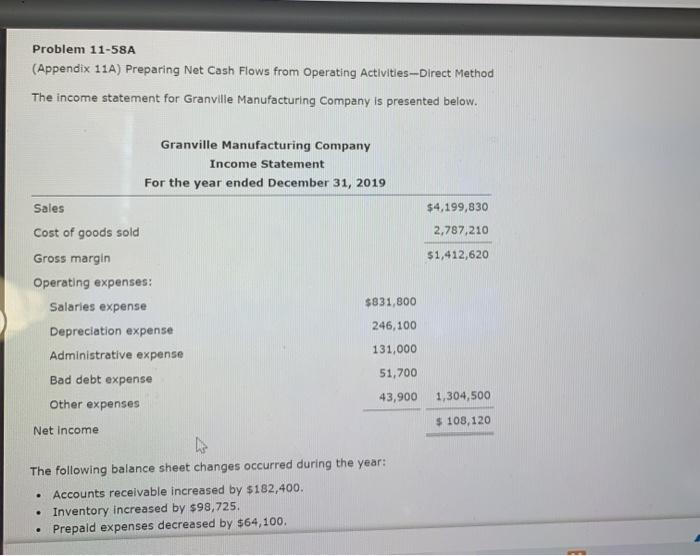

Question: Problem 11-58A (Appendix 11A) Preparing Net Cash Flows from Operating Activities-Direct Method The income statement for Granville Manufacturing Company is presented below. Granville Manufacturing Company

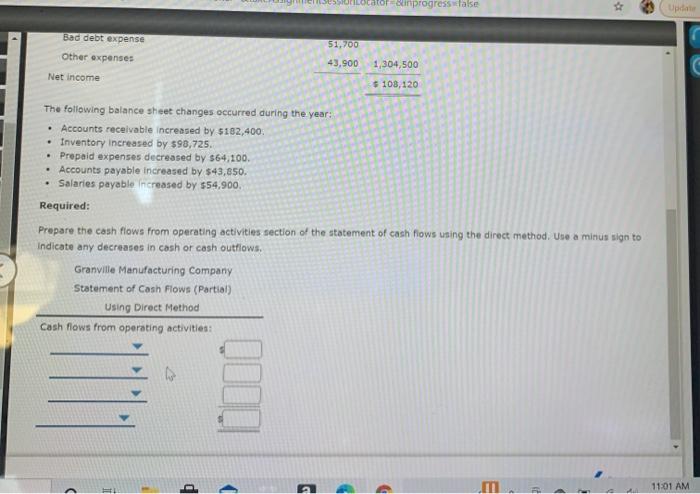

Problem 11-58A (Appendix 11A) Preparing Net Cash Flows from Operating Activities-Direct Method The income statement for Granville Manufacturing Company is presented below. Granville Manufacturing Company Income Statement For the year ended December 31, 2019 Sales $4,199,830 2,787,210 $1,412,620 Cost of goods sold Gross margin Operating expenses: Salaries expense Depreciation expense Administrative expense $831,800 246,100 131,000 51,700 Bad debt expense 43,900 Other expenses 1,304,500 $ 108,120 Net Income . The following balance sheet changes occurred during the year: Accounts recelvable increased by $182,400. Inventory Increased by $98,725. Prepald expenses decreased by $64,100 inprogress false Update Bad debt expense 51,700 Other expenses 43,900 1,304,500 Net income $ 108,120 The following balance sheet changes occurred during the year: Accounts receivable increased by $182,400 Inventory increased by $98,725. Prepaid expenses decreased by $64,100. Accounts payable increased by $43,850. Salaries payable increased by $54,900 Required: Prepare the cash flows from operating activities section of the statement of cash flows using the direct method. Use a minus sign to Indicate any decreases in cash or cash outflows. Granville Manufacturing Company Statement of Cash Flows (Partial) Using Direct Method Cash flows from operating activities: A G m 11:01 AM

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts