Question: Problem 11-B Measuring Risk Over the past five years, Cory Dogs, Inc. shareholders have had returns of 15.17%, 15.06% 10.59%, 6.67%, and 8.08% respectively, What

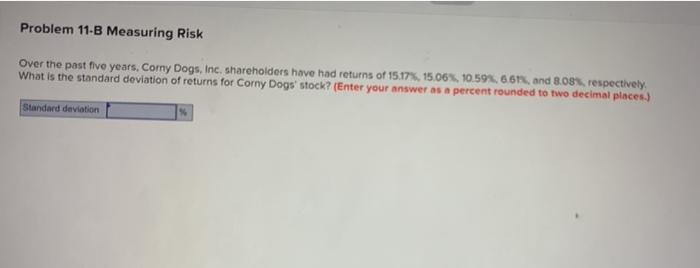

Problem 11-B Measuring Risk Over the past five years, Cory Dogs, Inc. shareholders have had returns of 15.17%, 15.06% 10.59%, 6.67%, and 8.08% respectively, What is the standard deviation of returns for Cory Dogs' stock? (Enter your answer as a percent rounded to two decimal places) Standard deviation

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts