Question: Problem 1-2 (Algorithmic ) The Tax Formula for Individuals (L0 1.3) Jason and Mary are married taxpayers in 2019 .They are both under age 65

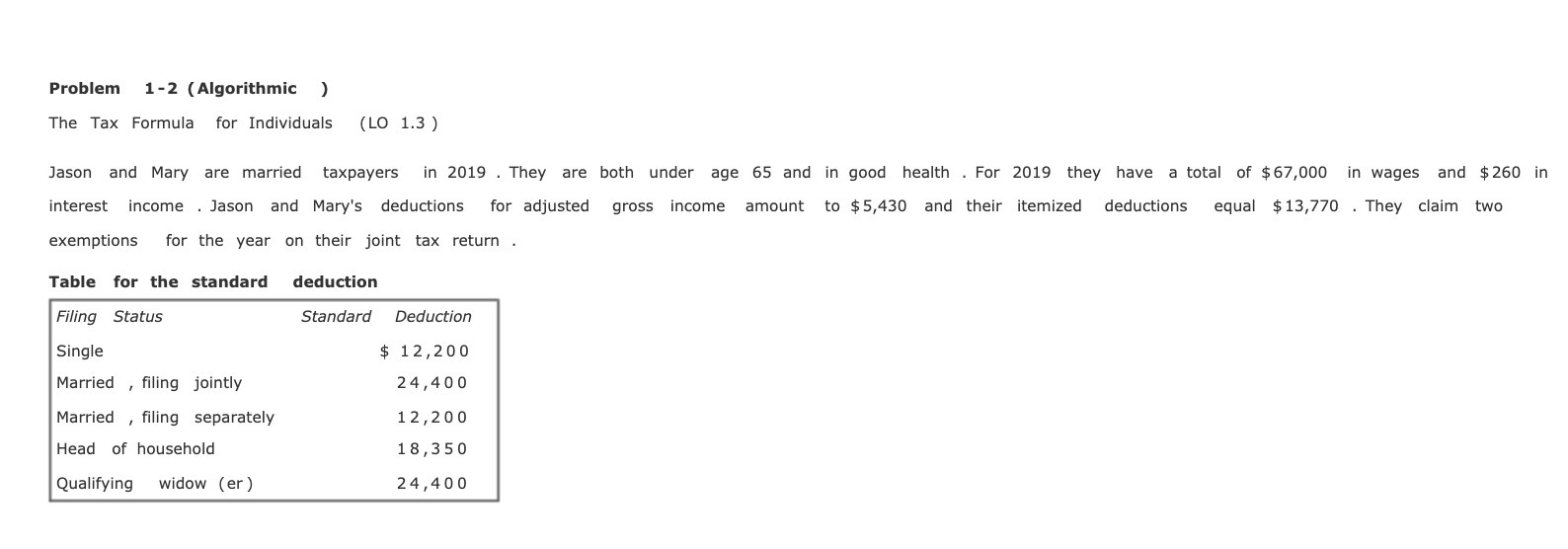

Problem 1-2 (Algorithmic ) The Tax Formula for Individuals (L0 1.3) Jason and Mary are married taxpayers in 2019 .They are both under age 65 and in good health . For 2019 they have a total of $67,000 in wages and $260 in interest income .Jason and Mary's deductions for adjusted gross income amount to $5,430 and their itemized deductions equal $13,770 .They claim two exemptions for the year on their joint tax return . Table for the standard deduction Filing Status Standard Deduction Single $ 12,200 Married ,ling jointly 24,400 Married ,ling separately 12,200 Head of household 13 ,3 5 0 Qualifying widow (er) 24,400

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts