Question: Problem 12-12 (algorithmic) Question Help The tree diagram in figure below describes the uncertain cash flows for an engineering project. The analysis period is two

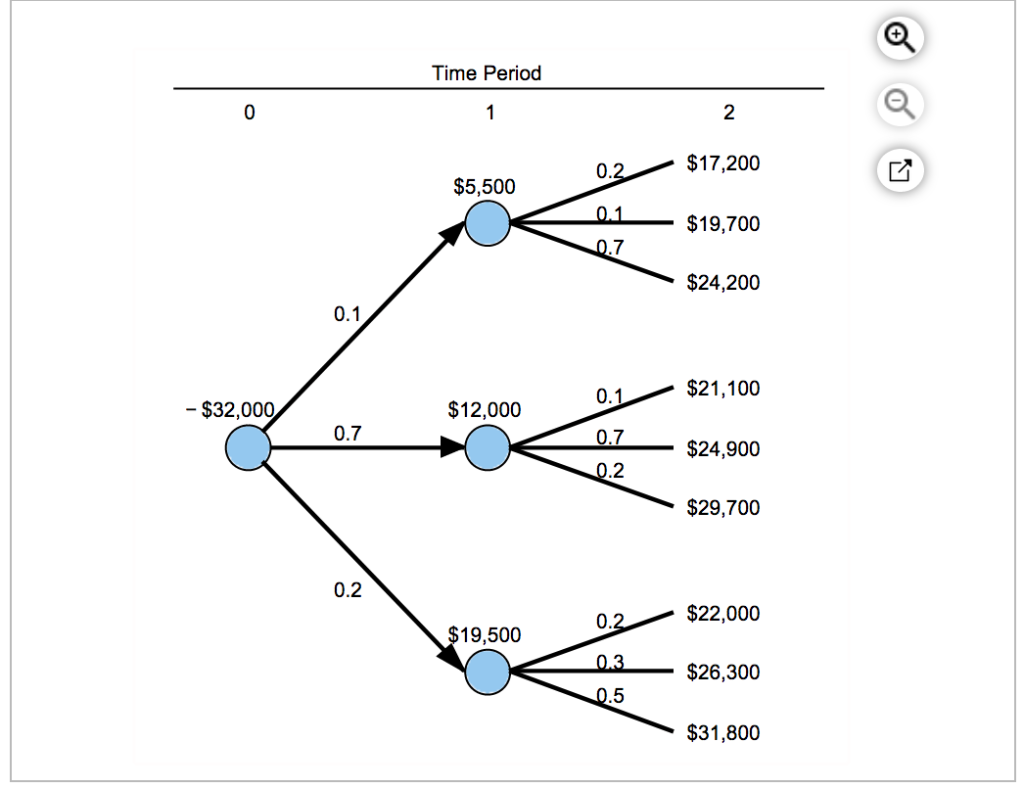

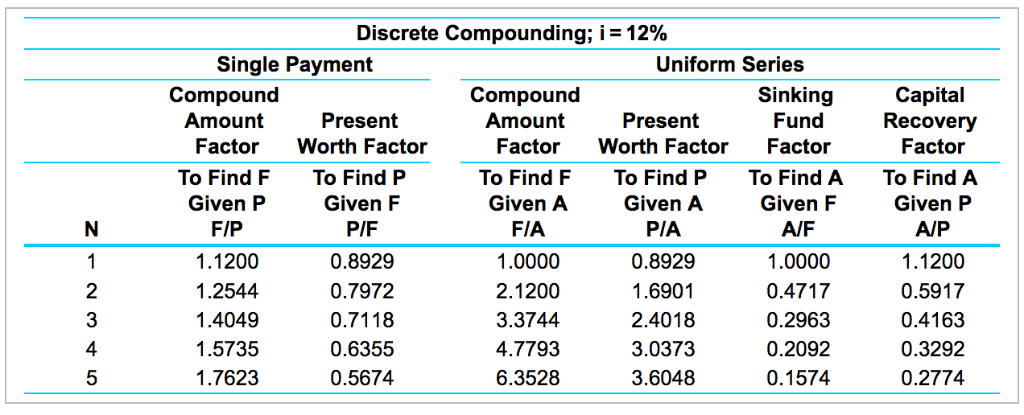

Problem 12-12 (algorithmic) Question Help The tree diagram in figure below describes the uncertain cash flows for an engineering project. The analysis period is two years, and MARR 12% per year . Based on this information, a. What are the E(PW), V(PW), and SD(PW) of the project? b. What is the probability that PW20? Click the icon to view the tree diagram. Click the icon to view the interest and annuity table for discrete compounding when the MARR is 12% per year. Time Period 1 2 $17,200 0.2 $5,500 0.1 $19,700 0.7 $24,200 0.1 $21,100 0.1 $32,000 $12,000 0.7 0.7 $24,900 0.2 $29,700 0.2 $22,000 0.2 $19,500 0.3 $26,300 0.5 $31,800 Discrete Compounding; i= 12% Single Payment Uniform Series Sinking Capital Recovery Compound Amount Compound Present Present Fund Amount Worth Factor Factor Factor Worth Factor Factor Factor To Find A Given F To Find A To Find F To Find P To Find F To Find P Given P Given F Given A Given A Given P N F/P P/F FIA P/A A/F A/P 0.8929 0.8929 1 1.1200 1.0000 1.0000 1.1200 0.7972 1.6901 1.2544 2.1200 0.4717 0.5917 0.7118 3.3744 3 1.4049 2.4018 0.2963 0.4163 3.0373 0.2092 4 1.5735 0.6355 4.7793 0.3292 0.5674 6.3528 3.6048 5 1.7623 0.1574 0.2774 - NO Problem 12-12 (algorithmic) Question Help The tree diagram in figure below describes the uncertain cash flows for an engineering project. The analysis period is two years, and MARR 12% per year . Based on this information, a. What are the E(PW), V(PW), and SD(PW) of the project? b. What is the probability that PW20? Click the icon to view the tree diagram. Click the icon to view the interest and annuity table for discrete compounding when the MARR is 12% per year. Time Period 1 2 $17,200 0.2 $5,500 0.1 $19,700 0.7 $24,200 0.1 $21,100 0.1 $32,000 $12,000 0.7 0.7 $24,900 0.2 $29,700 0.2 $22,000 0.2 $19,500 0.3 $26,300 0.5 $31,800 Discrete Compounding; i= 12% Single Payment Uniform Series Sinking Capital Recovery Compound Amount Compound Present Present Fund Amount Worth Factor Factor Factor Worth Factor Factor Factor To Find A Given F To Find A To Find F To Find P To Find F To Find P Given P Given F Given A Given A Given P N F/P P/F FIA P/A A/F A/P 0.8929 0.8929 1 1.1200 1.0000 1.0000 1.1200 0.7972 1.6901 1.2544 2.1200 0.4717 0.5917 0.7118 3.3744 3 1.4049 2.4018 0.2963 0.4163 3.0373 0.2092 4 1.5735 0.6355 4.7793 0.3292 0.5674 6.3528 3.6048 5 1.7623 0.1574 0.2774 - NO

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts