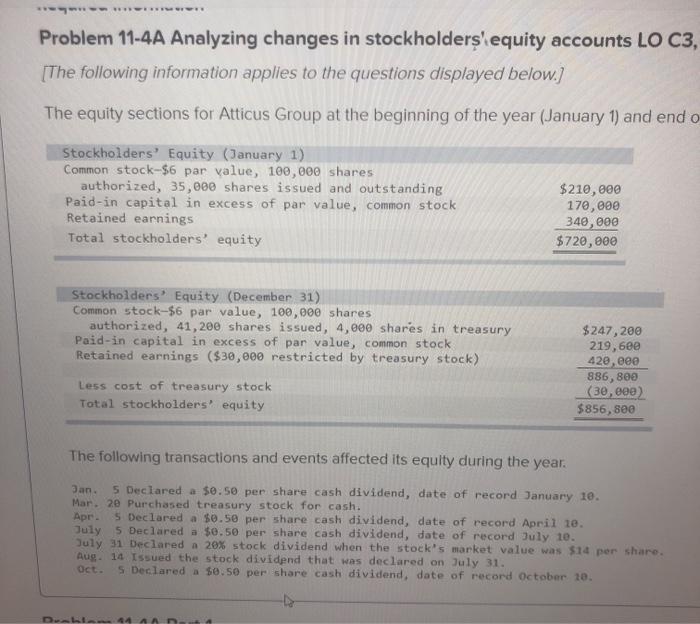

Question: Problem 11-4A Analyzing changes in stockholders equity accounts LO C3, [The following information applies to the questions displayed below. The equity sections for Atticus Group

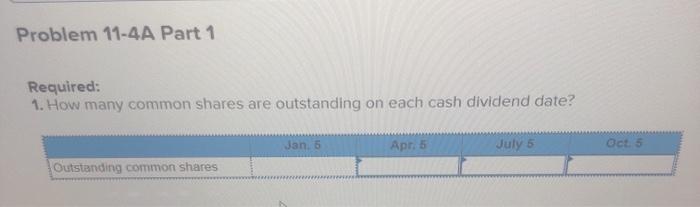

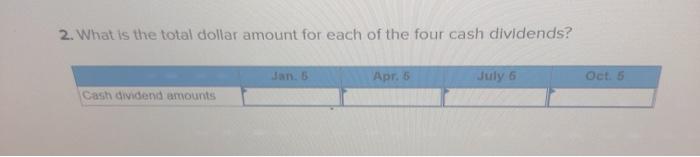

Problem 11-4A Analyzing changes in stockholders equity accounts LO C3, [The following information applies to the questions displayed below. The equity sections for Atticus Group at the beginning of the year (January 1) and end o Stockholders' Equity (January 1) Common stock-$6 par value, 100,000 shares authorized, 35,000 shares issued and outstanding Paid-in capital in excess of par value, common stock Retained earnings Total stockholders' equity $210,000 170,000 340,000 $720,000 Stockholders' Equity (December 31) Common stock-$6 par value, 100,000 shares authorized, 41,200 shares issued, 4,000 shares in treasury Paid-in capital in excess of par value, common stock Retained earnings ($30,000 restricted by treasury stock) Less cost of treasury stock Total stockholders' equity $247,200 219,6ee 420, eee 886, 800 (30,000) $856, 800 The following transactions and events affected its equity during the year. Jan. 5 Declared a $0.50 per share cash dividend, date of record January 10. Mar. 20 Purchased treasury stock for cash. Apr. 5 Declared a $0.50 per share cash dividend, date of record April 1e. July 5 Declared a $0.50 per share cash dividend, date of record July 10. July 31 Declared a 20% stock dividend when the stock's market value was $14 per share. Aug. 14 Issued the stock dividend that was declared on July 31. Oct S Declared a $0.50 per share cash dividend, date of record October 10. Dh44 A 1 Problem 11-4A Part 1 Required: 1. How many common shares are outstanding on each cash dividend date? Jan 5 Apr. 5 July 5 Oct 5 Outstanding common shares 2. What is the total dollar amount for each of the four cash dividends? Apr. s July 6 Oct. 5 Cash dividend amounts

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts