Question: Problem 12 Intro Win Big Inc. is considering the development of a new hotel and casino. The initial cost of the project is $90 million,

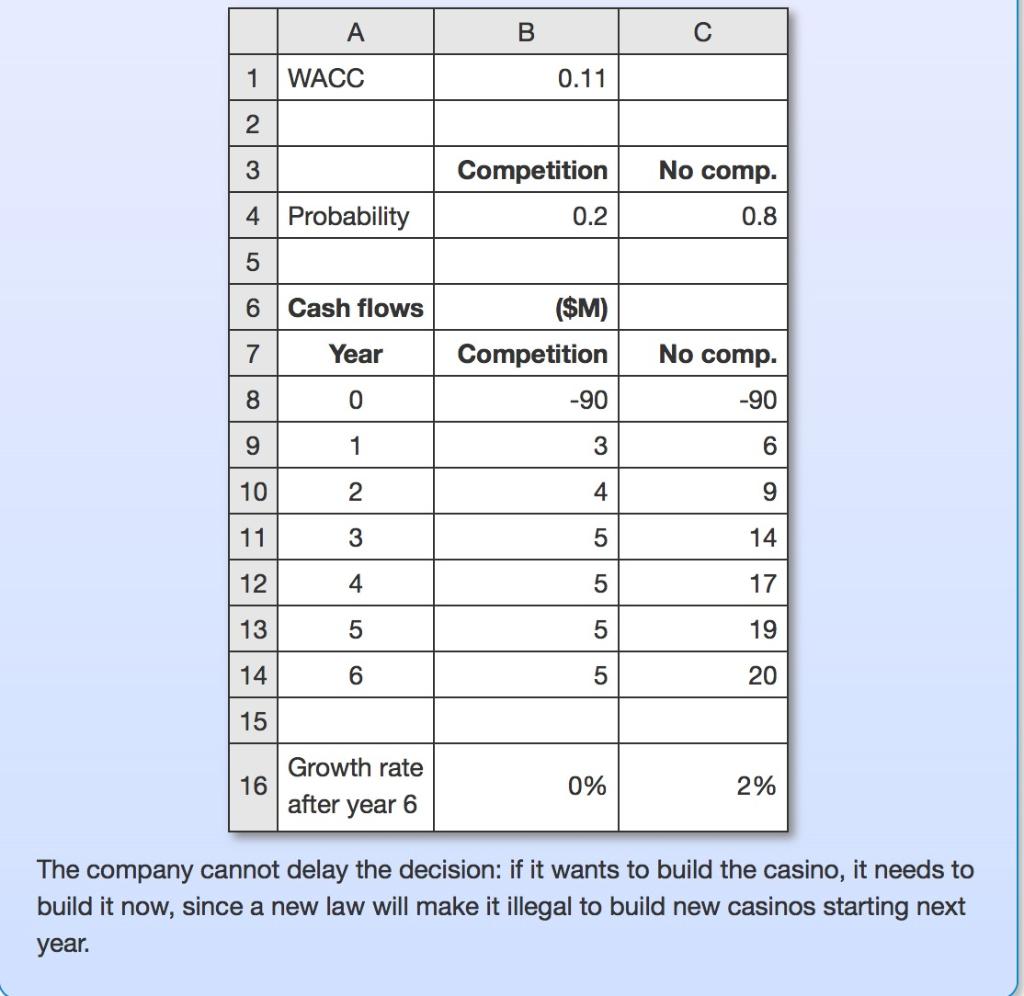

Problem 12 Intro Win Big Inc. is considering the development of a new hotel and casino. The initial cost of the project is $90 million, including the land, building and furniture. The company has a weighted average cost of capital of 11%. There is a 20% probability that another casino will be built on a nearby Indian reservation. The expected cash flows for each case are given below. After 6 years, cash flows are expected to increase at a constant rate forever. A B 1 WACC 0.11 2 3 Competition No comp. 0.2 0.8 4 Probability 5 LO 6 Cash flows ($M) Competition Year No comp. 7 8 0 -90 -90 9 1 3 6 10 2 4 9 11 3 5 14 12 4 5 17 13 5 5 19 14 6 5 20 15 16 Growth rate after year 6 0% 2% The company cannot delay the decision: if it wants to build the casino, it needs to build it now, since a new law will make it illegal to build new casinos starting next year. Attempt 1/3 for 10 pts. Part 1 What is the expected NPV of the project (in $ million)? 0+ decimals Submit Part 2 Attempt 1/3 for 10 pts. While the company cannot delay the project, it can sell the casino after the first year for $81 million. What is the NPV of the project now (in $ million)? 0+ decimals Submit Attempt 1/3 for 10 pts. Part 3 What is the value of the option (in $ million)? 1+ decimals Submit Problem 12 Intro Win Big Inc. is considering the development of a new hotel and casino. The initial cost of the project is $90 million, including the land, building and furniture. The company has a weighted average cost of capital of 11%. There is a 20% probability that another casino will be built on a nearby Indian reservation. The expected cash flows for each case are given below. After 6 years, cash flows are expected to increase at a constant rate forever. A B 1 WACC 0.11 2 3 Competition No comp. 0.2 0.8 4 Probability 5 LO 6 Cash flows ($M) Competition Year No comp. 7 8 0 -90 -90 9 1 3 6 10 2 4 9 11 3 5 14 12 4 5 17 13 5 5 19 14 6 5 20 15 16 Growth rate after year 6 0% 2% The company cannot delay the decision: if it wants to build the casino, it needs to build it now, since a new law will make it illegal to build new casinos starting next year. Attempt 1/3 for 10 pts. Part 1 What is the expected NPV of the project (in $ million)? 0+ decimals Submit Part 2 Attempt 1/3 for 10 pts. While the company cannot delay the project, it can sell the casino after the first year for $81 million. What is the NPV of the project now (in $ million)? 0+ decimals Submit Attempt 1/3 for 10 pts. Part 3 What is the value of the option (in $ million)? 1+ decimals Submit

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts