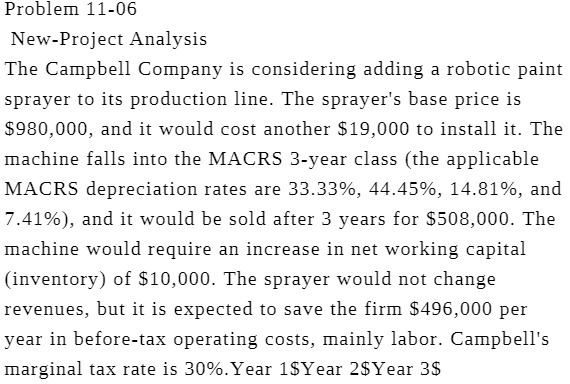

Question: Problem 11-36 New-Project Analysis The Campbell Company is considering adding a robotic paint sprayer to its production line. The sprayer's base price is $330,0DD, and

Problem 11-36 New-Project Analysis The Campbell Company is considering adding a robotic paint sprayer to its production line. The sprayer's base price is $330,0DD, and it would cost another $13,013!) to install it. The machine falls into the MACRS 3-year class [the applicable MAKERS depreciation rates are 33.33%, 44.45%, 14.31%, and 141%}, and it would be sold after 3 years for $503,DDU. The machine would require an increase in net working capital (inventory) of $1,. The sprayer would not change reyenues, but it is expected to save the firm $496,0 per year in before-tars. operating costs, mainly labor. Campbell's marginal ta}: rate is 3D%.Year 1$Year 2$Year 33

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts