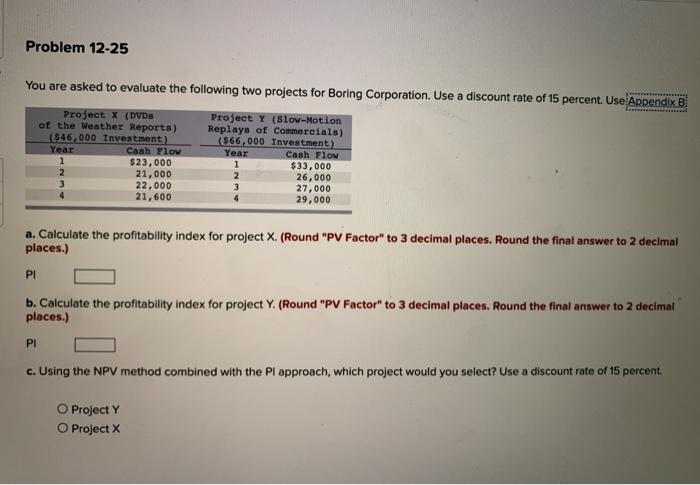

Question: Problem 12-25 You are asked to evaluate the following two projects for Boring Corporation. Use a discount rate of 15 percent. Use Appendix B Project

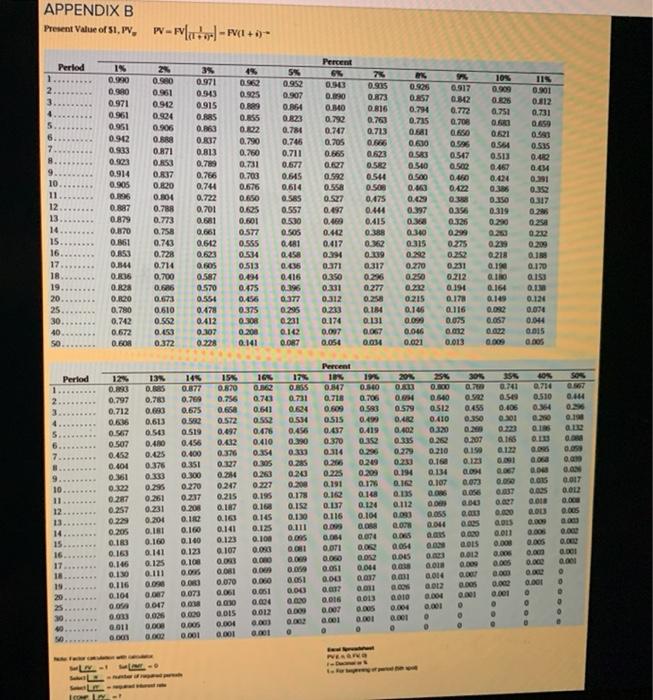

Problem 12-25 You are asked to evaluate the following two projects for Boring Corporation. Use a discount rate of 15 percent. Use Appendix B Project X (DVDS of the Weather Reports) (546.000 Investment) Year Cash Flow 1 $23,000 2 21,000 22,000 21,600 Project Y (Slow-Motion Replays of Commercials) ($66,000 Investment) Year Cash Flow 1 $33,000 2 26,000 3 27,000 29,000 a. Calculate the profitability index for project X. (Round "PV Factor" to 3 decimal places. Round the final answer to 2 decimal places.) PI b. Calculate the profitability index for project Y. (Round "PV Factor" to 3 decimal places. Round the final answer to 2 decimal places.) PI c. Using the NPV method combined with the Pl approach, which project would you select? Use a discount rate of 15 percent O Project Y O Project X APPENDIX B Present Value of S1, P, W-FV|-|- - FV(1+0) SE 1250 C150 7% 0.935 ORTS 10% 0.909 OS 0.925 OKRG 0.855 0.816 5% 0.952 0.907 0.864 0R22 0.788 0.746 0.711 0.577 0.645 0.614 en 0.925 0.857 0.794 0.735 0.81 0.60 0.563 0.500 0.500 0. IIN 0.901 0.812 0.731 019 0.893 0.535 0.517 0.842 0.772 0.709 O.RO 0.585 0.547 0.500 0.00 0.915 0.885 0.863 0.837 0.813 0.789 0.766 0.744 0.722 0.701 0.681 0.661 0.612 Period 1 2 3 4 5 6 7 8 9. 10 11 12 13 14 15 16 17 18 19 20 25 30 40 SO 0.4M 0.31 0.970 0.99 0.971 0.961 0.951 0.912 0.933 0.923 0.914 0.905 O.RS 0.887 0.879 0.3 0.861 O.ASS 0.344 ORS 0.28 0.000 0.780 0.742 0.672 0.608 0.22 2% 0.98 0.961 0.912 0.524 0.906 OR 0.871 0.853 0.837 0.220 0.804 0.788 0.773 0.758 0.743 0.728 0.714 0.700 0. 0.673 0.610 0.562 0.751 . 0.821 0.564 0.513 0.467 0.424 0.386 0.350 0.319 0.280 Percent 6% 0.563 D. 0.140 0.792 0.77 0.705 0.665 0.07 0.592 0.558 0.947 0.497 0.480 0.402 0.417 0.394 0.371 0.350 0.331 0.312 0.233 0.174 0.007 0.056 0.730 0.760 0.731 0.703 0.676 D...SO 0.625 0.601 0.577 0.555 0534 0.513 0.094 0.475 0.156 0.375 0.308 0.200 0.141 0.75 0.713 0.686 0.623 0.5R2 0.544 0.500 0.475 0.444 0.415 0.388 062 0219 0.317 0.26 0.277 0.28 Q.184 0.131 0.067 0.034 0.317 0.29 020 0.22 0.397 OM 0.340 0.315 0.557 0.530 0.50 0.481 0.450 0.636 0.416 02296 0.377 0.295 0.231 0102 0.087 0.505 0.587 0570 0.556 0.478 0.412 0.107 0.270 0.250 0.2 0.215 0.58 0.39 0.125 0.299 0.275 0.25 0.231 0.212 0.194 0.178 0.116 0.075 0.02 0.013 0.2 0218 0.190 GIO 0.164 0.109 0.00 0.057 0.170 Q.15 OM 0.124 0.074 0.044 0.015 0.106 0.00 0.046 0.372 Period WS 17 OS 0.731 09 2 3 HISO DO TOVO 5 ID CO 0.30 0.30 GIDO 12% D.RO 0.797 0.712 0.636 0.567 0.507 0.452 0.404 0.361 0.322 0.267 0.257 0.229 0.2015 0.163 0.163 0.146 0.13 0.116 0.104 00 13 DOS 0.70 O.RO 0.613 0.50 0.40 0.025 0.375 0.333 0.295 0.261 0.231 0.204 0.181 0.160 0.141 0.125 9 10 145 0.877 0.769 0.675 0:58 0519 0.456 0.000 0.351 0.300 0.270 0.237 0.205 0.1 0.160 0.140 0.123 0.108 0.0 OOR) 0.073 . 0.000 0.005 0.001 15% 0.820 0.256 0.658 O.572 0.497 0.02 0.376 0.222 0.24 0.247 0.215 0.187 0.163 0.10 0.123 0.107 0.03 0.01 0.070 0.061 ono DIS 0.004 0.001 IGN 02 0.70 0.641 052 0.476 0.410 0.354 0305 02 0227 0.195 0.163 0.145 0.125 0.100 0.00 0.00 0.20 0.200 0.178 0152 0.1) 0.111 0.0 Percent EX 12 20% 30% 40 0.847 0.80 0.63 O. 0.714 . 0.718 0.705 0.84 0.540 0.se 0.510 0.444 0.600 0.583 0.579 0512 0.455 0.406 0.354 0.515 0.410 0.37 0.419 0.220 1 0.370 0352 0.252 0.207 0.314 0.250 0.229 0.210 0.150 0.216 0.249 0.231 0.16 0.091 0.225 0.203 0.194 0.134 0.001 0.191 176 1 0.107 0.073 0.015 0.017 0.16 Q1 0.13 0.056 0.012 0.137 0.124 0.112 0.00 0.010 0.116 0.104 0.00 0.055 0.09 0.0 0.000 0.00 0.054 0.011 0.000 0.DTI 0.005 0.00 wo 0.0 0.012 0.00 0.001 0.044 0.018 BOO 0.00 0.00 0.00 0.00 0.037 0.00 0.014 0.002 0.011 . 0.02 0.00 0.00 0.00 0.010 0.016 0.004 0.00 0.001 0.00 0.004 0 0.001 0.001 0.001 0 0 o 12 WIDO 0.00 14 15 16 17 18 19 20 DO 0 0.00 0.0 0.051 0.00 0.020 0.000 0.00 0.051 0.000 0.012 0. 0.007 0.017 0.00 0.00 ETOD 0 0 @ o 0.011 0.00 0 NES

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts