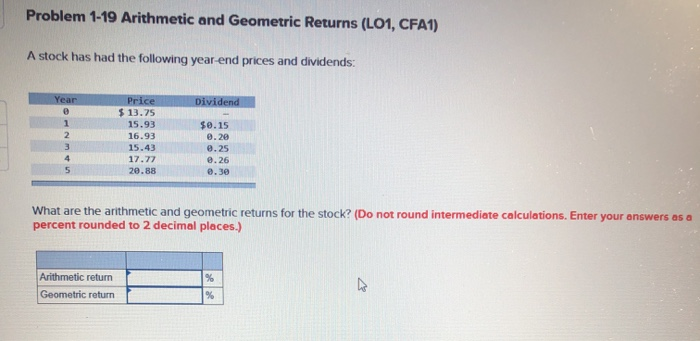

Question: Problem 1-19 Arithmetic and Geometric Returns (LO1, CFA1) A stock has had the following year-end prices and dividends: Year Dividend 1 2 Price $ 13.75

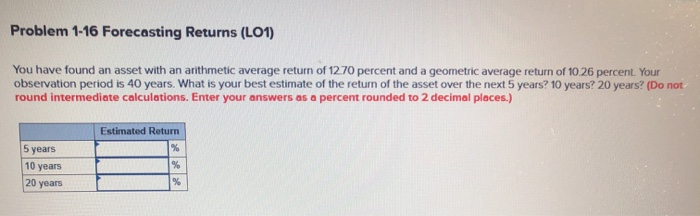

Problem 1-19 Arithmetic and Geometric Returns (LO1, CFA1) A stock has had the following year-end prices and dividends: Year Dividend 1 2 Price $ 13.75 15.93 16.93 15.43 17.72 20.88 $0.15 0.20 0.25 @.26 4 5 0.30 What are the arithmetic and geometric returns for the stock? (Do not round intermediate calculations. Enter your answers as a percent rounded to 2 decimal places.) Arithmetic return Geometric return % % Problem 1-16 Forecasting Returns (L01) You have found an asset with an arithmetic average return of 1270 percent and a geometric average return of 10 26 percent. Your observation period is 40 years. What is your best estimate of the return of the asset over the next 5 years? 10 years? 20 years? (Do not round intermediate calculations. Enter your answers as a percent rounded to 2 decimal places.) 5 years 10 years 20 years Estimated Return % % %

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts