Question: Problem 12-01 What would be the initial offering price for the following bonds (assume $1,000 par value and semiannual compounding)? Do not round intermediate calculations.

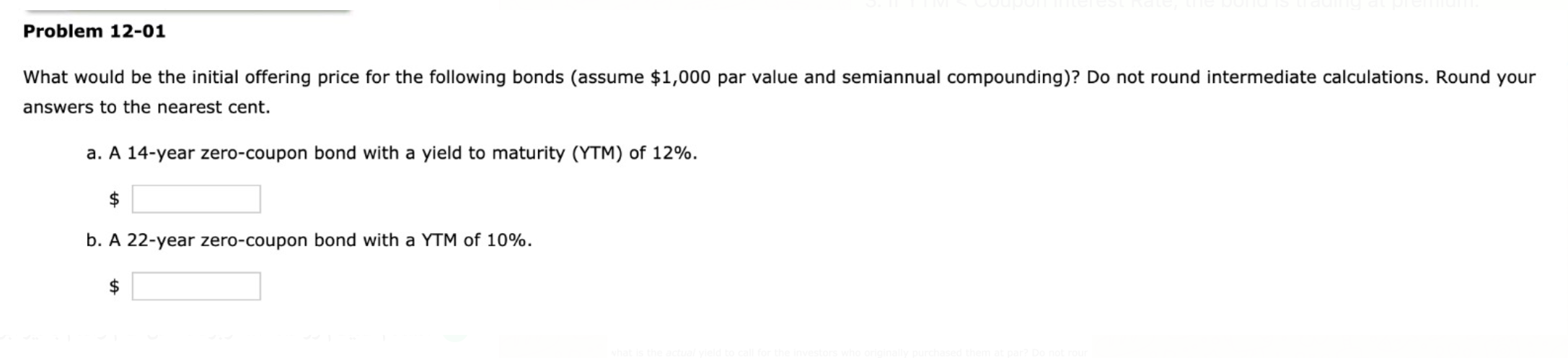

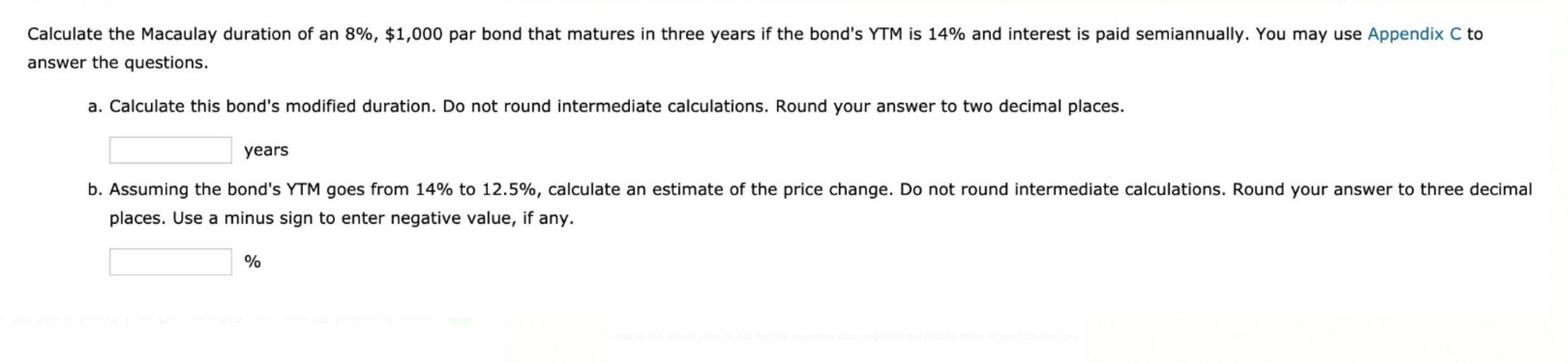

Problem 12-01 What would be the initial offering price for the following bonds (assume $1,000 par value and semiannual compounding)? Do not round intermediate calculations. Round your answers to the nearest cent. a. A 14-year zero-coupon bond with a yield to maturity (YTM) of 12%. $ b. A 22-year zero-coupon bond with a YTM of 10%. $ Calculate the Macaulay duration of an 8%, $1,000 par bond that matures in three years if the bond's YTM is 14% and interest is paid semiannually. You may use Appendix C to answer the questions. a. Calculate this bond's modified duration. Do not round intermediate calculations. Round your answer to two decimal places. years b. Assuming the bond's YTM goes from 14% to 12.5%, calculate an estimate of the price change. Do not round intermediate calculations. Round your answer to three decimal places. Use a minus sign to enter negative value, if any. %

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts