Question: Problem 12-43 Cost Distribution Using Allocation Bases; Hospital (LO 12-40) Refer to the organization chart for Rocky Mountain General Hospital given in the preceding problem.

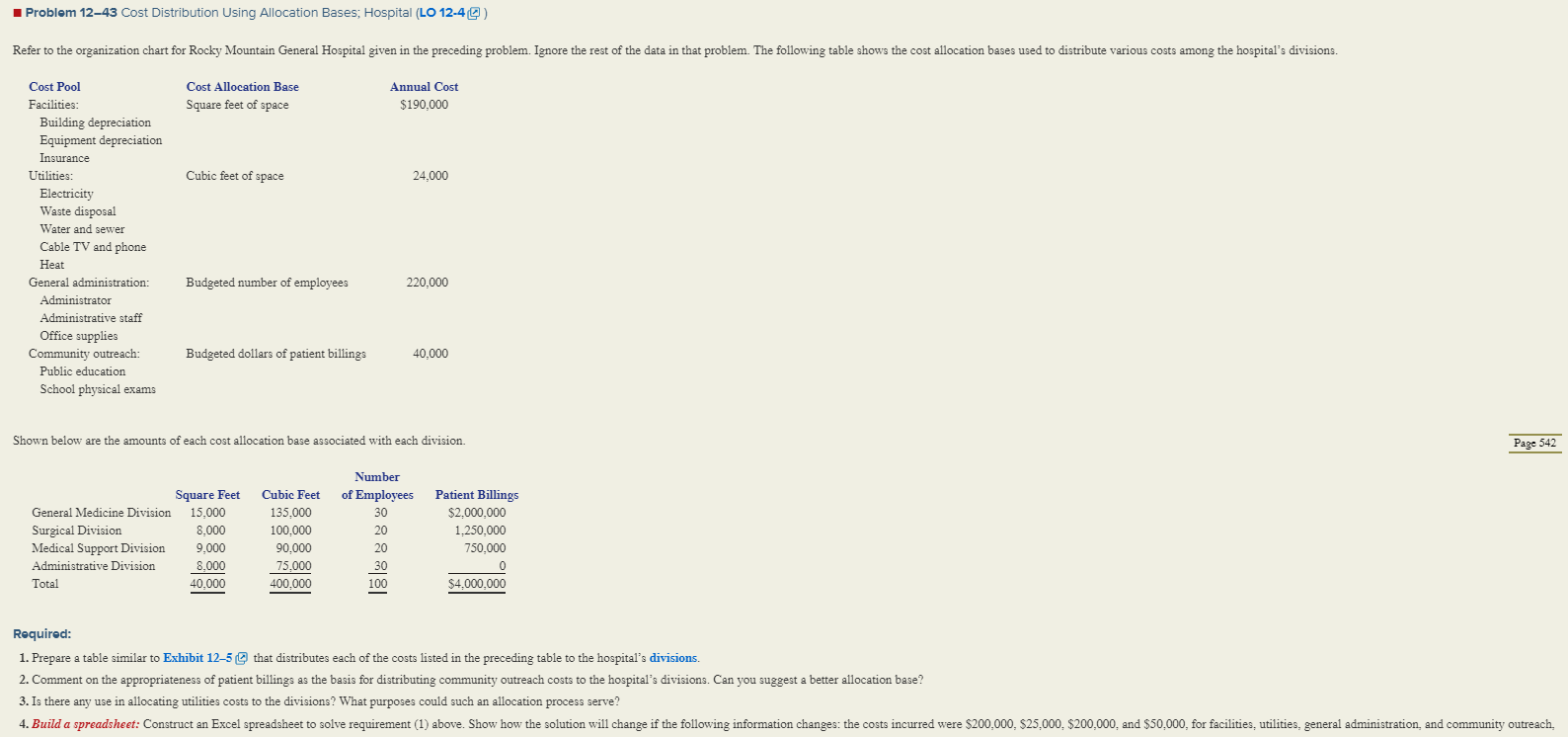

Problem 12-43 Cost Distribution Using Allocation Bases; Hospital (LO 12-40) Refer to the organization chart for Rocky Mountain General Hospital given in the preceding problem. Ignore the rest of the data in that problem. The following table shows the cost allocation bases used to distribute various costs among the hospital's divisions. Cost Allocation Base Square feet of space Annual Cost $190,000 Cubic feet of space 24,000 Cost Pool Facilities: Building depreciation Equipment depreciation Insurance Utilities: Electricity Waste disposal Water and sewer Cable TV and phone Heat General administration: Administrator Administrative staff Office supplies Community outreach: Public education School physical exams Budgeted number of employees 220,000 Budgeted dollars of patient billings 40,000 Shown below are the amounts of each cost allocation base associated with each division. Page 542 Number of Employees Square Feet General Medicine Division 15.000 Surgical Division 8,000 Medical Support Division 9.000 Administrative Division 8.000 Total 40.000 Cubic Feet 135.000 100,000 90.000 75,000 400.000 Patient Billings $2.000.000 1.250.000 750,000 $4.000.000 Required: 1. Prepare a table similar to Exhibit 12-5 that distributes each of the costs listed in the preceding table to the hospital's divisions 2. Comment on the appropriateness of patient billings as the basis for distributing community Outreach costs to the hospital's divisions. Can you suggest a better allocation base? 3. Is there any use in allocating utilities costs to the divisions? What purposes could such an allocation process serve? 4. Build a spreadsheet: Construct an Excel spreadsheet to solve requirement (1) above. Show how the solution will change if the following information changes: the costs incurred were $200,000, $25,000. $200,000. and $50.000, for facilities, utilities, general administration, and community outreach, Problem 12-43 Cost Distribution Using Allocation Bases; Hospital (LO 12-40) Refer to the organization chart for Rocky Mountain General Hospital given in the preceding problem. Ignore the rest of the data in that problem. The following table shows the cost allocation bases used to distribute various costs among the hospital's divisions. Cost Allocation Base Square feet of space Annual Cost $190,000 Cubic feet of space 24,000 Cost Pool Facilities: Building depreciation Equipment depreciation Insurance Utilities: Electricity Waste disposal Water and sewer Cable TV and phone Heat General administration: Administrator Administrative staff Office supplies Community outreach: Public education School physical exams Budgeted number of employees 220,000 Budgeted dollars of patient billings 40,000 Shown below are the amounts of each cost allocation base associated with each division. Page 542 Number of Employees Square Feet General Medicine Division 15.000 Surgical Division 8,000 Medical Support Division 9.000 Administrative Division 8.000 Total 40.000 Cubic Feet 135.000 100,000 90.000 75,000 400.000 Patient Billings $2.000.000 1.250.000 750,000 $4.000.000 Required: 1. Prepare a table similar to Exhibit 12-5 that distributes each of the costs listed in the preceding table to the hospital's divisions 2. Comment on the appropriateness of patient billings as the basis for distributing community Outreach costs to the hospital's divisions. Can you suggest a better allocation base? 3. Is there any use in allocating utilities costs to the divisions? What purposes could such an allocation process serve? 4. Build a spreadsheet: Construct an Excel spreadsheet to solve requirement (1) above. Show how the solution will change if the following information changes: the costs incurred were $200,000, $25,000. $200,000. and $50.000, for facilities, utilities, general administration, and community outreach

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts