Question: Problem 11-66 Find Maximum Input Price: Estimated Net Realizable Value Method (LO 11-7) Ticon Corporation's manufacturing operation produces two joint products. Product delta sells for

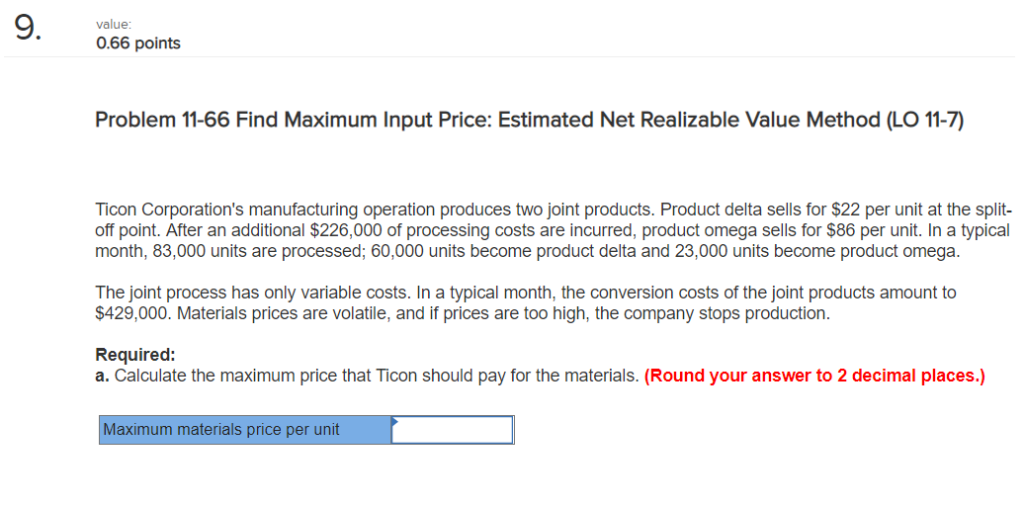

Problem 11-66 Find Maximum Input Price: Estimated Net Realizable Value Method (LO 11-7)

Ticon Corporation's manufacturing operation produces two joint products. Product delta sells for $22 per unit at the split-off point. After an additional $226,000 of processing costs are incurred, product omega sells for $86 per unit. In a typical month, 83,000 units are processed; 60,000 units become product delta and 23,000 units become product omega.

The joint process has only variable costs. In a typical month, the conversion costs of the joint products amount to $429,000. Materials prices are volatile, and if prices are too high, the company stops production.

Required:

a. Calculate the maximum price that Ticon should pay for the materials.

Maximum materials price per unit:

value: 0.66 points Problem 11-66 Find Maximum Input Price: Estimated Net Realizable Value Method (LO 11-7) Ticon Corporation's manufacturing operation produces two joint products. Product delta sells for $22 per unit at the split- off point. After an additional $226,000 of processing costs are incurred, product omega sells for $86 per unit. In a typical month, 83,000 units are processed; 60,000 units become product delta and 23,000 units become product omega. The joint process has only variable costs. In a typical month, the conversion costs of the joint products amount to $429,000. Materials prices are volatile, and if prices are too high, the company stops production. Required a. Calculate the maximum price that Ticon should pay for the materials. (Round your answer to 2 decimal places.) Maximum materials price per unit

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts