Question: Problem 11-61 (LO 11-5) Using the simplified method, determine the tax-free amount of the following distributions from a qualified pension plan. Individual contributions, if any,

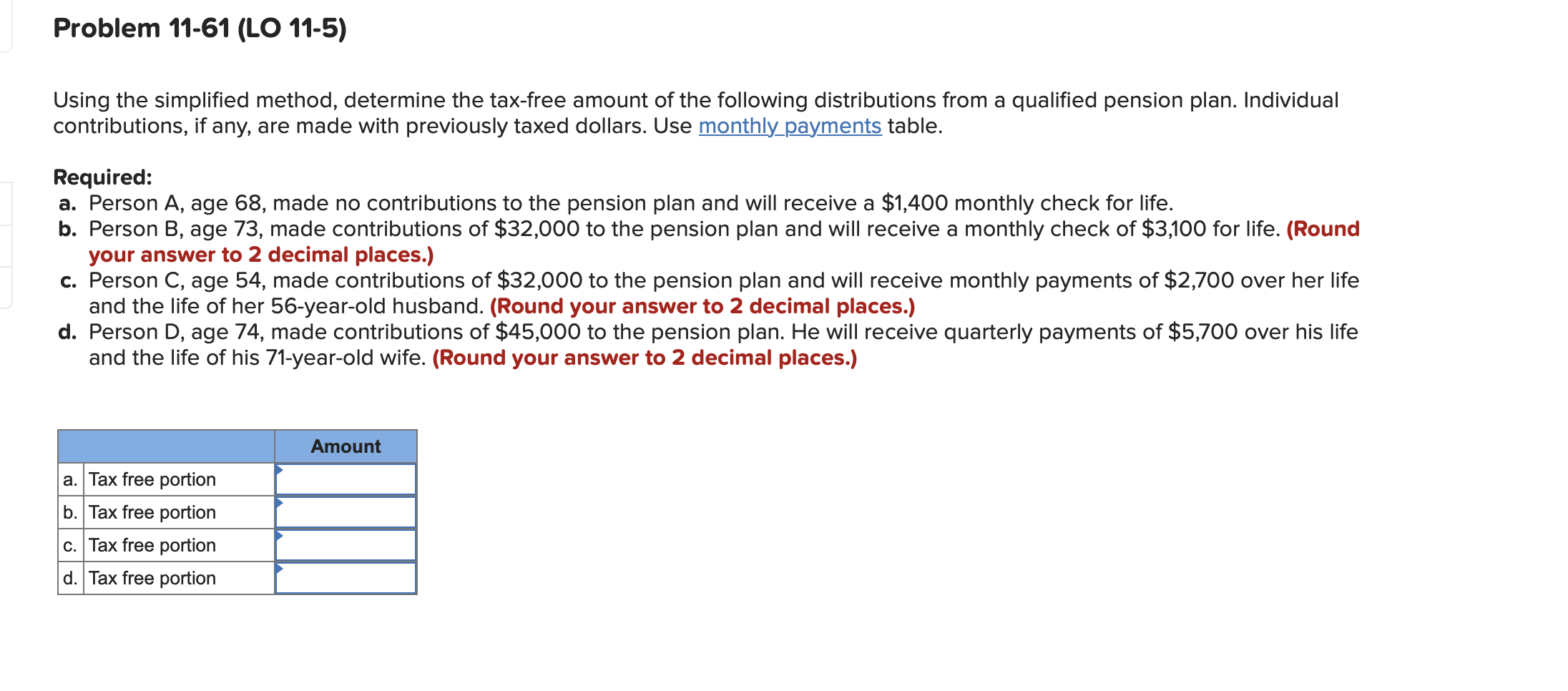

Problem 11-61 (LO 11-5) Using the simplified method, determine the tax-free amount of the following distributions from a qualified pension plan. Individual contributions, if any, are made with previously taxed dollars. Use monthly payments table. Required: a. Person A, age 68, made no contributions to the pension plan and will receive a $1,400 monthly check for life. b. Person B, age 73, made contributions of $32,000 to the pension plan and will receive a monthly check of $3,100 for life. (Round your answer to 2 decimal places.) c. Person C, age 54, made contributions of $32,000 to the pension plan and will receive monthly payments of $2,700 over her life and the life of her 56-year-old husband. (Round your answer to 2 decimal places.) d. Person D, age 74, made contributions of $45,000 to the pension plan. He will receive quarterly payments of $5,700 over his life and the life of his 71-year-old wife. (Round your answer to 2 decimal places.) Amount a. Tax free portion b. Tax free portion c. Tax free portion d. Tax free portion

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts