Question: Problem 11-40 (algorithmic) Consider a risky investment project. The expected NPW of the project is $100 million and its standard deviation is estimated to be

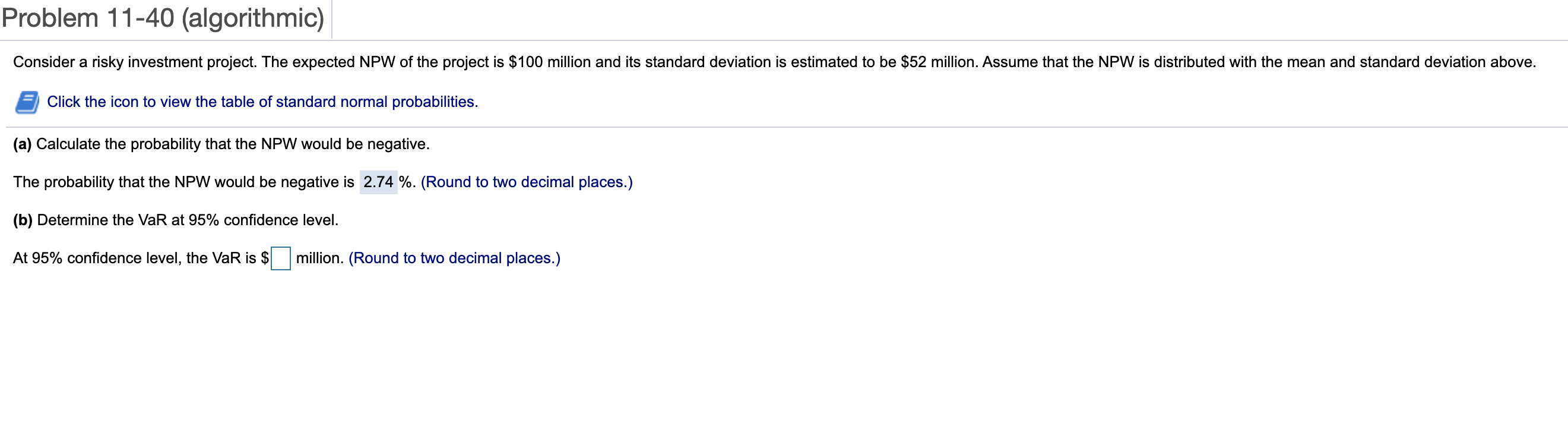

Problem 11-40 (algorithmic) Consider a risky investment project. The expected NPW of the project is $100 million and its standard deviation is estimated to be $52 million. Assume that the NPW is distributed with the mean and standard deviation above. Click the icon to view the table of standard normal probabilities. (a) Calculate the probability that the NPW would be negative. The probability that the NPW would be negative is 2.74 %. (Round to two decimal places.) (b) Determine the VaR at 95% confidence level. At 95% confidence level, the VaR is $ million. (Round to two decimal places.)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts