Question: Problem 12-22 (Algo) Net Present Value Analysis [LO12-2] Problem 12-22 (Algo) Net Present Value Analysis [LO12-2] The Sweetwater Candy Company would like to buy a

Problem 12-22 (Algo) Net Present Value Analysis [LO12-2]

![Problem 12-22 (Algo) Net Present Value Analysis [LO12-2] Problem 12-22 (Algo) Net](https://dsd5zvtm8ll6.cloudfront.net/si.experts.images/questions/2024/09/66facd1c27d3b_53966facd1bbadd8.jpg)

![Present Value Analysis [LO12-2] The Sweetwater Candy Company would like to buy](https://dsd5zvtm8ll6.cloudfront.net/si.experts.images/questions/2024/09/66facd1cd288c_54066facd1c73064.jpg)

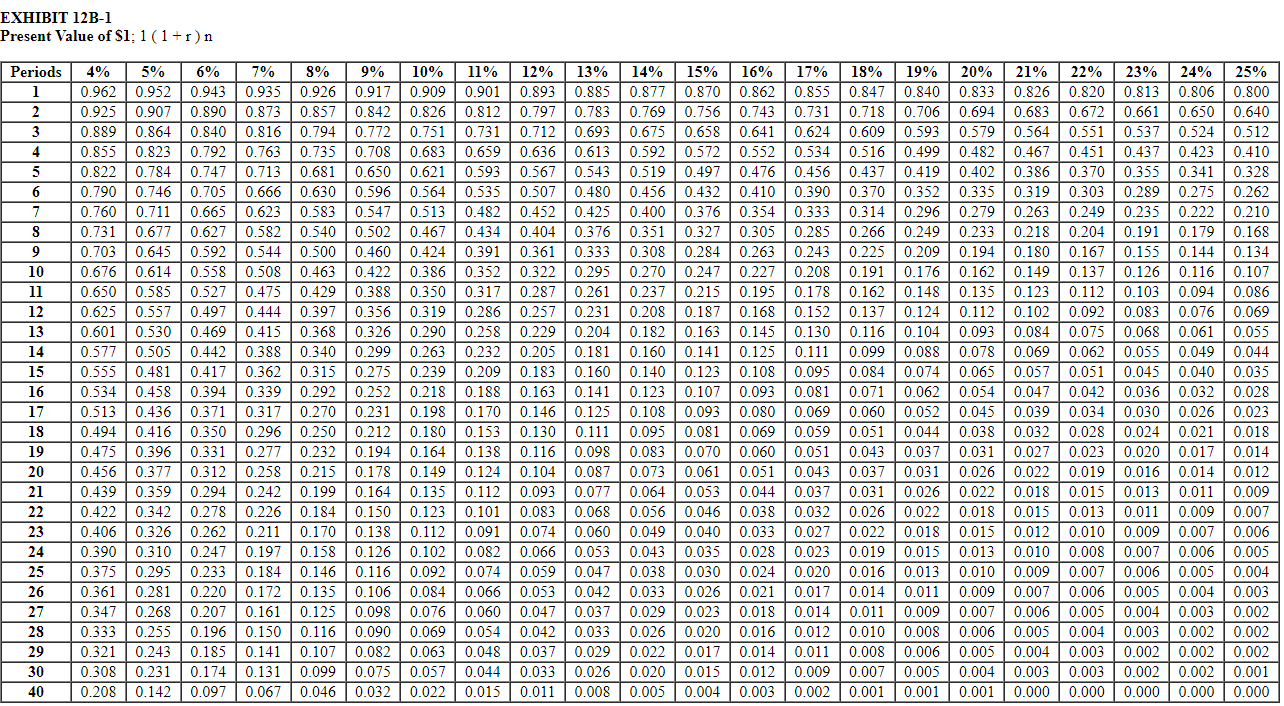

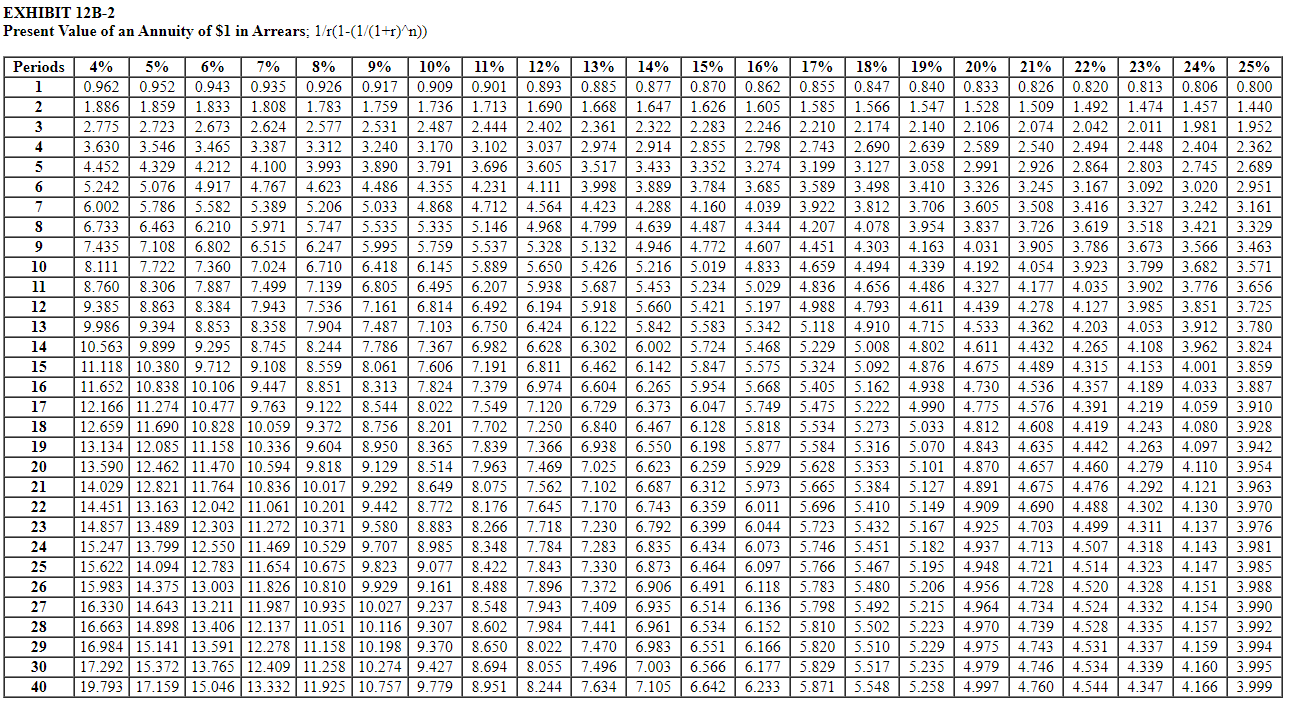

Problem 12-22 (Algo) Net Present Value Analysis [LO12-2] The Sweetwater Candy Company would like to buy a new machine that would automatically "dip chocolates. The dipping operation currently is done largely by hand. The machine the company is considering costs $190,000. The manufacturer estimates that the machine would be usable for five years but would require the replacement of several key parts at the end of the third year. These parts would cost $11,100, including installation. After five years, the machine could be sold for $8,000. The company estimates that the cost to operate the machine will be $9,100 per year. The present method of dipping chocolates costs $51,000 per year. In addition to reducing costs, the new machine will increase production by 7,000 boxes of chocolates per year. The company realizes a contribution margin of $1.55 per box. A 21% rate of return is required on all investments. Click here to view Exhibit 12B-1 and Exhibit 12B-2, to determine the appropriate discount factor(s) using tables. Required: 1. What are the annual net cash inflows that will be provided by the new dipping machine? 2. Compute the new machine's net present value. Complete this question by entering your answers in the tabs below. Required 1 Required 2 What are the annual net cash inflows that will be provided by the new dipping machine? Total annual net cash inflows Required 1 Required 2 > Complete this question by entering your answers in the tabs below. Required 1 Required 2 Compute the new machine's net present value. (Enter negative amount with a minus sign. Round your final answer to the nearest whole dollar amount.) Net present value EXHIBIT 12B-1 Present Value of Sl; 1 (1+r) n 12% 0.842 0.718 0.683 Periods 1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25 26 27 28 29 30 40 4% 5% 6% 7% 8% 9% 10% 11% 13% 14% 15% 16% 17% 18% 19% 20% 21% 22% 23% 24% 25% 0.962 0.952 0.943 0.935 0.926 0.917 0.909 0.901 0.893 0.885 0.877 0.870 0.862 0.855 0.847 0.840 0.833 0.826 0.820 0.813 0.806 0.800 0.925 0.907 0.890 0.873 0.857 0.826 0.812 0.797 0.783 0.769 0.756 0.743 0.731 0.706 | 0.694 0.672 0.661 0.650 0.640 0.889 0.864 0.840 0.816 0.794 0.772 0.751 0.731 0.712 0.693 0.675 0.658 0.641 0.624 0.609 0.593 0.579 0.564 0.551 0.537 0.524 0.512 0.855 0.823 0.792 0.763 0.735 0.708 0.683 0.659 0.636 0.613 | 0.592 0.572 0.5520.534 0.516 0.499 0.482 0.467 0.451 0.437 0.423 0.410 0.822 0.784 0.747 0.713 0.681 0.650 0.621 0.593 0.567 0.543 0.519 0.497 0.476 0.456 0.437 0.419 0.402 0.386 0.370 0.355 0.341 0.328 0.790 0.746 0.705 0.666 0.630 0.596 0.564 0.535 0.507 0.480 0.456 0.432 0.410 0.390 0.370 0.352 0.335 0.319 0.303 0.289 0.275 0.262 0.760 0.711 0.665 0.623 0.583 0.547 0.513 0.482 0.452 0.425 0.400 0.376 0.354 0.333 0.314 0.296 | 0.279 0.263 0.2490.235 0.222 0.210 0.731 0.677 0.627 0.5820.540 0.502 0.467 0.434 0.404 0.376 0.351 0.327 0.305 0.285 0.266 0.249 0.233 0.218 0.204 0.191 0.179 0.168 0.703 0.645 0.5920.544 0.500 0.460 0.424 0.391 0.361 0.333 0.308 0.284 0.263 0.243 0.225 0.209 0.194 0.180 0.167 0.155 0.144 0.134 0.676 0.614 0.558 0.508 0.463 0.422 0.386 0.352 0.322 0.295 0.270 0.247 0.227 0.208 0.191 0.176 0.162 0.149 0.137 0.126 0.116 0.107 0.650 0.585 0.527 0.475 0.429 0.388 0.350 0.317 0.287 0.261 0.237 0.215 0.19 0.178 0.162 0.148 0.135 0.123 0.112 0.103 0.094 | 0.086 0.625 0.557 0.497 0.444 0.397 0.356 0.319 0.286 0.257 0.231 0.208 0.187 0.168 0.152 0.137 0.124 0.112 0.102 0.092 0.083 0.076 0.069 0.601 0.530 0.469 0.415 0.368 0.326 0.290 0.258 0.229 0.204 0.182 0.163 0.145 0.130 0.116 0.104 0.093 0.084 0.075 0.068 0.061 0.055 0.577 0.505 0.442 0.388 0.340 0.299 0.263 0.232 0.205 0.181 0.160 0.141 0.125 0.111 0.099 0.088 0.078 0.069 0.062 0.055 0.049 0.044 0.555 0.481 0.417 0.362 0.315 0.275 0.239 0.209 0.183 0.160 0.140 0.123 0.108 0.095 0.084 0.074 | 0.065 0.057 0.051 0.045 0.040 0.534 0.458 0.035 0.394 0.3390.292 0.252 0.218 0.188 0.163 0.141 0.123 0.107 0.093 0.081 0.071 0.062 0.054 0.047 0.042 0.036 0.032 0.028 0.513 0.436 0.371 0.317 0.270 0.231 0.198 0.170 0.146 0.125 0.108 0.093 0.080 0.069 0.060 0.052 0.045 0.039 0.034 0.030 0.026 0.023 0.494 0.416 0.350 0.296 0.250 0.212 0.180 0.153 0.130 0.111 0.095 0.069 0.059 0.051 0.044 0.038 0.032 0.028 0.024 0.021 0.018 0.475 0.396 0.331 0.277 | 0.232 0.194 0.164 0.138 0.116 0.098 0.083 0.070 | 0.060 0.051 0.043 0.037 | 0.031 0.027 0.023 0.020 0.017 0.014 0.456 0.377 0.312 0.258 0.215 0.178 0.149 0.124 0.104 0.087 0.073 0.061 0.051 0.043 0.037 0.031 0.026 0.022 0.019 0.0160.014 0.012 0.439 0.359 0.242 0.199 0.164 0.135 0.112 0.093 0.077 0.064 0.053 0.044 0.037 0.031 0.026 0.022 0.018 0.015 0.013 0.011 0.009 0.422 0.342 0.278 0.226 0.184 0.150 0.123 0.101 0.083 0.068 0.056 0.046 0.038 0.032 0.026 0.022 0.018 0.015 0.013 0.011 | 0.009 0.007 0.406 0.326 0.262 0.211 0.170 0.138 0.112 0.091 | 0.074 | 0.060 0.049 0.040 0.033 0.027 0.022 0.018 0.015 0.012 0.010 | 0.009 0.007 0.006 0.390 0.310 0.247 0.197 0.158 0.126 0.102 0.082 0.066 0.053 0.043 0.035 0.028 0.023 0.019 0.015 0.013 0.010 0.008 0.007 0.006 0.005 0.375 0.295 0.184 0.146 0.116 0.092 0.074 0.059 0.047 0.038 0.030 0.024 0.0200.016 0.013 0.010 0.009 0.007 0.006 0.005 0.004 0.361 0.281 0.220 0.172 0.135 0.106 0.084 0.066 0.053 0.042 0.033 0.026 0.021 0.017 0.014 0.011 | 0.009 0.007 0.006 0.005 0.004 0.003 0.347 0.268 0.207 0.161 0.125 0.098 0.076 0.060 0.047 | 0.037 0.029 0.023 0.018 0.014 0.011 0.009 0.007 0.006 0.005 0.004 0.003 0.002 0.333 0.255 0.1960.150 0.116 0.090 0.069 0.054 0.042 0.033 0.026 0.020 0.016 0.012 0.010 0.008 0.006 0.005 0.004 0.003 0.002 0.002 0.321 0.243 0.185 0.141 0.107 0.082 0.063 0.048 0.037 0.029 0.022 0.017 0.014 0.011 0.008 0.006 0.005 0.004 | 0.003 0.002 0.002 0.002 0.308 0.231 0.174 0.131 0.099 0.075 0.057 0.044 0.033 0.026 0.020 0.015 0.012 0.009 0.007 0.005 0.004 0.003 0.003 0.002 0.002 0.001 0.208 0.142 0.097 0.067 0.046 0.032 0.022 0.015 0.011 0.008 0.005 0.004 0.003 0.002 0.001 0.001 0.001 0.000 0.000 0.000 0.000 0.000 0.081 0.294 0.233 EXHIBIT 12B-2 Present Value of an Annuity of $1 in Arrears: 1/r(1-(1/(1+r)^n)) Periods 1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25 26 27 28 29 30 40 4% 5% 6% 7% 8% 9% 10% 11% 12% 13% 14% 15% 16% 17% 18% 19% 20% 21% 22% 0.962 0.952 0.943 0.935 0.926 0.917 0.909 0.901 0.8930.885 0.877 0.870 0.862 0.855 0.847 0.840 0.833 0.826 0.820 1.886 1.859 1.833 1.808 1.783 1.759 1.736 1.713 | 1.690 1.668 1.647 | 1.626 1.605 | 1.585 1.566 1.547 1.528 1.509 2.775 1.492 2.723 2.673 2.624 2.577 2.531 2.487 2.444 2.402 2.361 2.322 2.283 2.246 2.210 2.174 | 2.140 2.106 2.074 | 2.042 3.630 3.546 3.465 3.387 3.312 3.240 3.1703.102 3.037 2.974 2.914 | 2.855 2.798 2.743 2.690 2.639 2.589 2.540 2.494 4.452 4.329 4.212 4.100 3.993 | 3.890 3.791 3.696 3.605 3.517 3.433 | 3.352 3.274 3.199 3.127 3.058 2.991 2.926 2.864 5.2425.076 4.917 4.767 4.623 4.486 4.355 4.231 4.111 3.998 3.889 3.784 3.685 3.589 3.498 3.410 3.326 3.245 3.167 6.002 5.786 5.582 5.389 5.206 5.033 4.868 4.712 4.564 4.423 4.288 4.160 4.039 3.922 3.812 3.706 3.605 3.508 3.416 6.733 6.463 6.210 5.971 5.747 5.535 5.335 5.146 4.968 4.799 4.639 | 4.487 4.344 4.207 4.078 3.954 3.837 7.435 3.726 3.619 7.108 6.802 6.515 6.247 5.995 5.7595.537 5.3285.132 4.946 4.772 4.607 4.451 4.303 4.163 4.031 | 3.905 3.786 8.111 7.722 7.360 7.024 6.710 6.418 6.145 5.889 5.650 5.426 5.216 5.019 4.833 4.659 4.494 4.339 4.192 4.054 | 3.923 8.760 8.306 7.887 7.499 7.139 6.805 6.495 6.207 5.938 5.687 5.453 5.234 5.029 4.836 4.656 4.486 4.327 4.177 9.385 4.035 8.863 8.384 7.943 7.536 7.161 6.814 6.4926.1945.918 5.660 5.421 5.197 4.988 4.793 4.611 4.439 4.278 4.127 9.986 9.394 8.853 8.358 7.904 7.487 7.103 6.750 6.424 6.122 5.8425.583 5.342 5.1184.910 4.715 4.533 4.362 4.203 10.563 | 9.899 9.295 8.745 8.244 7.786 7.367 6.982 6.628 6.302 6.002 5.724 5.468 5.229 5.008 4.802 4.611 4.432 4.265 11.118 10.380 9.712 9.108 8.559 8.061 7.606 7.191 6.811 6.462 6.142 5.847 5.575 5.324 5.092 4.876 4.675 4.489 11.652 10.838 10.106 9.447 4.315 8.851 8.313 7.824 7.3796.9746.604 6.265 5.954 5.668 5.405 5.1624.938 4.730 4.536 4.357 12.166 | 11.274 10.477 | 9.763 9.122 8.544 8.022 7.549 7.1206.729 6.373 6.047 5.749 5.475 5.222 4.990 4.775 4.576 4.391 12.659 11.690 10.828 10.059 9.372 8.756 8.201 7.702 7.250 6.840 6.467 6.128 5.818 5.534 5.2735.033 4.812 4.608 4.419 13.134 12.085 11.158 10.336 9.604 8.950 8.365 7.839 7.366 6.938 6.550 6.198 5.877 5.584 5.316 5.070 4.843 4.635 4.442 13.590 12.462 11.470 10.594 | 9.818 9.129 8.514 7.963 7.4697.025 6.623 6.259 5.9295.628 5.3535.101 4.870 4.657 4.460 14.029 12.821 11.764 10.836 10.017 | 9.292 8.6498.075 7.562 7.102 6.687 6.3125.973 5.665 5.384 5.127 4.891 4.675 4.476 14.451 | 13.163 12.042 11.061 10.201 | 9.442 8.772 8.176 7.645 7.170 6.743 6.359 6.011 5.696 5.410 5.149 4.909 4.690 14.857 13.489 12.303 11.272 10.371 9.580 4.488 8.883 8.266 7.7187.230 6.792 6.399 6.044 5.723 5.432 5.167 4.925 4.703 4.499 15.247 13.799 12.550 11.469 10.529 9.707 8.985 | 8.348 7.784 7.283 6.835 6.434 6.073 5.746 5.451 5.182 4.937 4.713 4.507 15.622 14.094 12.783 11.654 10.675 9.823 9.077 8.422 7.843 7.330 6.873 6.464 6.097 5.766 5.467 5.1954.948 4.721 4.514 15.983 14.375 | 13.003 11.826 10.810 | 9.929 9.161 8.488 7.896 7.372 6.906 6.491 6.118 5.783 5.480 5.206 4.956 4.728 16.330 14.643 13.211 11.987 4.520 10.935 | 10.027 | 9.237 8.548 7.943 7.409 6.935 6.514 6.136 5.798 5.492 5.215 4.964 4.734 4.524 16.663 14.898 13.406 12.13711.051 10.116 9.307 8.602 7.984 7.441 6.961 6.534 6.152 5.810 5.5025.223 4.970 4.739 4.528 16.984 15.141 13.591 12.278 11.158 10.1989.370 8.650 8.022 7.470 6.983 6.551 6.1665.820 5.510 5.229 | 4.975 4.743 17.292 | 15.372 13.765 12.409 | 11.258 10.274 9.427 4.531 8.694 8.055 7.496 7.003 6.566 6.177 5.8295.517 5.235 4.979 4.746 | 4.534 19.793 17.159 15.046 13.332 11.925 10.757 | 9.779 | 8.951 8.244 7.634 7.105 6.642 6.233 5.871 5.548 5.258 4.997 4.760 4.544 23% 24% 25% 0.813 0.806 0.800 1.474 1.457 | 1.440 2.011 1.981 1.952 2.448 2.404 2.362 2.803 2.745 2.689 3.092 3.020 2.951 3.327 3.242 3.161 3.518 3.421 3.329 3.673 | 3.566 3.463 3.799 3.682 3.571 3.902 3.776 3.656 3.985 3.851 3.725 4.053 3.912 3.780 4.108 3.962 3.824 4.153 4.001 3.859 4.189 4.033 3.887 4.219 4.059 3.910 4.243 4.080 3.928 4.263 4.097 3.942 4.279 4.110 3.954 4.292 4.121 3.963 4.302 4.130 3.970 4.311 4.137 3.976 4.318 4.143 3.981 4.323 4.147 3.985 4.328 4.151 3.988 4.332 4.154 3.990 4.335 4.157 3.992 4.337 4.159 | 3.994 4.339 4.160 3.995 4.347 4.166 3.999

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts