Question: Problem 11-8 Real versus Nominal Returns (LO2) You purchase 100 shares of stock for $25 a share. The stock pays a $2 per share dividend

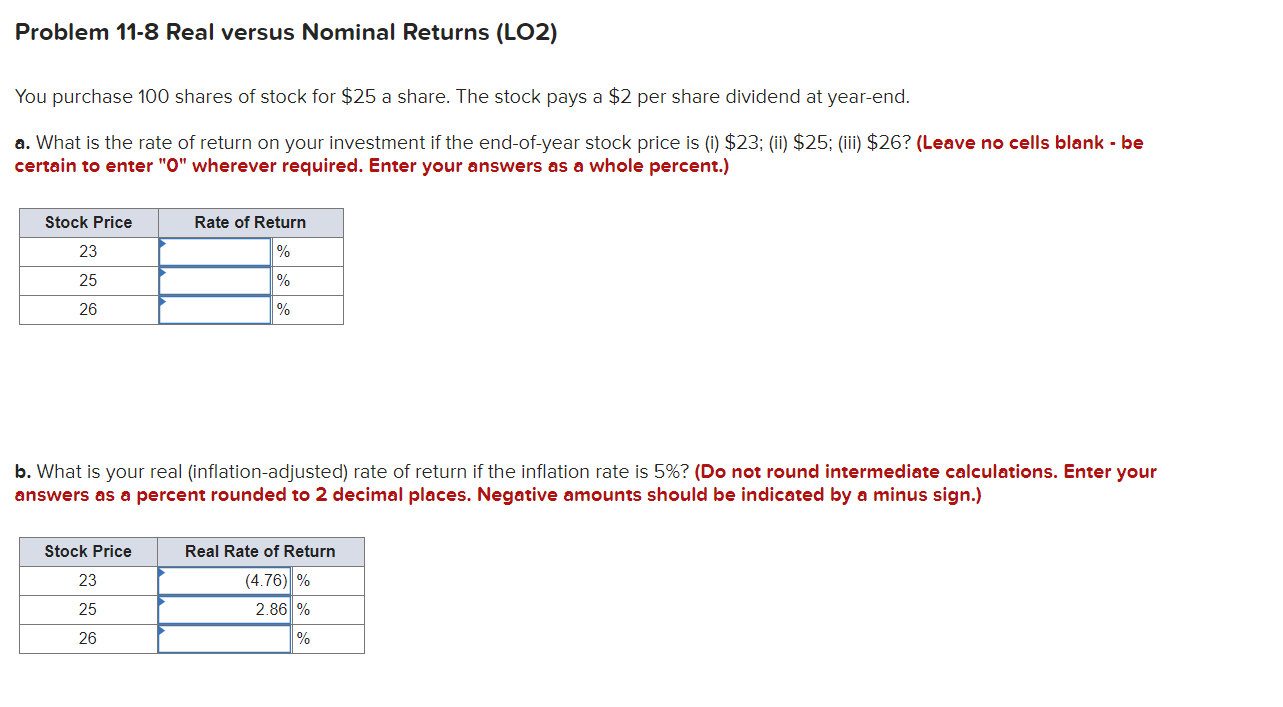

Problem 11-8 Real versus Nominal Returns (LO2) You purchase 100 shares of stock for $25 a share. The stock pays a $2 per share dividend at year-end. a. What is the rate of return on your investment if the end-of-year stock price is (1) $23; (ii) $25; (iii) $26? (Leave no cells blank - be certain to enter "0" wherever required. Enter your answers as a whole percent.) Stock Price Rate of Return 23 % 25 % 26 % b. What is your real (inflation-adjusted) rate of return if the inflation rate is 5%? (Do not round intermediate calculations. Enter your answers as a percent rounded to 2 decimal places. Negative amounts should be indicated by a minus sign.) Stock Price Real Rate of Return 23 (4.76) % 2.86 % 25 26 %

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts