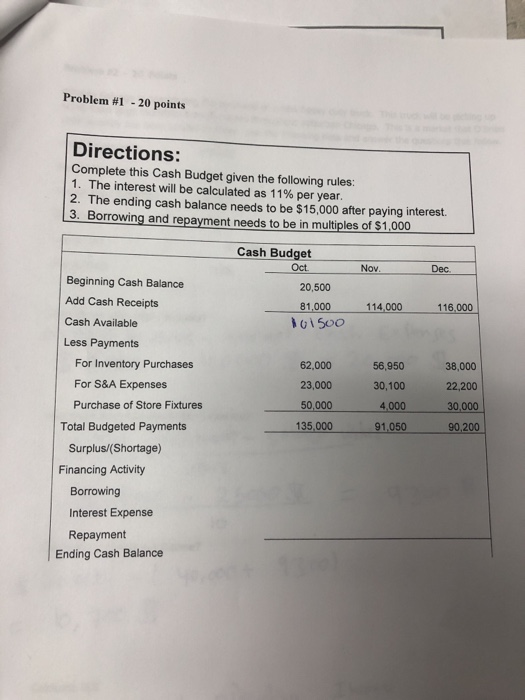

Question: Problem #1-20 points Directions: Complete this Cash Budget given the following rules: I. The interest will be calculated as 11% per year. 2. The ending

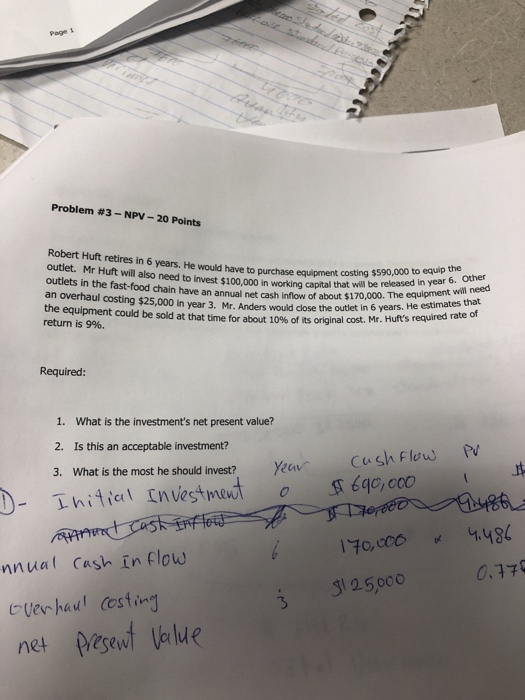

Problem #1-20 points Directions: Complete this Cash Budget given the following rules: I. The interest will be calculated as 11% per year. 2. The ending cash balance needs to be $15,000 after paying interest. 3. Borrowing and repayment needs to be in multiples of $1,000 Cash Budget Oct Nov Dec Beginning Cash Balance Add Cash Receipts Cash Available Less Payments 20,500 81,000 1500 114,000 116,000 For Inventory Purchases For S&A Expenses Purchase of Store Fixtures 62,000 23,000 50,000 135,000 56,950 30,100 4,000 91,050 38,000 22,200 30,000 90,200 Total Budgeted Payments Surplus/(Shortage) Financing Activity Borrowing Interest Expense Repayment Ending Cash Balance Page 1 Problem #3-NPV-20 Points Robert Huft retires in 6 years. He would have to purchase equipment released in yeawlneed outlet. Mr Huft will also need to invest $100,000 in working ca costing $590,000 to equip the outlets in the fast-food chain have an annual net cash inflow of about $170,000. The an overhaul costing the equipment could be sold at that time for about 10% of its original cost, Mr. return is 996. capital that will be released in year 6. Other equipment wl 925,000 in year 3. Mr. Anders would close the outet in 6 years. He estimates that Huft's required rate of Required 1. What is the investment's net present value? 2. Is this an acceptable investment? 3. What is the most he should invest? Yeav cush Flew nnual Cash in Flouw 0.17 3 12500o

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts