Question: Problem 12-1 ( LO O 3) Estimating the effective tax rate. Roberts Corporation began operations in 2013 and finally began to report pretax profits in

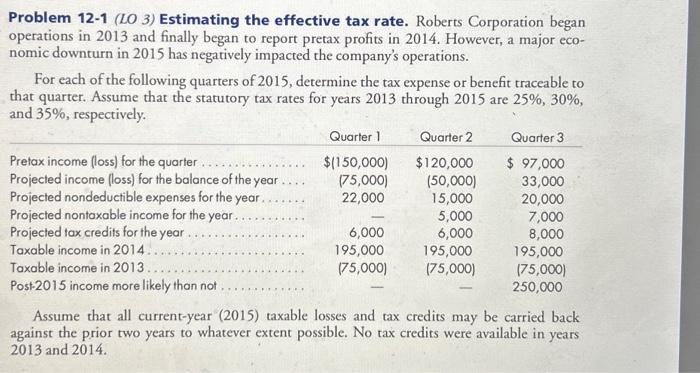

Problem 12-1 ( LO O 3) Estimating the effective tax rate. Roberts Corporation began operations in 2013 and finally began to report pretax profits in 2014. However, a major economic downturn in 2015 has negatively impacted the company's operations. For each of the following quarters of 2015, determine the tax expense or benefit traceable to that quarter. Assume that the statutory tax rates for years 2013 through 2015 are 25%,30%, and 35%, respectively. Assume that all current-year (2015) taxable losses and tax credits may be carried back against the prior two years to whatever extent possible. No tax credits were available in years 2013 and 2014

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts