Question: Problem 12-25 Net Present Value Analysis of a Lease or Buy Decision [LO12-2] The Riteway Ad Agency provides cars for its sales staff. In the

![Decision [LO12-2] The Riteway Ad Agency provides cars for its sales staff.](https://dsd5zvtm8ll6.cloudfront.net/si.experts.images/questions/2024/10/670388c8cba27_872670388c86b0a8.jpg)

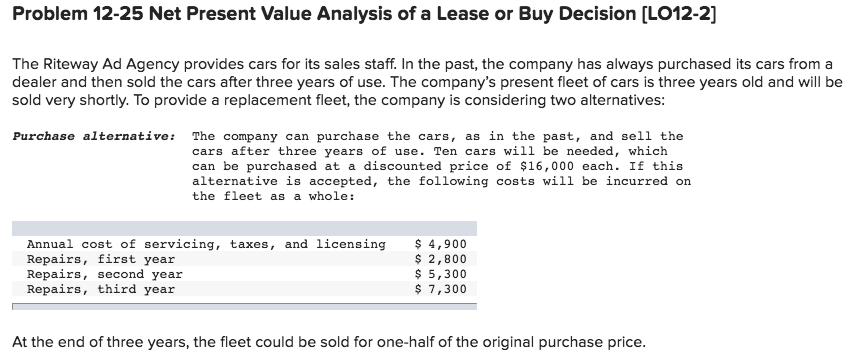

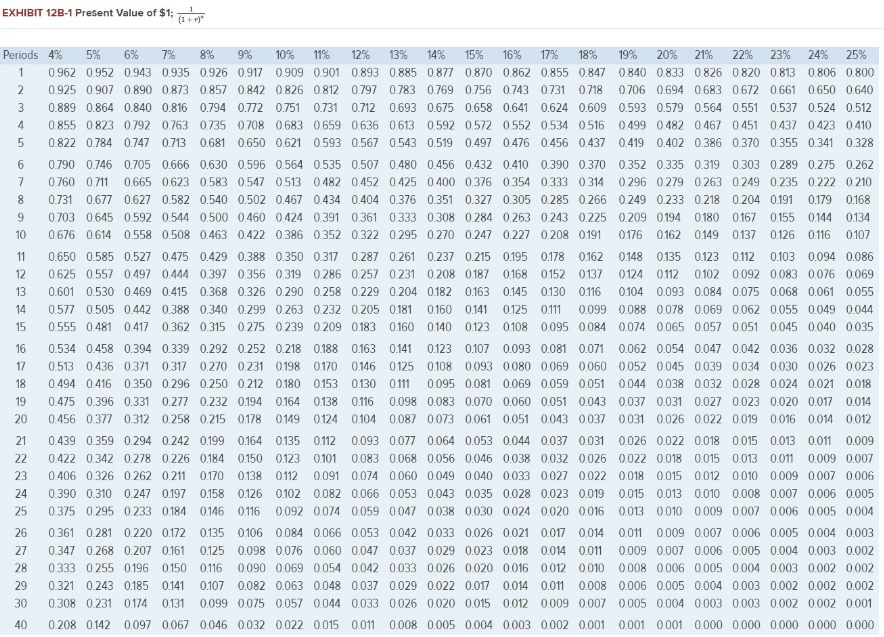

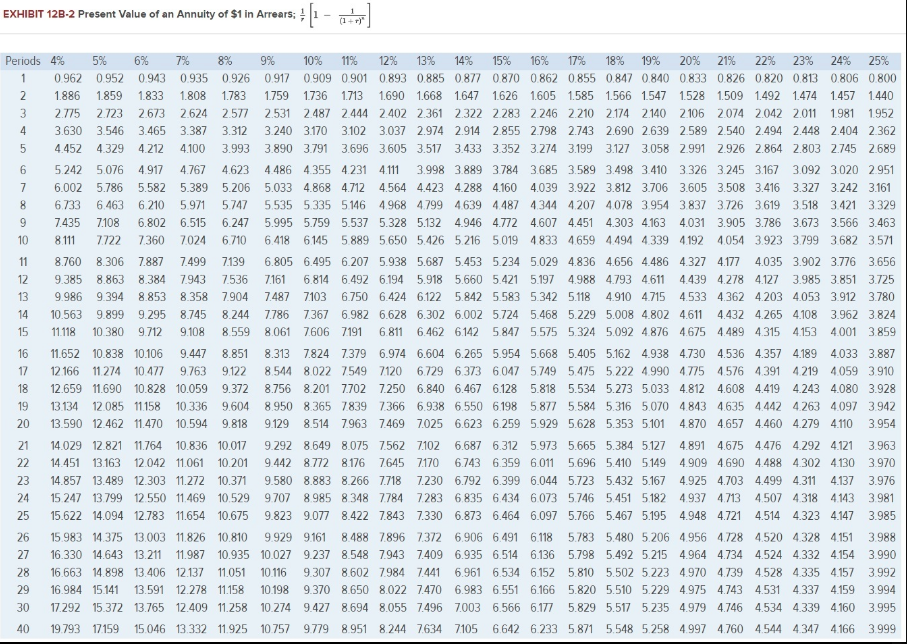

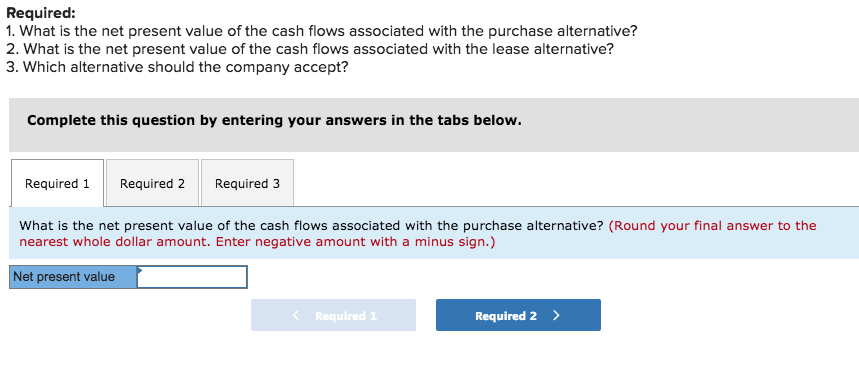

Problem 12-25 Net Present Value Analysis of a Lease or Buy Decision [LO12-2] The Riteway Ad Agency provides cars for its sales staff. In the past, the company has always purchased its cars from a dealer and then sold the cars after three years of use. The company's present fleet of cars is three years old and will be sold very shortly. To provide a replacement fleet, the company is considering two alternatives: Purchase alternative: The company can purchase the cars, as in the past, and sell the cars after three years of use. Ten cars will be needed, which can be purchased at a discounted price of $16,000 each. If this alternative is accepted, the following costs will be incurred on the fleet as a whole: Annual cost of servicing, taxes, and licensing Repairs, first year Repairs, second year Repairs, third year $ 4,900 $ 2,800 $ 5,300 $ 7,300 At the end of three years, the fleet could be sold for one-half of the original purchase price. At the end of three years, the fleet could be sold for one-half of the original purchase price. Lease alternative: The company can lease the cars under a three-year lease contract. The lease cost would be $68,000 per year (the first payment due at the end of Year 1). As part of this lease cost, the owner would provide all servicing and repairs, license the cars, and pay all the taxes. Riteway would be required to make a $14,000 security deposit at the beginning of the lease period, which would be refunded when the cars were returned to the owner at the end of the lease contract. Riteway Ad Agency's required rate of return is 18%. Click here to view Exhibit 12B-1 and Exhibit 12B-2, to determine the appropriate discount factor(s) using tables. EXHIBIT 12B-1 Present Value of $1; 12 Periods 4% 5% 6% 7% 8% 9% 10% 11% 12% 13% 14% 15% 16% 17% 18% 19% 20% 21% 22% 23% 24% 25% 1 0.962 0.952 0.943 0.935 0.926 0.917 0.909 0.901 0.893 0.885 0.877 0.870 0.862 0.855 0.847 0.840 0.833 0.826 0.820 0.813 0.806 0.800 2 0.925 0.907 0.890 0.873 0.857 0.842 0.826 0.812 0.797 0783 0.769 0.756 0.743 0.731 0.718 0.706 0.694 0.683 0.672 0.661 0.650 0.640 3 0.889 0.864 0.840 0.816 0.794 0.772 0.751 0.731 0.712 0.693 0.675 0.658 0.641 0.624 0.609 0.593 0.579 0.564 0.551 0.537 0.524 0.512 4 0855 0.823 0.792 0763 0.735 0.708 0683 0659 0636 0613 0.592 0.572 0.552 0.534 0.516 0.499 0482 0467 0.451 0.437 0.423 0.410 5 0.822 0.784 0.747 0.713 0.681 0.650 0.621 0.593 0.567 0.543 0.519 0.497 0.476 0.456 0.437 0.419 0.402 0.386 0.370 0.355 0.341 0.328 6 0.790 0.746 0.705 0.666 0.630 0.596 0.564 0.535 0.507 0.480 0.456 0.432 0.410 0.390 0.370 0.352 0.335 0.319 0.303 0.289 0.275 0.262 7 0760 0711 0665 0.623 0.583 0.547 05130482 0.452 0425 0.400 0.376 0354 0.333 0.314 0296 0279 0263 0249 0235 0.222 0.210 8 0.731 0.677 0.627 0.582 0.540 0.502 0.467 0.434 0.404 0.376 0.351 0.327 0.305 0.285 0.266 0.249 0.233 0.218 0.204 0.191 0.179 0.168 9 0.703 0.645 0.592 0.544 0.500 0.460 0.424 0.391 0.361 0.333 0.308 0.284 0.263 0.243 0.225 0.209 0.194 0.180 0.167 0.155 0.144 0.134 10 0.676 0.614 0.558 0.508 0.463 0.422 0.386 0.352 0.322 0.295 0.270 0.247 0.227 0.208 0.1910.176 0.162 0.149 0.137 0.126 0.116 0.107 11 0.650 0.585 0.527 0.475 0.429 0.388 0.350 0.317 0.287 0.261 0.237 0.215 0.195 0.178 0.162 0.148 0.135 0.123 0.112 0.103 0.094 0.086 120625 0557 0.497 0.444 0.397 0.356 0.319 0286 0257 0231 0208 0187 0.168 0.152 01370124 0112 0102 0092 0.083 0.076 0.069 13 0.601 0.530 0.469 0.415 0.368 0.326 0.290 0.258 0.229 0.204 0.182 0.163 0.145 0.130 0.116 0.104 0.093 0.084 0.075 0.068 0.061 0.055 14 0.577 0.505 0.442 0.388 0.340 0.299 0.263 0.232 0.205 0.181 0.160 0.141 0.125 0.111 0.099 0.088 0.078 0.069 0.062 0.055 0.049 0.044 15 0555 0.481 0.417 0.362 0.315 0.275 0.239 0.209 0.183 0160 0140 0.123 0.108 0.095 0.084 0.074 0.065 0.057 0051 0.045 0.040 0.035 16 0.534 0.458 0.394 0.339 0.292 0.252 0.218 0.188 0.163 0.141 0.123 0.107 0.093 0.081 0.071 0.062 0.054 0.047 0.042 0.036 0.032 0.028 17 0513 0.436 0.371 0.317 0.270 0.231 0.198 01700146 0.125 0.108 0.093 0.080 0.069 0.060 0.052 0045 0039 0.034 0.030 0.026 0.023 18 0.494 0.416 0.350 0.296 0.250 0.212 0.180 0.153 0.130 0.111 0.095 0.081 0.069 0.059 0.051 0.044 0.038 0.032 0.028 0.024 0.021 0.018 19 0 .475 0.396 0.331 0.277 0.232 0.194 0.164 0.138 0.116 0.098 0.083 0.070 0.060 0.051 0.043 0.037 0.031 0.027 0.023 0.020 0.017 0.014 20 0456 0377 0.312 0.258 0215 0178 0.149 0124 0104 0087 0.073 0.061 0.051 0.043 0.037 0.031 0.026 0022 0.0190016 0.014 0.012 21 0.439 0.359 0.294 0.24 0.199 0.164 0.135 0.112 0.093 0.077 0.064 0.053 0.044 0.037 0.031 0.026 0.022 0.018 0.015 0.013 0.0110.009 22 0.422 0.342 0.278 0.226 0.184 0.150 0.123 0.101 0.083 0.068 0.056 0.046 0.038 0.032 0.025 0.022 0.018 0.015 0.013 0.011 0.009 0.007 23 0.406 0326 0.262 0.211 0.170 0.138 0.112 0.091 0.074 0.060 0.049 0.040 0.033 0.027 0.022 0.018 0.015 0.012 0010 0.009 0.007 0.006 24 0.390 0.310 0.247 0.197 0.158 0.126 0.102 0.082 0.066 0.053 0.043 0.035 0.028 0.023 0.019 0.015 0.013 0.010 0.008 0.007 0.006 0.005 25 0.375 0295 0233 01840146 0.116 0092 0.074 0059 0047 0.038 0.030 0.024 0.020 0.0160.013 0010 0009 0.007 0.006 0.005 0.004 26 0.361 0.281 0.220 0.172 0.135 0.106 0.084 0.066 0.053 0.042 0.033 0.025 0.021 0.017 0.014 0.011 0.009 0.007 0.006 0.005 0.004 0.003 27 0.347 0.268 0.207 0.161 0.125 0.098 0.076 0.060 0.047 0.037 0.029 0.023 0.018 0.014 0.0110.009 0.007 0.006 0.005 0.004 0.003 0.002 28 0333 0255 0196 0150 0.116 0.090 0.069 0054 0042 0033 0026 0.020 0.016 0012 0.010 0.008 0.006 0005 0004 0.003 0002 0.002 290.321 0.243 0.185 0.141 0.107 0.082 0.063 0.048 0.037 0.029 0.022 0.017 0.014 0.011 0.008 0.006 0.005 0.004 0.003 0.002 0.002 0.002 30 0308 0231 0.174 0.131 0.099 0.075 0.057 0.044 0.033 0026 0.020 0.015 0.012 0.009 0.007 0.005 0.004 0.003 0.003 0.002 0.002 0.001 40 0.208 0.142 0.097 0.067 0.046 0.032 0.022 0.015 0.011 0.008 0.005 0.004 0.003 0.002 0.001 0.001 0.001 0.000 0.000 0.000 0.000 0.000 EXHIBIT 128-2 Present Value of an Annuity of $1 in Arrears: 1 - 4 Periods 4% 5% 6% 7% 8% 9% 10% 11% 12% 13% 14% 15% 16% 17% 18% 19% 20% 21% 22% 23% 24% 25% 0.962 0.952 0.943 0.935 0.926 0.917 0.909 0901 0.893 0.885 0.877 0.870 0862 0.855 0.847 0.840 0.833 0826 0.820 0.813 0.806 0800 2 1.886 1859 1833 1.808 1783 1759 1736 1.713 1.690 1.668 1.647 1.626 1.605 1.585 1.566 1547 1528 1.509 1.492 1.474 1.457 1.440 2.775 2.723 2.673 2.624 2.577 2531 2.487 2444 2.402 2.361 2.322 2283 2246 2.210 2.174 2140 2106 2074 2042 2.011 1981 1952 3.630 3.546 3.465 3.387 3.312 3.240 3.170 3.102 3.037 2.974 2.914 2.855 2.798 2.743 2.690 2.639 2.589 2.540 2.494 2.448 2.404 2.362 5 4.452 4.329 4.212 4.100 3.993 3.890 3.791 3.696 3.605 3.517 3.433 3.352 3.274 3.1993.127 3.058 2.991 2.926 2.864 2.803 2.745 2.689 6 5.242 5.076 4.917 4.767 4.623 4.486 4355 4.231 4.111 3.998 3.889 3.784 3.685 3.589 3.498 3.410 3326 3245 3.167 3.092 3.020 2.951 7 6.002 5.786 5.582 5.389 5.206 5.033 4.868 4.712 4.564 4.423 4.288 4.160 4.039 3.922 3.812 3.706 3.605 3.508 3.416 3.327 3.242 3.161 4.487 4.344 4207 4078 3.954 3.837 3.726 3.619 3.518 3.421 3329 9 7.435 7108 6.802 6.515 6.247 5.995 5.759 5.537 5.328 5.132 4.946 4.772 4.607 4.451 4.303 4.163 4.031 3.905 3.786 3.673 3.566 3.463 10 8111 77227360 7024 6710 6.418 6145 5889 5650 5.426 5216 5019 4.833 4.659 4494 43394192 4054 3.923 3.799 3682 3571 11 8.760 8.306 7.887 7.499 7.139 6.805 6.495 6.207 5.938 5.687 5.453 5.234 5.029 4.836 4.656 4.486 4.327 4.177 4.035 3.902 3.776 3.656 12 9.385 8.863 8.384 7.943 7536 71616.814 6.492 6.194 5.918 5.660 5.421 5.197 4.988 4.793 4.611 4.439 4.278 4.127 3.985 3.851 3.725 13 9.986 9.394 8.853 8.358 7.904 7.487 7103 6.750 6.424 6.122 5.842 5.583 5.342 5.118 4.910 4715 4.533 4.362 4203 4053 3.912 3.780 14 10.563 9.899 9.295 8.745 8.244 7.786 7.367 6.982 6.628 6.302 6.002 5.724 5.468 5.229 5.008 4.802 4.611 4.432 4.265 4.108 3.962 3.824 15 11.118 10.380 9712 9.108 8.5598.061 7606 7191 6.811 6.462 6.142 5.847 5575 5324 5.092 4.876 4675 4.489 4315 4.153 4.001 3.859 16 11.652 10.838 10.106 9.447 8.851 8.313 7.824 7.379 6.974 6.604 6.265 5.954 5.668 5.405 5.162 4.938 4.730 4.536 4.357 4.189 4.033 3.887 17 12.166 11.274 10.477 9763 9122 8.544 8022 75497120 6.729 6.373 6047 5749 5.475 5.222 4.990 4775 4576 4391 4219 4059 3910 18 12.659 11.690 10.828 10.059 9.372 8.756 8.201 7.702 7.250 6.840 6.467 6.128 5.818 5.534 5.273 5.033 4.812 4.608 4.419 4.243 4.080 3.928 19 13.134 12.085 11158 10.336 9.604 8.950 8.365 7839 7366 6.938 6.550 6198 5877 5584 5.316 5.070 4.843 4.635 4.442 4.263 4.097 3942 20 13.590 12.462 11.470 10.594 9.818 9.129 8.514 7.963 7.469 7.025 6.623 6.259 5.929 5.628 5.353 5.101 4.870 4.657 4.460 4.279 4.110 3.954 21 14.029 12.821 11.764 10.836 10.017 9.292 8.649 8.075 7.562 7102 6.687 6.312 5.973 5.665 5.384 5.127 4.891 4.675 4.476 4.292 4.121 3.963 22 14.451 13.163 12.042 11.061 10.2019.442 8.772 8.176 7645 7170 6.743 6.359 6.011 5.696 5.410 5.149 4.909 4.690 4.488 4302 4.130 3.970 23 14.857 13.489 12.303 11.272 10.371 9.580 8.883 8.266 7.718 7.230 6.792 6.399 6.044 5.723 5.432 5.167 4.925 4.703 4.499 4.311 4.137 3.976 550 11.469 10.529 9707 8.985 8348 7784 7283 6.835 6.434 6073 5.746 5.451 5182 4.937 4.713 4.507 4318 25 15.622 14.094 12.783 11.654 10.675 9.823 9.077 8.422 7.843 7.330 6.873 6.464 6.097 5.766 5.467 5.195 4.948 4.721 4.514 4.323 4.147 3.985 26 15.983 14.375 13.003 11.826 10.810 9.929 9161 8.488 7896 7.372 6.906 6.491 6.118 5.783 5.480 5206 4.956 4.728 4.520 4328 4.151 3988 27 16.330 14.643 13.211 11.987 10.935 10.027 9.237 8.548 7943 7.409 6.935 6.514 6.136 5.798 5.492 5.215 4.964 4.734 4.524 4.332 4.154 3.990 28 16.663 14.898 13.406 12.137 11.051 10.116 9.307 8602 7984 7441 6.961 6.534 6.152 5.810 5.502 5.223 4.970 4.739 4.528 4.335 4.157 3.992 29 16.984 15.141 13.591 12.278 11.158 10.198 9.370 8.650 8.022 7.470 6.983 6.551 6.166 5.820 5.510 5.229 4.975 4.743 4.531 4.337 4.159 3.994 30 17.292 15.372 13.765 12.409 11.258 10.274 9.427 8.694 8.055 7496 7.003 6.566 6.177 5.829 5.517 5.235 4.979 4.746 4.534 4.339 4.160 3.995 40 19793 17159 15.046 13.332 11.925 10757 9779 8.951 8244 7634 7105 6.642 6233 5.871 5548 5258 4.997 4760 4.544 4347 4.166 3999 Required: 1. What is the net present value of the cash flows associated with the purchase alternative? 2. What is the net present value of the cash flows associated with the lease alternative? 3. Which alternative should the company accept? Complete this question by entering your answers in the tabs below. Required 1 Required 2 Required 3 What is the net present value of the cash flows associated with the purchase alternative? (Round your final answer to the nearest whole dollar amount. Enter negative amount with a minus sign.) Net present value Required 1 Required 2 > Required 1 Required 2 Required 3 What is the net present value of the cash flows associated with the lease alternative? (Round your final answer to the nearest whole dollar amount. Enter negative amount with a minus sign.) Net present value Required 1 Required 2 Required 3 Which alternative should the company accept? O Purchase alternative Lease alternative

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts