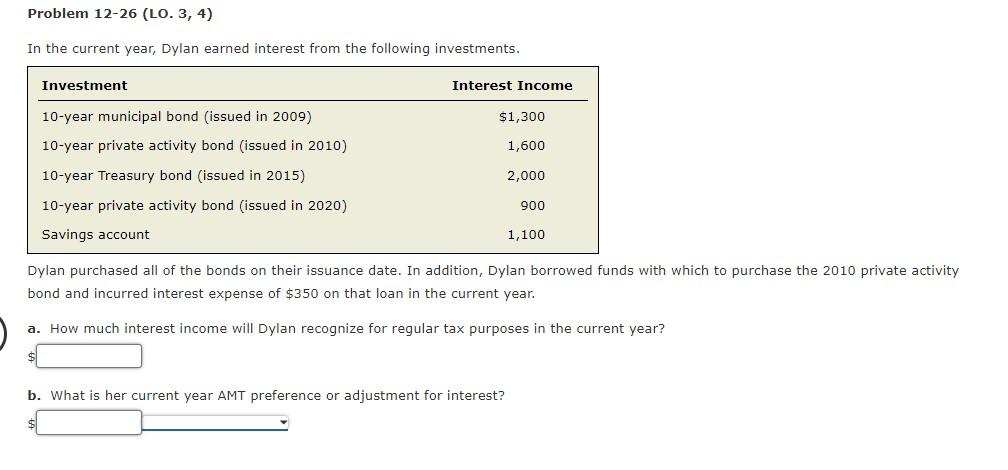

Question: Problem 12-26 (LO. 3, 4) In the current year, Dylan earned interest from the following investments. Investment Interest Income $1,300 10-year municipal bond (issued in

Problem 12-26 (LO. 3, 4) In the current year, Dylan earned interest from the following investments. Investment Interest Income $1,300 10-year municipal bond (issued in 2009) 10-year private activity bond (issued in 2010) 1,600 2,000 10-year Treasury bond (issued in 2015) 10-year private activity bond (issued in 2020) 900 Savings account 1,100 Dylan purchased all of the bonds on their issuance date. In addition, Dylan borrowed funds with which to purchase the 2010 private activity bond and incurred interest expense of $350 on that loan in the current year. a. How much interest income will Dylan recognize for regular tax purposes in the current year? b. What is her current year AMT preference or adjustment for interest

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts