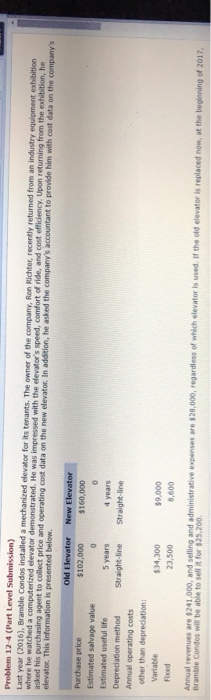

Question: Problem 12-4 (Part Level Submission) (2016), Bramble Condos installed a mechanized elevator for its tenants. The owner of the company, Ron Richter, recently retu where

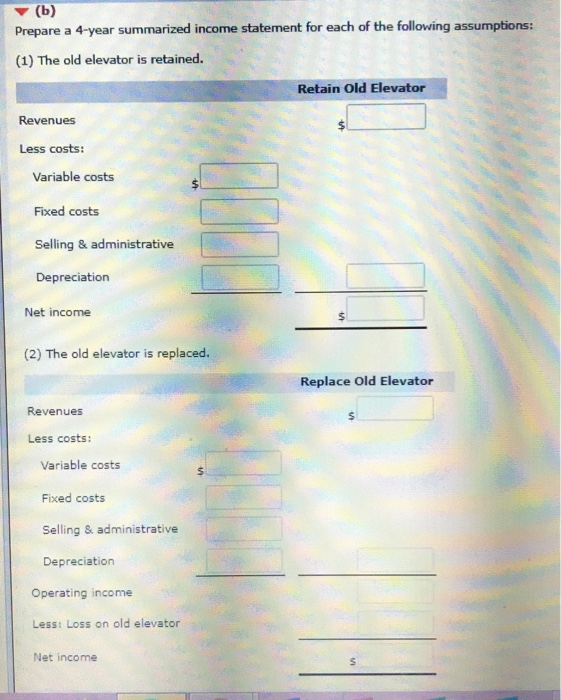

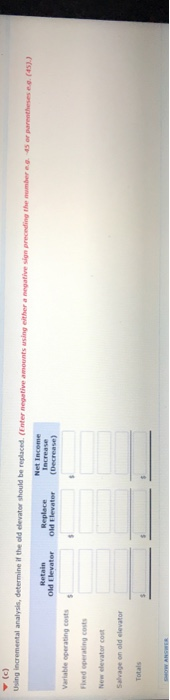

Problem 12-4 (Part Level Submission) (2016), Bramble Condos installed a mechanized elevator for its tenants. The owner of the company, Ron Richter, recently retu where he watched a asked his of ride, and cost from sing agent to collect price and he asked the company's accountant to provide him with cost data on the $102,000 $160,000 Estimated useful life Depreciation method Annual operating costs 5 years 4 years 34,300 23,500 $9,000 8,600 Flxed Annual revenues are $241,000, and selling and administrative expenses are $28,000, regardless of which elevator is used. If the old elevator is replaced Bramble Condos will be able to sell it for $25,200 (a) Determine any gain or loss if the old elevator is replaced. INK TO TEXT Prepare a 4-year summarized income statement for each of the following assumptions: (1) The old elevator is retained. Retain Old Elevator Revenues Less costs: Variable costs Fixed costs Selling & administrative Depreciation Net income (2) The old elevator is replaced Replace old Elevator Revenues Less costs: Variable costs Fixed costs Selling & administrative Depreciation Operating income Less: Loss on old elevator Net income e.g. (45)) Retain Replace Variable operating costss Fixed operating costs

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts