Question: Problem 11-6 A four-year project has cash flows before taxes and depreciation of $12,000 per year. The project requires the purchase of a $50,000 asset

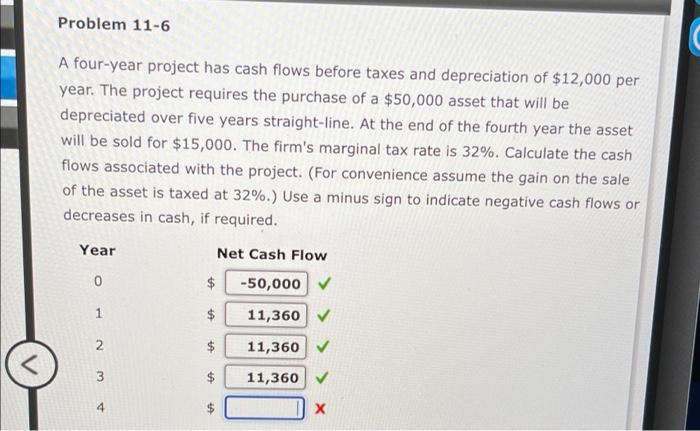

Problem 11-6 A four-year project has cash flows before taxes and depreciation of $12,000 per year. The project requires the purchase of a $50,000 asset that will be depreciated over five years straight-line. At the end of the fourth year the asset will be sold for $15,000. The firm's marginal tax rate is 32%. Calculate the cash flows associated with the project. (For convenience assume the gain on the sale of the asset is taxed at 32%.) Use a minus sign to indicate negative cash flows or decreases in cash, if required. Year Net Cash Flow 0 $ -50,000 1 $ 11,360 2 $ 11,360

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts