Question: Problem 12-14 Net present value method [L012-4] Aerospace Dynamics will invest $184,000 in a project that will produce the following cash flows. The cost of

![Problem 12-14 Net present value method [L012-4] Aerospace Dynamics will invest](https://dsd5zvtm8ll6.cloudfront.net/si.experts.images/questions/2024/10/66ffe95d36efa_45266ffe95cb53ba.jpg)

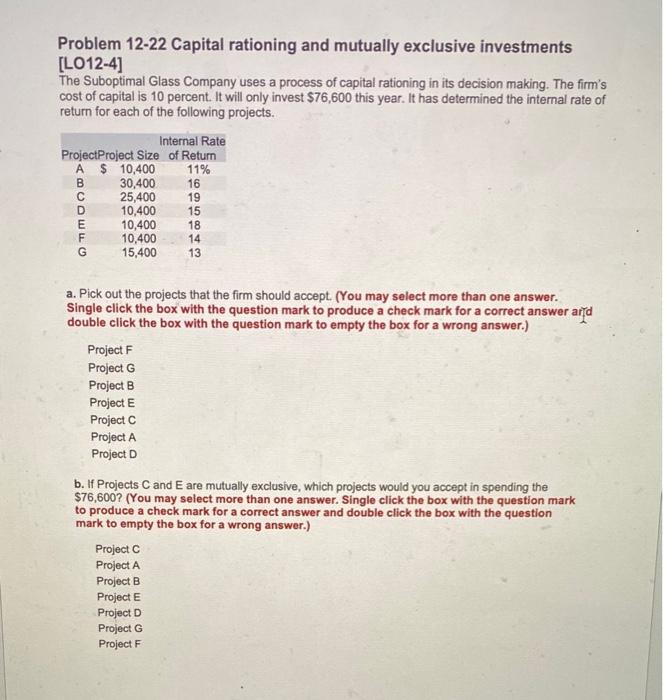

Problem 12-14 Net present value method [L012-4] Aerospace Dynamics will invest $184,000 in a project that will produce the following cash flows. The cost of capital is 9 percent. (Note that the fourth year's cash flow is negative.) Use Appendix B for an approximate answer but calculate your final answer using the formula and financial calculator methods. a. What is the net present value of the project? (Negative amount should be indicated by a minus sign. Do not round intermediate calculations and round your answer to 2 decimal places.) b. Should the project be undertaken? No Yes Problem 12-22 Capital rationing and mutually exclusive investments [LO12-4] The Suboptimal Glass Company uses a process of capital rationing in its decision making. The firm's cost of capital is 10 percent. It will only invest $76,600 this year. It has determined the internal rate of return for each of the following projects. a. Pick out the projects that the firm should accept. (You may select more than one answer. Single click the box with the question mark to produce a check mark for a correct answer and double click the box with the question mark to empty the box for a wrong answer.) Project F Project G Project B Project E Project C Project A Project D b. If Projects C and E are mutually exclusive, which projects would you accept in spending the $76,600 ? (You may select more than one answer. Single click the box with the question mark to produce a check mark for a correct answer and double click the box with the question mark to empty the box for a wrong answer.) Project C Project A Project B Project E Project D Project G Project F

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts