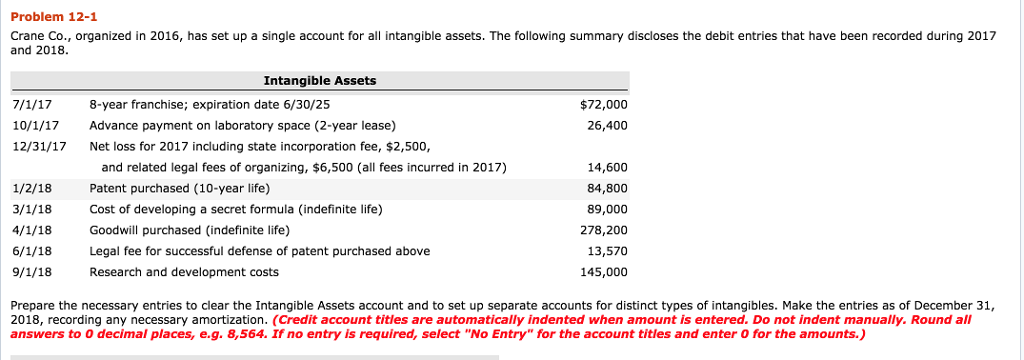

Question: Problem 12-1 Crane Co., organized in 2016, has set up a single account for all intangible assets. The following summary discloses the debit entries that

Problem 12-1 Crane Co., organized in 2016, has set up a single account for all intangible assets. The following summary discloses the debit entries that have been recorded during 2017 and 2018 Intangible Assets 10/1/17 12/31/17 8-year franchise; expiration date 6/30/25 Advance payment on laboratory space (2-year lease) Net loss for 2017 including state incorporation fee, $2,500, $72,000 26,400 and related legal fees of organizing, $6,500 (all fees incurred in 2017) Patent purchased (10-year life) Cost of developing a secret formula (indefinite life) Goodwill purchased (indefinite life) Legal fee for successful defense of patent purchased above Research and development costs 14,600 84,800 89,000 278,200 13,570 145,000 1/2/18 Prepare the necessary entries to clear the Intangible Assets account and to set up separate accounts for distinct types of intangibles. Make the entries as of December 31, 2018, recording any necessary amortization. (Credit account titles are automatically indented when amount is entered. Do not indent manually. Round all answers to O decimal places, e.g.8,564. If no entry is required, select "No Entry" for the account titles and enter 0 for the amounts.) Account Titles and Explanation Debit Credit (To clear the Intangible Assets) (To record current amount for Franchises) (To record current amount for Rents) Reflecting all balances accurately as of that date. (Ignore income tax effects.) Click if you would like to Show Work for this question: Open Show Work

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts