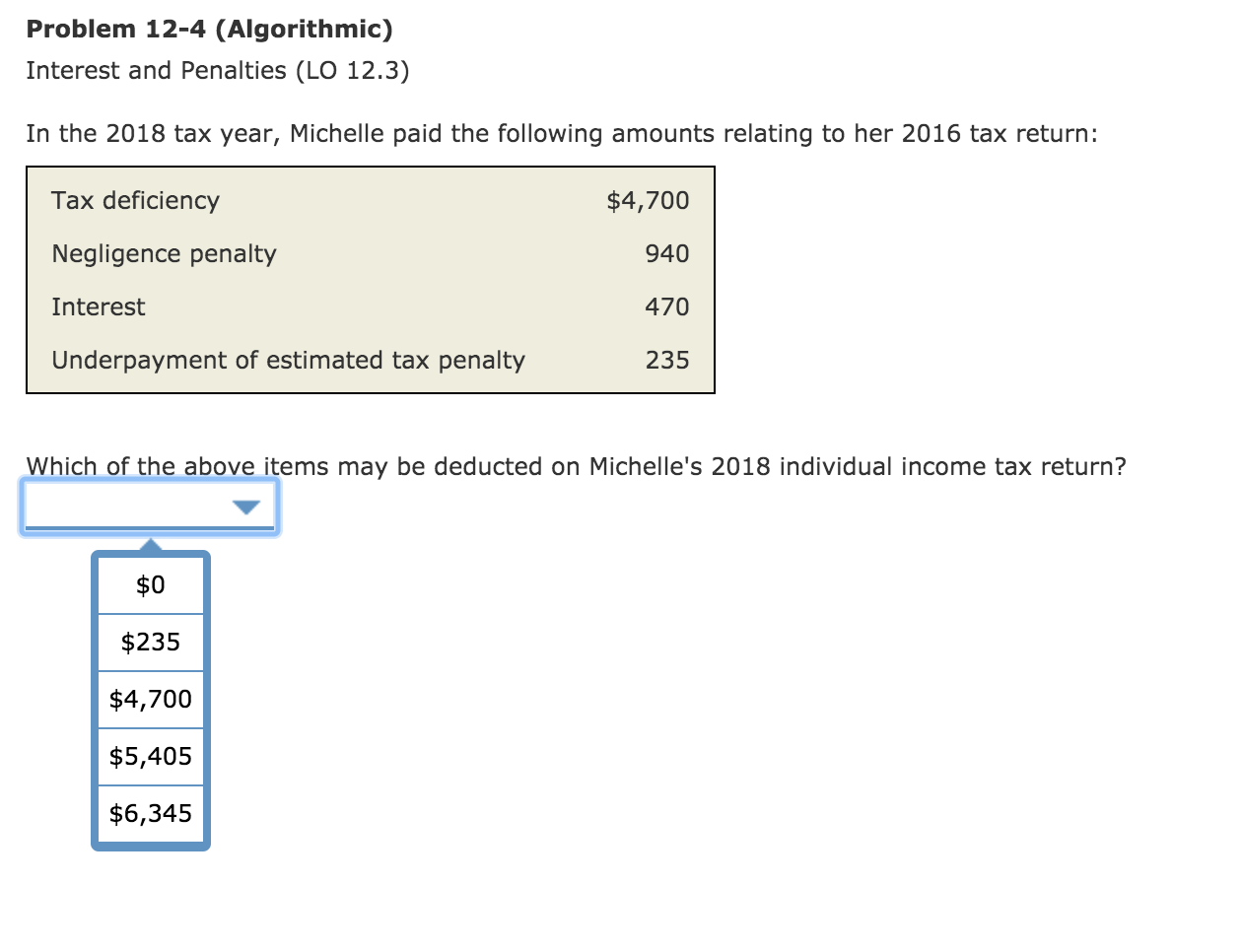

Question: Problem 12-4 (Algorithmic) Interest and Penalties (LO 12.3) In the 2018 tax year, Michelle paid the following amounts relating to her 2016 tax return: Tax

Problem 12-4 (Algorithmic) Interest and Penalties (LO 12.3) In the 2018 tax year, Michelle paid the following amounts relating to her 2016 tax return: Tax deficiency Negligence penalty $4,700 940 470 235 Interest Underpayment of estimated tax penalty Which of the above items may be deducted on Michelle's 2018 individual income tax return? $0 $235 $4,700 $5,405 $6,345

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts