Question: Problem 11-9 (similar to) Question Help (New project analysis) The Chung Chemical Corporation is considering the purchase of a chemical analysis machine. Although the machine

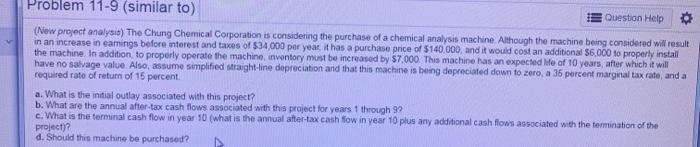

Problem 11-9 (similar to) Question Help (New project analysis) The Chung Chemical Corporation is considering the purchase of a chemical analysis machine. Although the machine being considered will result in an increase in eamings before interest and taxes of $34,000 per year, it has a purchase price of $140.000, and it would cost an additional $6,000 to properly install the machine. In addition to properly operate the machine, inventory must be increased by $7,000. This machine has an expected life of 10 years, after which it will have no salvage value. Also, assume simplified straight-line depreciation and that this machine is being depreciated down to zero, a 36 percent marginal tax rate, and a required rate of return of 15 percent a. What is the initial outlay associated with this project? b. What are the annual after-tax cash flows associated with this project for years through 92 c. What is the terminal cash flow in year 10 (what is the annual after-tax cash flow in year 10 plus any additional cash flows associated with the termination of the project)? d. Should this machine be purchased

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts