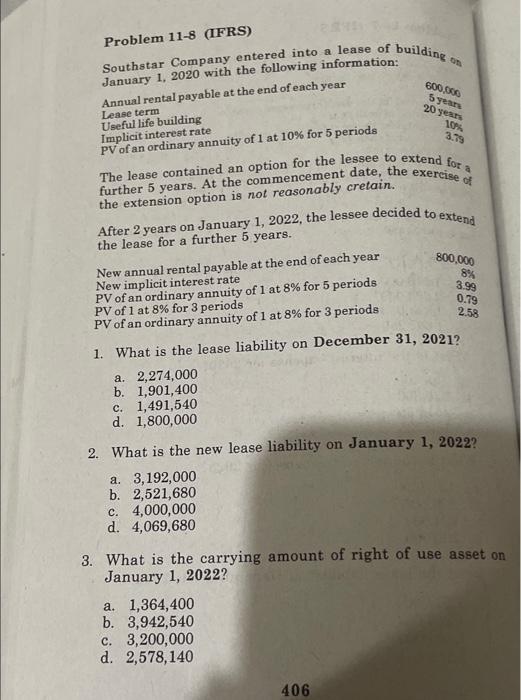

Question: PROBLEM 11-8 Please answer all om 600,000 5 years 20 years 10 3.79 a Problem 11-8 (IFRS) Southstar Company entered into a lease of building

om 600,000 5 years 20 years 10 3.79 a Problem 11-8 (IFRS) Southstar Company entered into a lease of building January 1, 2020 with the following information: Annual rental payable at the end of each year Lease term Useful life building Implicit interest rate PV of an ordinary annuity of 1 at 10% for 5 periods further 5 years. At the commencement date, the exercise of The lease contained an option for the lessee to extend for the extension option is not reasonably cretain. After 2 years on January 1, 2022, the lessee decided to extend the lease for a further 5 years. New annual rental payable at the end of each year New implicit interest rate PV of an ordinary annuity of 1 at 8% for 5 periods PV of 1 at 8% for 3 periods PV of an ordinary annuity of 1 at 8% for 3 periods 1. What is the lease liability on December 31, 2021? a. 2,274,000 b. 1,901,400 c. 1,491,540 d. 1,800,000 800,000 8% 3.99 0.79 2.58 2. What is the new lease liability on January 1, 20222 a. 3,192,000 b. 2,521,680 c. 4,000,000 d. 4,069,680 3. What is the carrying amount of right of use asset on January 1, 2022? a. 1,364,400 b. 3,942,540 c. 3,200,000 d. 2,578,140 406

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts