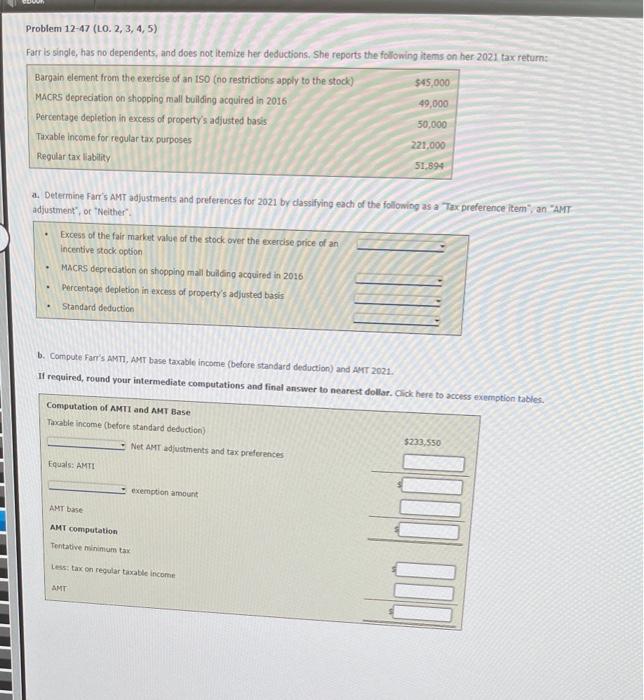

Question: Problem 12-47 (LO. 2,3,4,5) Farris single, has no dependents, and does not itemize her deductions. She reports the following items on her 2021 tax return

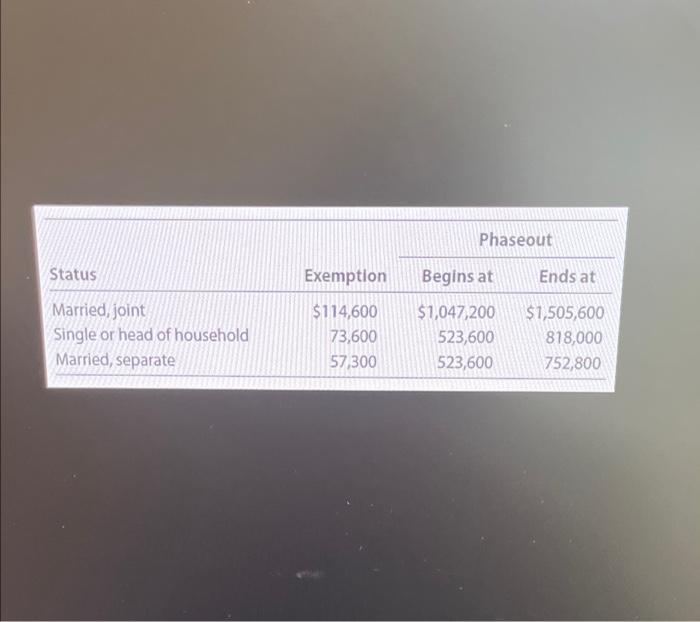

Problem 12-47 (LO. 2,3,4,5) Farris single, has no dependents, and does not itemize her deductions. She reports the following items on her 2021 tax return Bargain element from the exercise of an ISO (no restrictions apply to the stock) $45,000 MACRS depreciation on shopping mall building acquired in 2016 49,000 Percentage depletion in excess of property's adjusted basis 50,000 Taxable income for regular tax purposes 221.000 Regular tax liability 51.894 a. Determine Farr's AMT adjustments and preferences for 2021 by dassifying each of the following as a Tax preference item, an "AMT adjustment, or "Neither" Excess of the fair market value of the stock over the exercise price of an Incentive stock option MACRS depreciation on shopping mall building acquired in 2016 Percentage depletion in excess of property's adjusted basis Standard deduction b. Compute Far's AMTI, AMT base taxable income before standard deduction) and AMT 2021 If required, round your intermediate computations and final answer to nearest dollar. Click here to access exemption tables. Computation of AMTI and AMT Base Table Income (before standard deduction) Net AMT adjustments and tax preferences $233.550 Equals: AMTI exemption amount AMT base AMT computation Tentative minimum tax Les tax on regular table income ANT Phaseout Status Exemption Begins at Ends at Married, joint Single or head of household Married, separate $114,600 73,600 57,300 $1,047,200 523,600 523,600 $1,505,600 818,000 752,800

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts