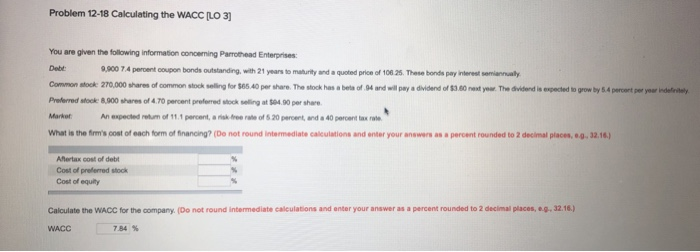

Question: Problem 12-18 Calculating the WACC [LO 3 You are given the following information conceming Pamothead Enterprises 900 74 percent coupon bonds outstanding, wit, 2, years

Problem 12-18 Calculating the WACC [LO 3 You are given the following information conceming Pamothead Enterprises 900 74 percent coupon bonds outstanding, wit, 2, years to mnrty and -oled piceof,0.25 ntrestwrwnaly These bonds Preterned stock: 8900 shares of 470 cnt prefened sock selling at 04 90 p sha Market What is the fm's cost of ech fo ofnaning? (Do not round intemediate calculations and enter your answras 2 d linal pice..g., 3216) ...-rcent rounded and enter your answer as a percent nounded so 2 decimal places ag. 3216 784 % Problem 12-18 Calculating the WACC LO 3 You are given the following information conceming Parrothead Enterprises 74 cent coupon bonds onstadig, wit 21 years to "unty ardquoted pice or 06.25 These bonds pay owest wrurnaly Common stock: 270,000 shares of comon slock seling for 65 40 per share. The stock of 4 and wil ay a o be and entar your answars asa prcent ronded to 2 decimal p32.1 answer as a percent ounded to 2 decimal places, ag 32.16 WACC s Problem 12-18 Calculating the WACC LO 3 You are given the following information conoeming Parrothead Enterprises Debt: Common stock 270,000 shares of common stock selling for $6540 per share. The stock Praterred stook: 8,900 shares of 4.70 percent preferred stock selling at $04.90 per share Markot What is the frm's cost of each form of financing? (Do not round intermediate calculations and enter your answers as a percent rounded to 2 decimal places, .9.32.16.) 900 74 peroent coupon bonds outstanding, with 21 years to maturity and a quoted price of 106.25. These bonds pay interest semiannualy has a beta of 94 and wll pay a dividend of $3.80 nest yoar The dividand is espected to grow by 5.4 percent per yoar nodefiritely An expected retun of 11.1 percent, a risk free rale of 5 20 peroent, and a 40 percent tax rale Ahertax cost of debt Cost of preflerred stock Cost of equity Calculate the WACC for the company. (Do not round intermediate calculations and enter your answer as a percent rounded to 2 decimal places, e.g,32.16.) WACC 784 %

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts