Question: Problem 11-4 (algorithmic) A Question Help o You are considering an investment project with the financial information provided below. Suppose the company is most concerned

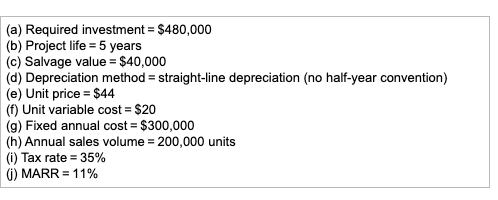

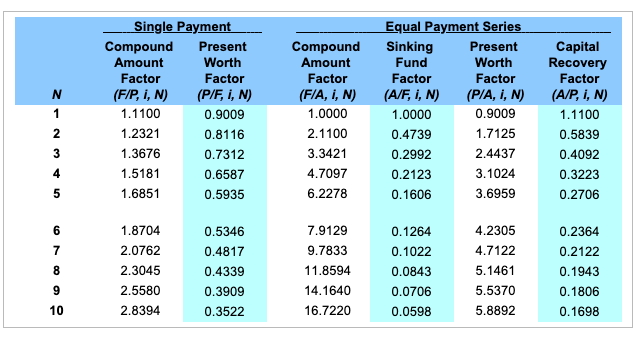

Problem 11-4 (algorithmic) A Question Help o You are considering an investment project with the financial information provided below. Suppose the company is most concerned about the impact of its price estimate on the project's rate of return. How would you address this concern? Click the icon to view the financial information about the investment project. Click the icon to view the interest factors for discrete compounding when i = 11% per year. The break-even value of unit price is $ 21.5. (Round to the nearest cent.) (a) Required investment = $480,000 (b) Project life = 5 years (c) Salvage value = $40,000 (d) Depreciation method = straight-line depreciation (no half-year convention) (e) Unit price = $44 (f) Unit variable cost = $20 (9) Fixed annual cost = $300,000 (h) Annual sales volume = 200,000 units (i) Tax rate = 35% 6) MARR = 11% N 1 Single Payment Compound Present Amount Worth Factor Factor (F/P, I, N) (P/F, I, N) 1.1100 0.9009 1.2321 0.8116 1.3676 0.7312 1.5181 0.6587 1.6851 0.5935 Compound Amount Factor (F/A, I, N) 1.0000 2.1100 3.3421 4.7097 6.2278 Equal Payment Series Sinking Present Fund Worth Factor Factor (A/F, I, N) (P/A, I, N) 1.0000 0.9009 0.4739 1.7125 0.2992 2.4437 0.2123 3.1024 0.1606 3.6959 Capital Recovery Factor (A/P, i, N) 1.1100 0.5839 0.4092 0.3223 2 3 4 5 0.2706 6 7 8 9 1.8704 2.0762 2.3045 2.5580 2.8394 0.5346 0.4817 0.4339 0.3909 0.3522 7.9129 9.7833 11.8594 14.1640 16.7220 0.1264 0.1022 0.0843 0.0706 0.0598 4.2305 4.7122 5.1461 5.5370 5.8892 0.2364 0.2122 0.1943 0.1806 0.1698 10

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts